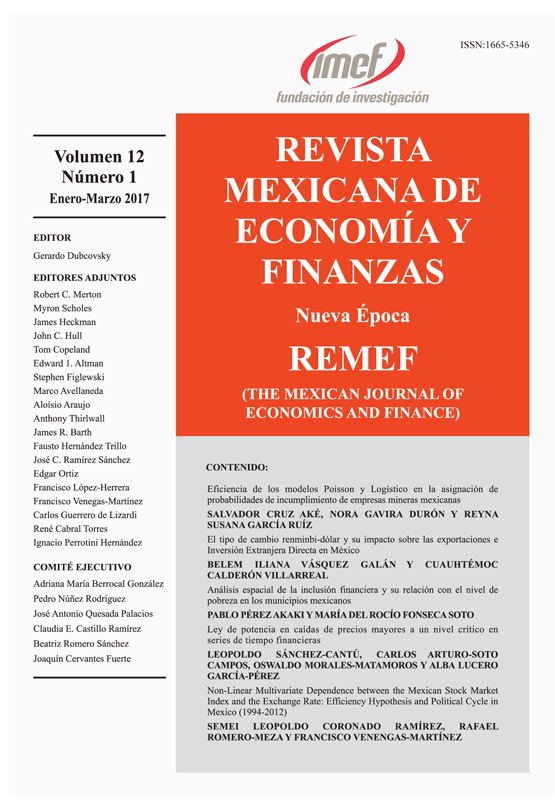

Efficiency of the Poisson and Logistic Models in the Allocation of Probabilities of default to Mexican Mining Companies

DOI:

https://doi.org/10.21919/remef.v12i1.9Abstract

The existence of the volatile environment and characteristics of the mining sector, affects compliance with payment of loans granted to companies in the sector, making scoring models based on normal, Probit or Logit models underestimate the probability of default. The objective of this article is to prove that the Logit models do not capture properly the default probabilities of mining companies to underestimate the tails, by analysis of stability and reliability of these probabilities, creating problems for goodness of fit and underestimation of the probability; while a Poisson model dummy variable captures the effects of tail and stabilizes the regression, estimators and their estimated probabilities. The results indicate that the logistic models are not designed to optimally analyze the independent variables with extreme values and are not associated with the quarter of operation, but are specific to each company. Poisson models were found to be able to capture the extreme values of the distribution; so they are best suited to determine the credit quality of mining companies.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2017-05-23

How to Cite

Cruz Aké, S., Gavira Durón, N., & García Ruíz, R. S. (2017). Efficiency of the Poisson and Logistic Models in the Allocation of Probabilities of default to Mexican Mining Companies. The Mexican Journal of Economics and Finance, 12(1). https://doi.org/10.21919/remef.v12i1.9

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas