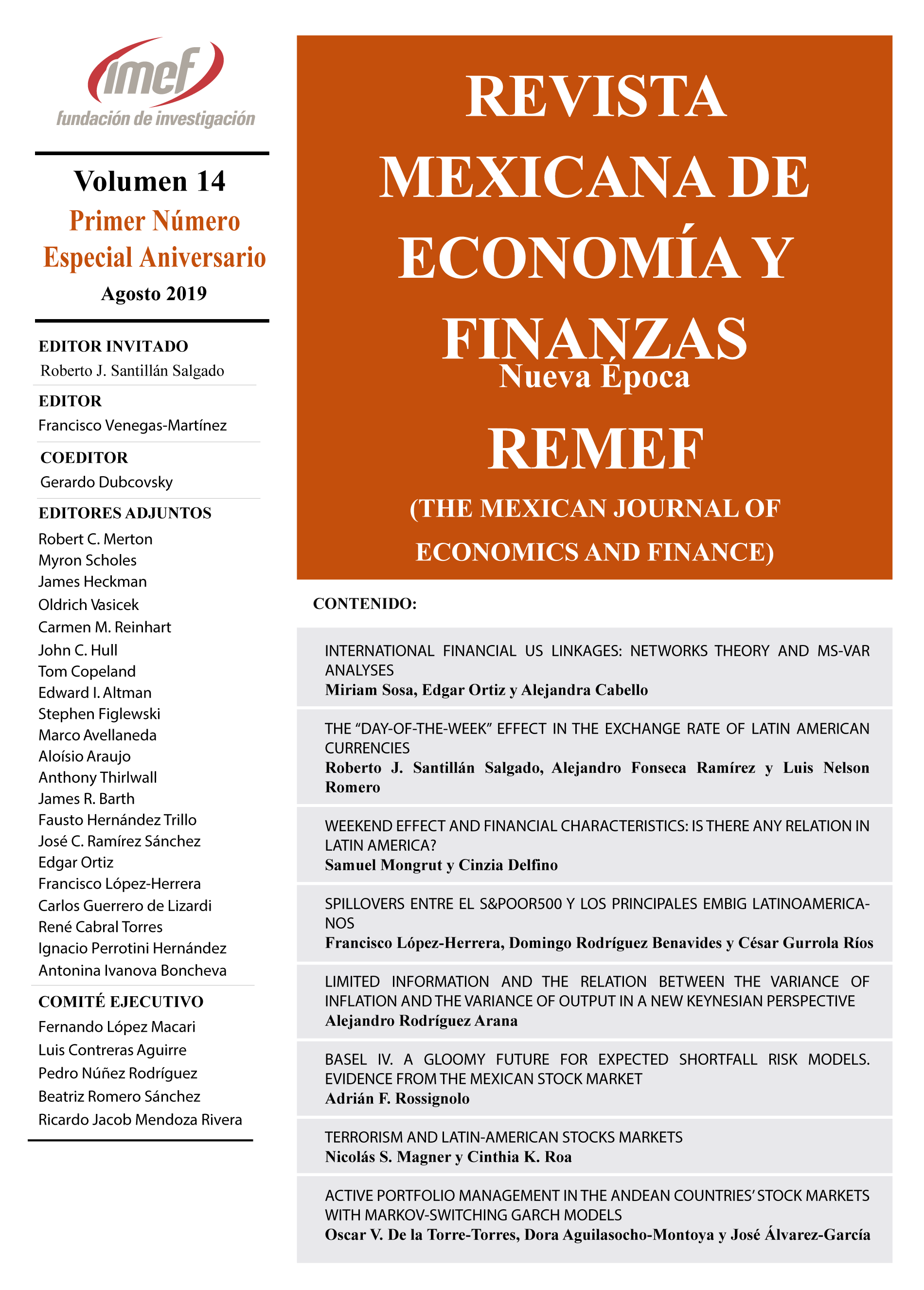

Spillovers entre el S&Poor500 y los principales EMBIG latinoamericanos

DOI:

https://doi.org/10.21919/remef.v14i0.421Keywords:

spillover, Spills, EMBI, S&P500, Sovereign BondsAbstract

This work performs an analysis of spillover effects between U.S. stock returns and changes in EMBI Global indices in Argentina, Brazil, Colombia, Mexico and Peru. A total spillover index is estimated to show significant increases at the turn of the century and during the global financial crisis. Breaking down the index into its directional components shows that the main sources of spillover among the markets analyzed are the U.S. stock market and the Brazilian bond index. An important limitation is that the EMBIGs of other Latin American countries are left out of the study and the main implication of the results is that it shows how the behavior of these instruments relates, which can be useful for portfolio decision-making. It is also noteworthy that the main recipients of spill effects are the indices of the bonds of Peru and Mexico, while the Argentine bond index is the least affected by external shocks.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2019-08-13

How to Cite

López-Herrera, F., Rodríguez Benavides, D., & Gurrola Ríos, C. (2019). Spillovers entre el S&Poor500 y los principales EMBIG latinoamericanos. The Mexican Journal of Economics and Finance, 14, 527–540. https://doi.org/10.21919/remef.v14i0.421

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas