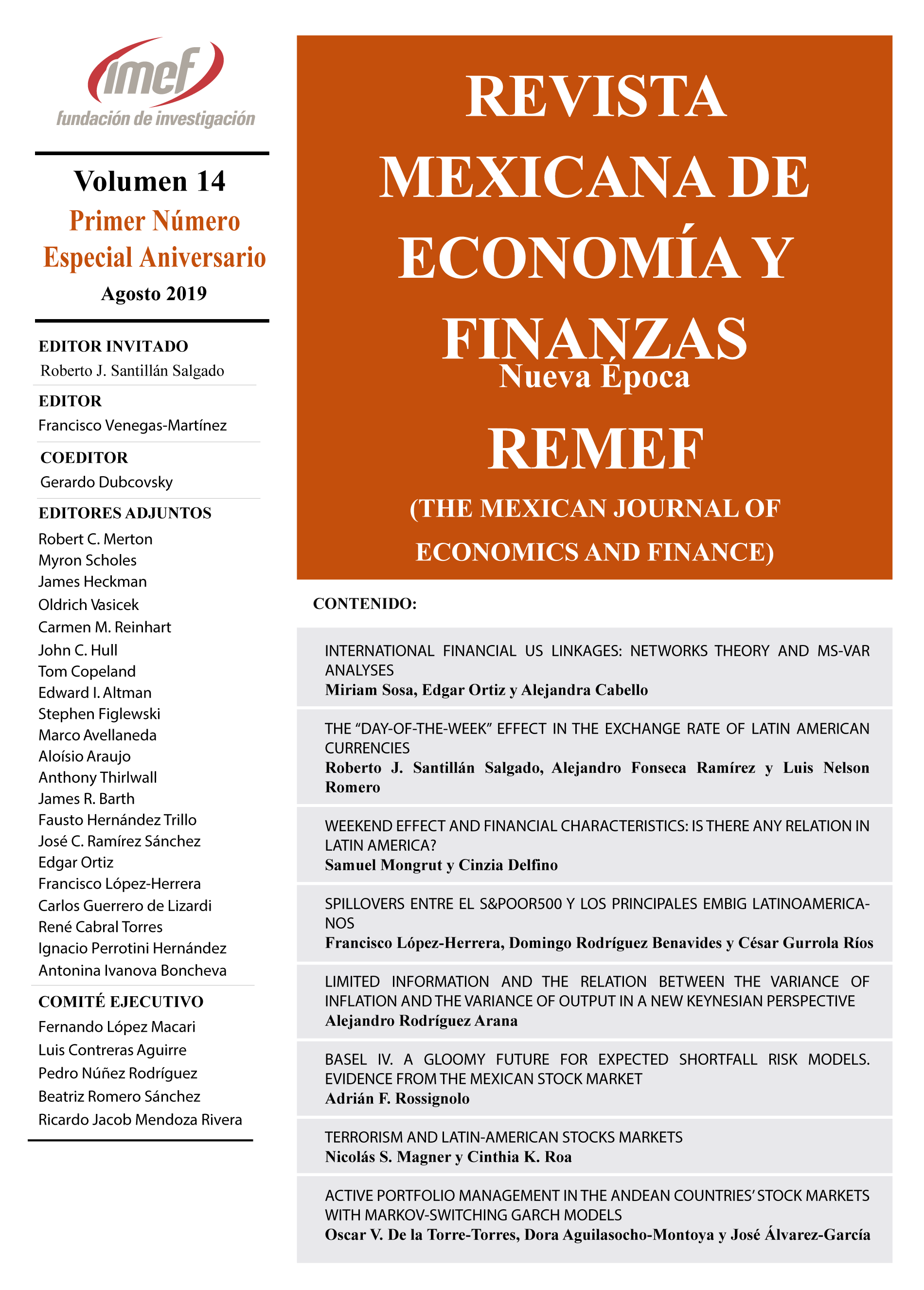

Terrorism and Latin-American Stocks Markets

DOI:

https://doi.org/10.21919/remef.v14i0.424Keywords:

Event study, terrorism, Latin-America stocksAbstract

This paper investigates the effects of major terrorist attacks of the last 20 years on a set of stocks listed at Latin-American stock markets. Utilizing the capital market model, we calculate abnormal returns during the day of the terror attacks for 115 stocks listed in 6 Latin-American countries. In this sense, we appreciate different reaction between countries, where Brazil, Peru, and Chile have a significant market reaction of terrorism. These results promote international diversification and the use of this loss to avoid significant capital losses. However, the results are limited by the validity of the capital market model. This paper has important implications for international investors and their investment risk management strategies. Despite the frequency of terrorist events, this is the first work that addresses a wide range of these in Latin American countries. The main conclusion is that there is a negative effect of terrorist events on Latin American markets, but this effect is mixed; there is a negative and significant impact of the US terrorist attacks and a weak and non-significant effect when the attacks occur outside the US.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2019-08-13

How to Cite

Magner, N. S., & Roa, C. K. (2019). Terrorism and Latin-American Stocks Markets. The Mexican Journal of Economics and Finance, 14, 583–599. https://doi.org/10.21919/remef.v14i0.424

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas