Polls, Prediction Markets, and Financial Variables

DOI:

https://doi.org/10.21919/remef.v13i3.325Keywords:

USA Presidential campaign, opinion surveys, prediction markets, NAFTAAbstract

This article investigates how the results of the electoral polls and the registration of electronic bets on the outcome of the 2016 Presidential election of the United States explain the stock market performance and the currency exchange rates for Canada and Mexico, the other two member countries of NAFTA. Although the Canadian and Mexican economies are not so different in size—both compared to the U.S.—, the financial variables of the first were not reactive to the news of the electoral process, whereas those of the latter were significantly affected. Opinion survey data and prediction market prices were obtained for November 2014 to November 2016 from FiveThirtyEight and Iowa Electronic Markets, respectively. The VAR and VECM models proved that the information of the prediction markets is incorporated faster than the information of the surveys, and that the Mexican stock exchange and the MXN-USD exchange rate were highly sensitive to campaign news. On the other hand, Canadian markets were not significantly affected. These findings are theoretically relevant from the perspective of the Efficient Market Hypothesis, which are useful to forecast market behavior during electoral periods in the United States; and is of importance for portfolio managers, regulators, and other decision makers.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Published

2018-06-20

How to Cite

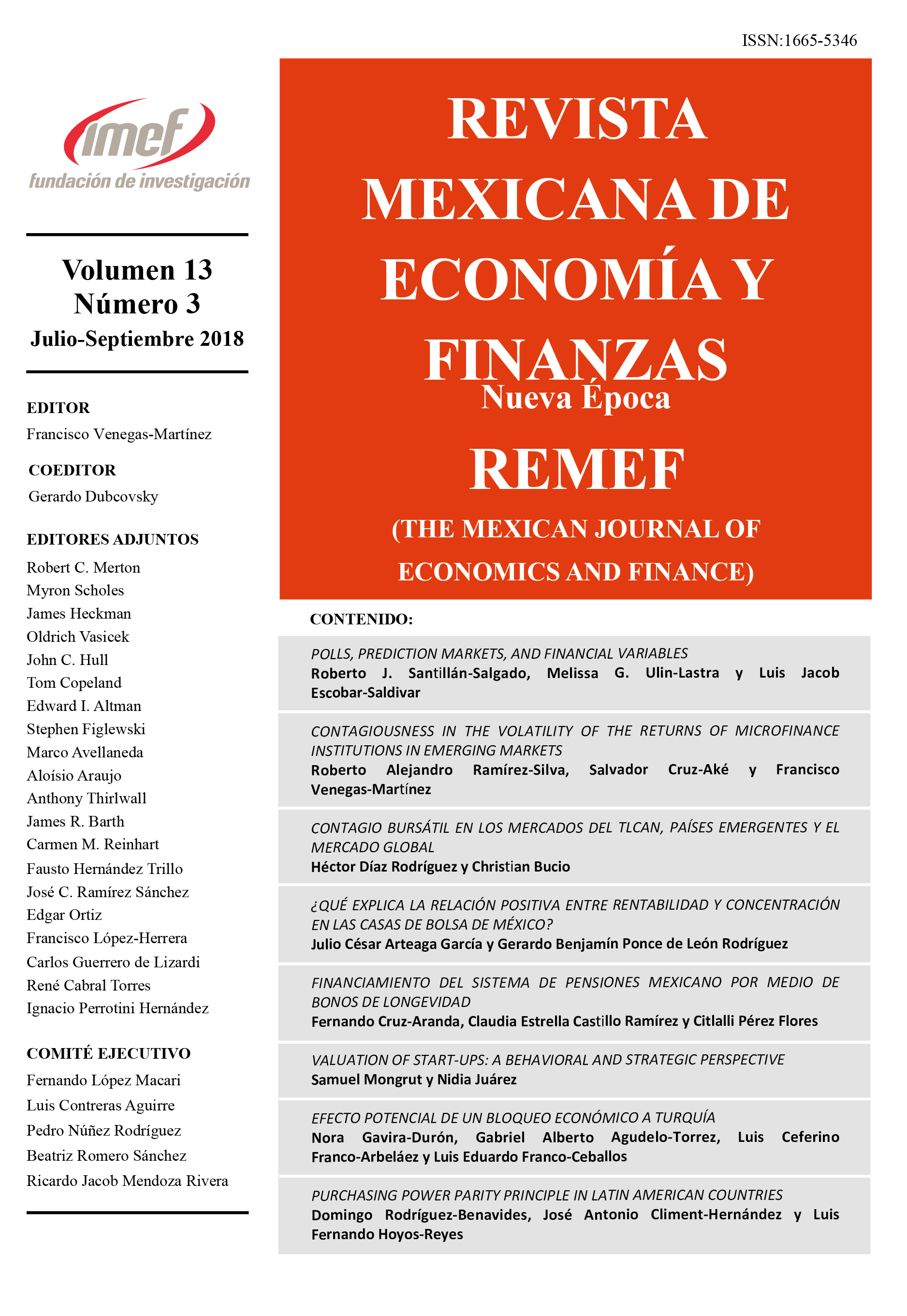

Santillán-Salgado, R. J., Ulin-Lastra, M. G., & Escobar-Saldivar, L. J. (2018). Polls, Prediction Markets, and Financial Variables. The Mexican Journal of Economics and Finance, 13(3), 295–323. https://doi.org/10.21919/remef.v13i3.325

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas