Los efectos del crédito bancario otorgado a la industria y al consumo en el crecimiento económico: evidencia de México, 1994-2017

DOI:

https://doi.org/10.21919/remef.v17i2.560Keywords:

Bank Loans, Industry, Economic Growth, GDP, Consumption, Long-Term.Abstract

The Effects of Bank Loans Granted to Industry and Consumption on Economic Growth: Evidence from Mexico, 1994-2017

This article empirically analyzes the relationship between bank credit granted to industry and consumption and economic growth in Mexico, using regression analysis as a method to measure long-term effects; Furthermore, a dichotomous variable was implemented to observe the existence of possible changes in the relationship between the variables with the occurrence of the 2008 financial crisis. It was found that, despite being a country with an inefficient financial system, there is a positive relationship with long-term economic growth; Likewise, the relationship between GDP and bank credit granted to industry denotes a change after the financial crisis of 2008, where the latter stopped having positive effects on economic growth. The obstacles to the study are due to the fact that the databases on bank credit were no longer updated in INEGI. Undoubtedly, the role of banking on growth is still important for Mexico, and better regulations on the implementation of credit for the industry should be considered.

Downloads

Metrics

Downloads

Additional Files

Published

How to Cite

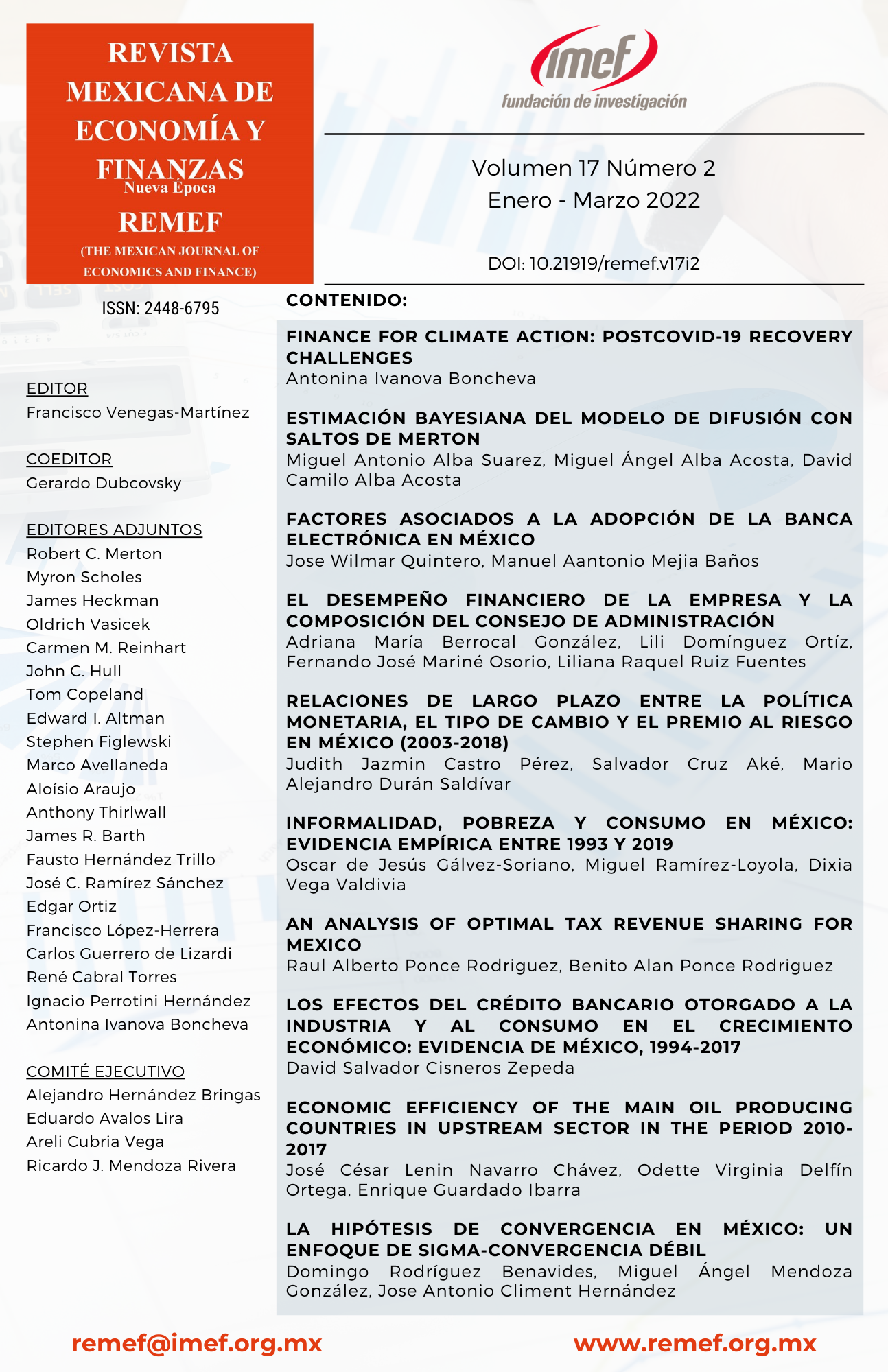

Issue

Section

License

PlumX detalle de metricas