Efecto Pass-Through en México en condiciones de alta y baja volatilidad

DOI:

https://doi.org/10.21919/remef.v15i1.403Keywords:

exchange rate, prices, pass-through, volatilityAbstract

(Pass-Through Effect in Mexico in Conditions of Low and High Volatility)

This work aims to measure the Pass-Through Effect (PTE), in conditions of low and high volatility, of the peso-dollar exchange rate on the prices of the distribution channel in Mexico. Using monthly data from 2000 to 2017, two vector error correction equations and impulse response functions were estimated. The results indicate that the accumulated pass-through elasticity generates, in conditions of high volatility, a greater percentage change on the prices to the producer, consumer, and importer. The implications are that, through monetary and exchange rate policies, the Bank of Mexico could implement mitigation measures to reduce the PTE. Further analysis is needed on the influence of structural conditions in order to understand the differences in speed and magnitude of the PTE on the distribution channel. The impact on the exchange-rate pass-through has been substantially higher on the prices to the producer, who then pass on these costs to the consumers. In conclusion, the degree of volatility significantly affects how currency depreciation impacts prices.

Downloads

Metrics

Downloads

Additional Files

Published

How to Cite

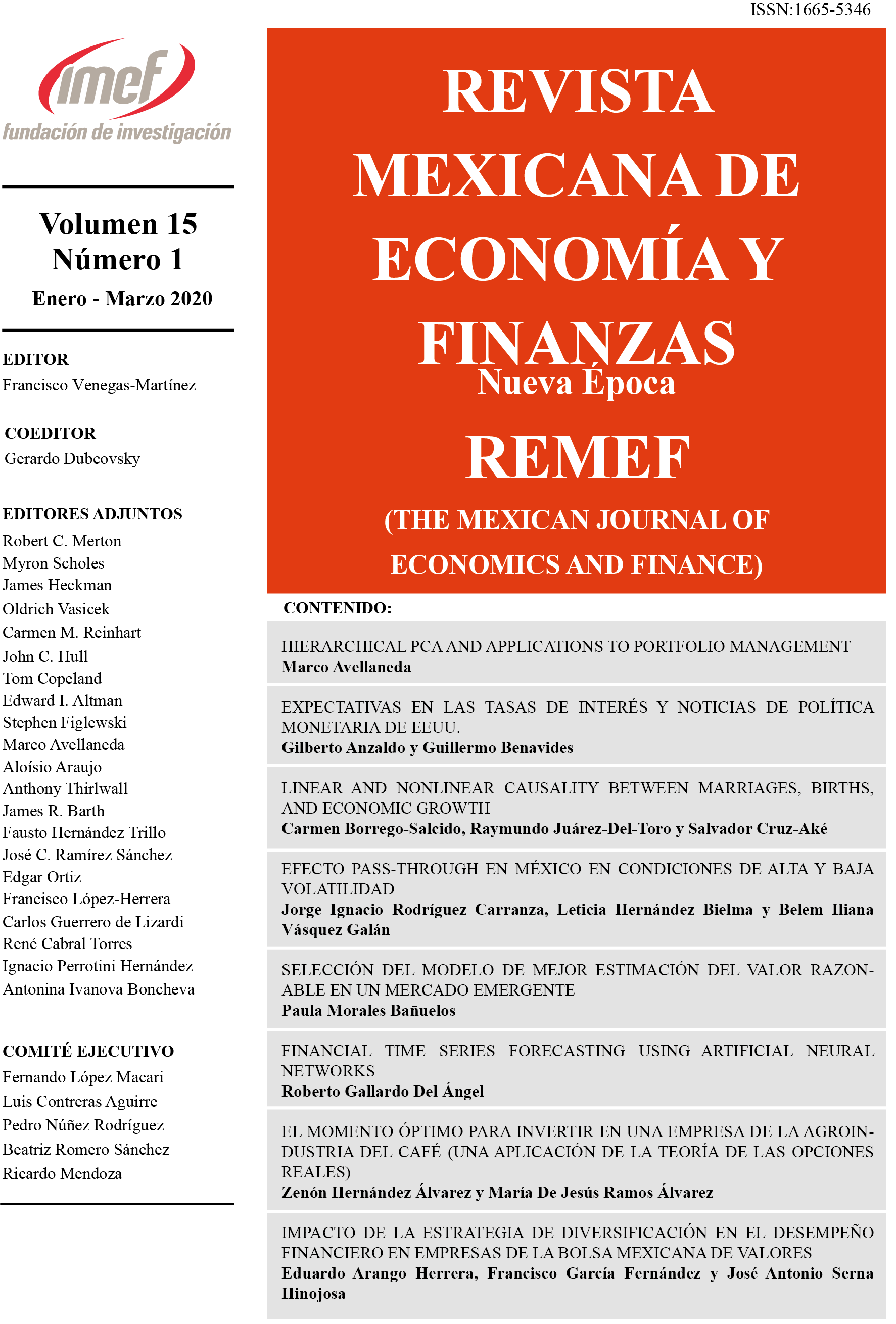

Issue

Section

License

PlumX detalle de metricas