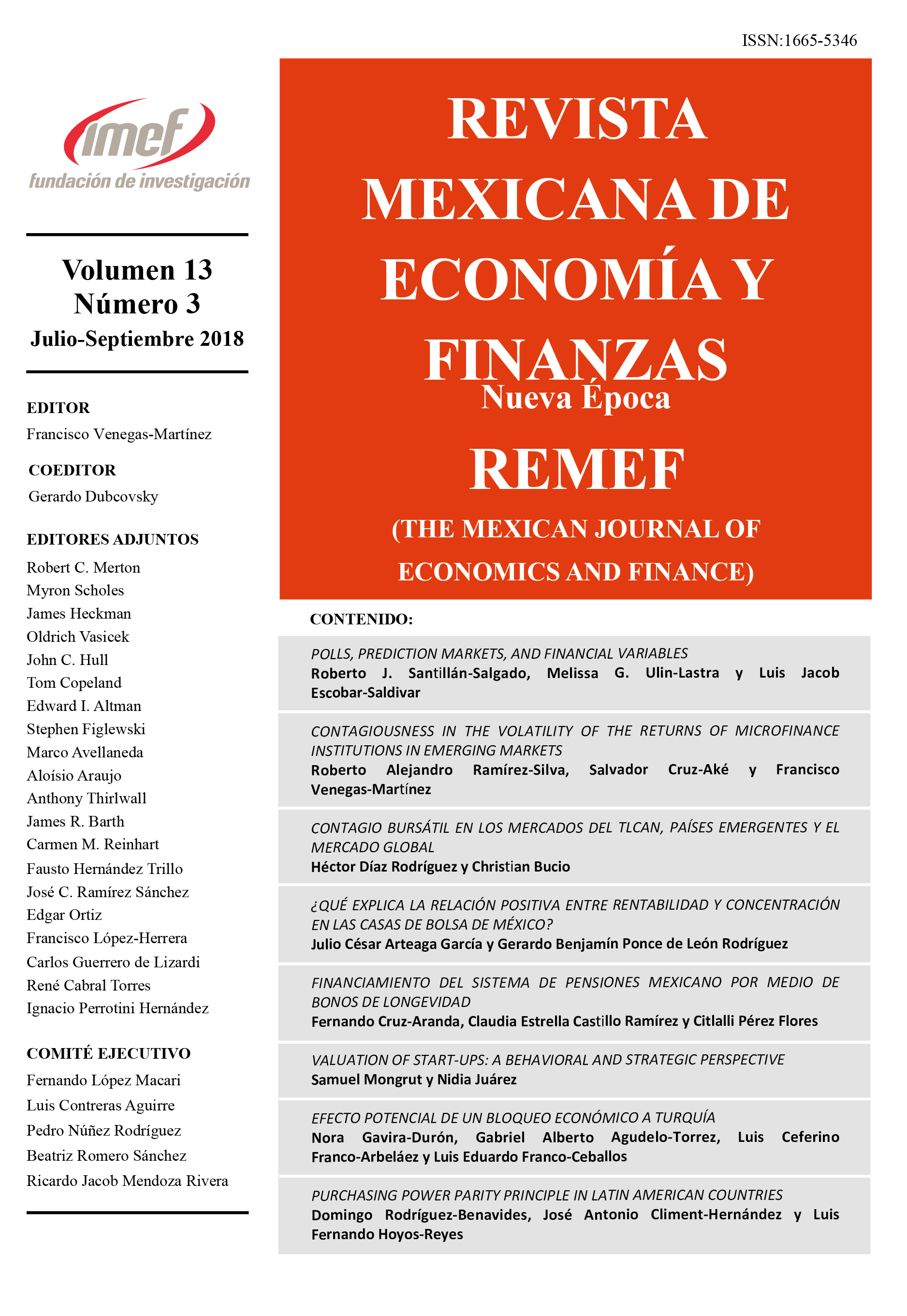

Financiamiento del sistema de pensiones mexicano por medio de bonos de longevidad

DOI:

https://doi.org/10.21919/remef.v13i3.303Keywords:

Pension system, population aging, longevity bond.Abstract

The objective of this work is to value and analyze the longevity bond that represents a long-term investment alternative to strengthen the pension funds of the Mexican population, that is, men and women who will reach 65 years of age. This presents an increase in life expectancy, risk of longevity, and a fall in the birth rate. Thus, the value of the zero-coupon bond is modeled through an equation that incorporates the estimated mortality rate at age and time , of each gender, with a projection of the mortality rate for 2040. The debt instrument is used to try and offset the probable losses that would be incurred by an insurance institution as consequence of the possible extension of the expected life of the insured and lower the probability of default of the corporate before them and providing them greater certainty; which contributes to this fund by providing access to the capital market and better social welfare to the retiree.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2018-06-28

How to Cite

Cruz-Aranda, F., Castillo Ramírez, C. E., & Pérez Flores, C. (2018). Financiamiento del sistema de pensiones mexicano por medio de bonos de longevidad. The Mexican Journal of Economics and Finance, 13(3), 387–417. https://doi.org/10.21919/remef.v13i3.303

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas