Análisis del riesgo de quiebra de instituciones financieras peruanas, 2015-2021

DOI:

https://doi.org/10.21919/remef.v17i3.735Keywords:

Multiple Banking, Municipal Savings Banks, Balance Sheet, Profit and Loss Statement, Bankruptcy RiskAbstract

Bankruptcy risk analysis of peruvian financial institutions, 2015-2021

In Peru, the economic dynamics of Multiple Banking and Municipal Savings Banks is relevant; however, these have not been studied in terms of bankruptcy risk, an important indicator in financial management and credit rating. This research aims to be a new contribution to the subject, since 26 active financial institutions were analyzed to assess the risk of bankruptcy. Using the multiple discriminant analysis of the Altman Z model complemented with the harmonic mean, the results show empirical evidence that only 20% of Multiple Banking institutions are in the safe zone and a worrying 13% are in the bankruptcy zone. In addition, the Municipal Savings Banks have a relatively better financial health as they are located 100% outside the bankruptcy zone. Studies are suggested in countries with similar economies. One limitation was to have worked with historical data. Among the conclusions to highlight it is found that Altman's Z model is effective in predicting the risk of bankruptcy of financial institutions.

Downloads

Metrics

Downloads

Additional Files

Published

How to Cite

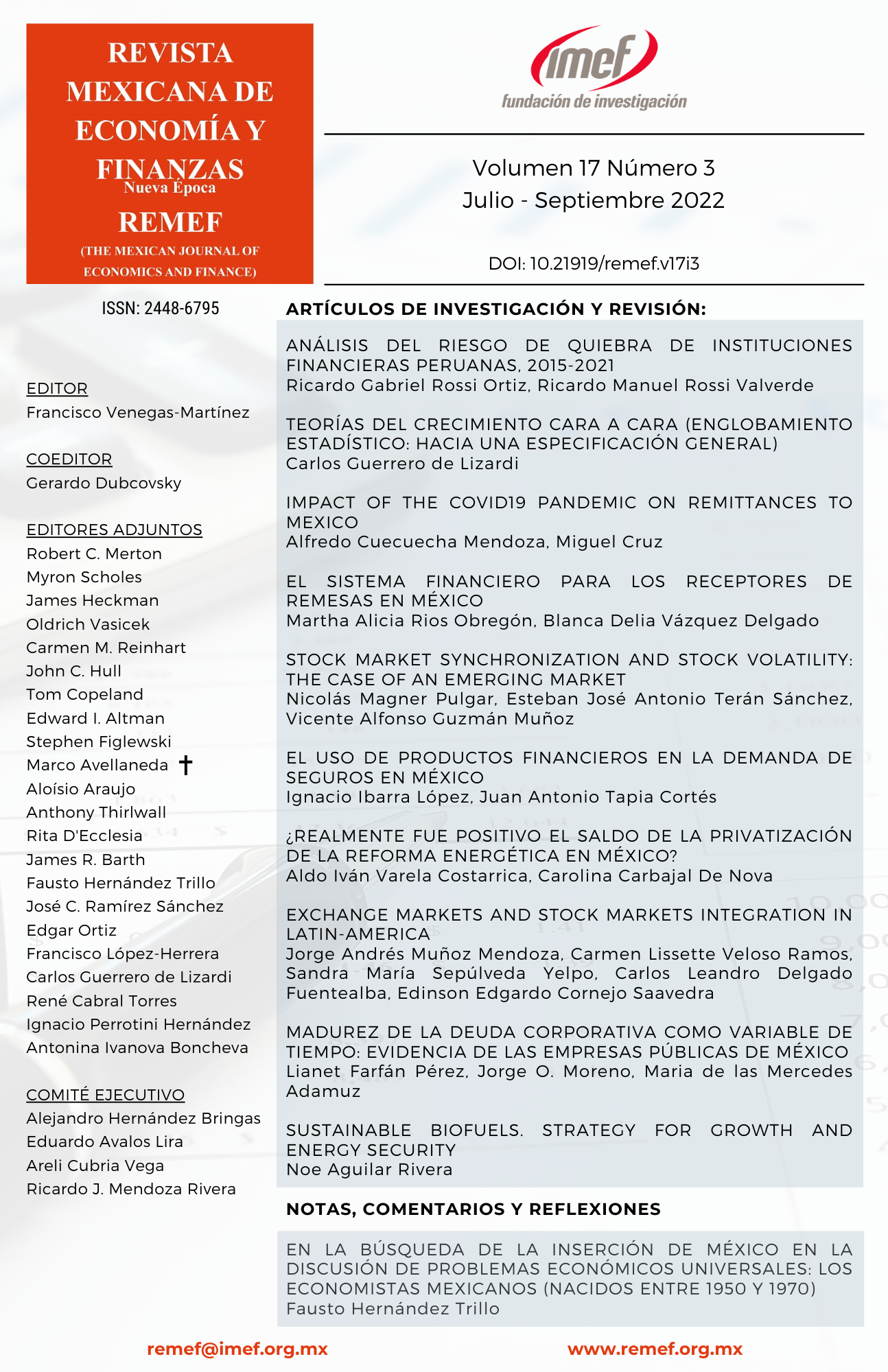

Issue

Section

License

PlumX detalle de metricas