MAXIMIZACIÓN DE UTILIDAD Y VALUACIÓN DE OPCIONES CON VOLATILIDAD ESTOCÁSTICA

DOI:

https://doi.org/10.21919/remef.v4i2.201Abstract

This paper develops a model of partial equilibrium to estimate derivative products when the volatility of the underlying asset displays stochastic volatility. The model considers an economy populated by rational agents (consumer-investors) who make decisions on consumption and investment in an environment of risk market. The price of the derivative and the coefficient of risk are characterized as solutions of a system of partial differential equations. Several specific forms of the utility function are analyzed in the valuing process.Downloads

How to Cite

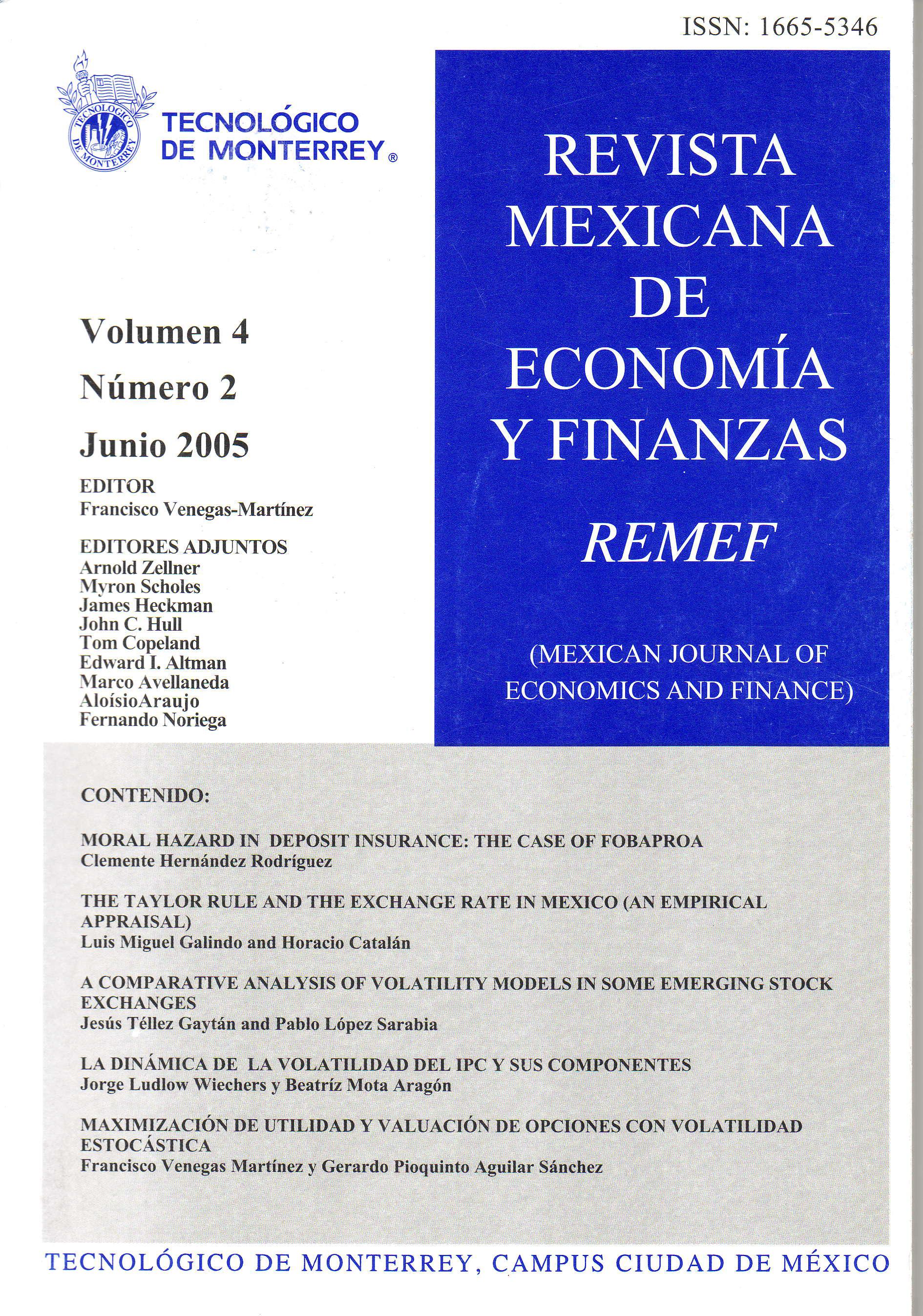

Venegas Martínez, F., & Aguilar Sánchez, G. P. (2017). MAXIMIZACIÓN DE UTILIDAD Y VALUACIÓN DE OPCIONES CON VOLATILIDAD ESTOCÁSTICA. Revista Mexicana De Economía Y Finanzas Nueva Época REMEF (The Mexican Journal of Economics and Finance), 4(2). https://doi.org/10.21919/remef.v4i2.201

Issue

Section

Artículos