PROBABILISTIC GREEKS

DOI:

https://doi.org/10.21919/remef.v3i3.171Keywords:

Estimation, Asset PricingAbstract

In the Black-Scholes-Merton option pricing formulas the coefficients that multiply the main variables ( the price of the underlying and the strike price) are equal to sorne "Greeks" (partial derivatives of the price with respect to the main variables). In this paper we prove that this property is not only true for a log-normal distribution, but it is also satisfied by any distribution that comply with sorne natural conditions and by sorne exotic options. These identities are derived from a new integral representation of the Greeks. This representation allows to derive Greeks in an easy and systematic way simplifying the long computation of partial derivatives traditionally involved in obtaining them. When computing Greeks, these results can be applied to simplify the derivation of closed form expressions, to speed up numerical methods, and to obtain better accuracy.Downloads

How to Cite

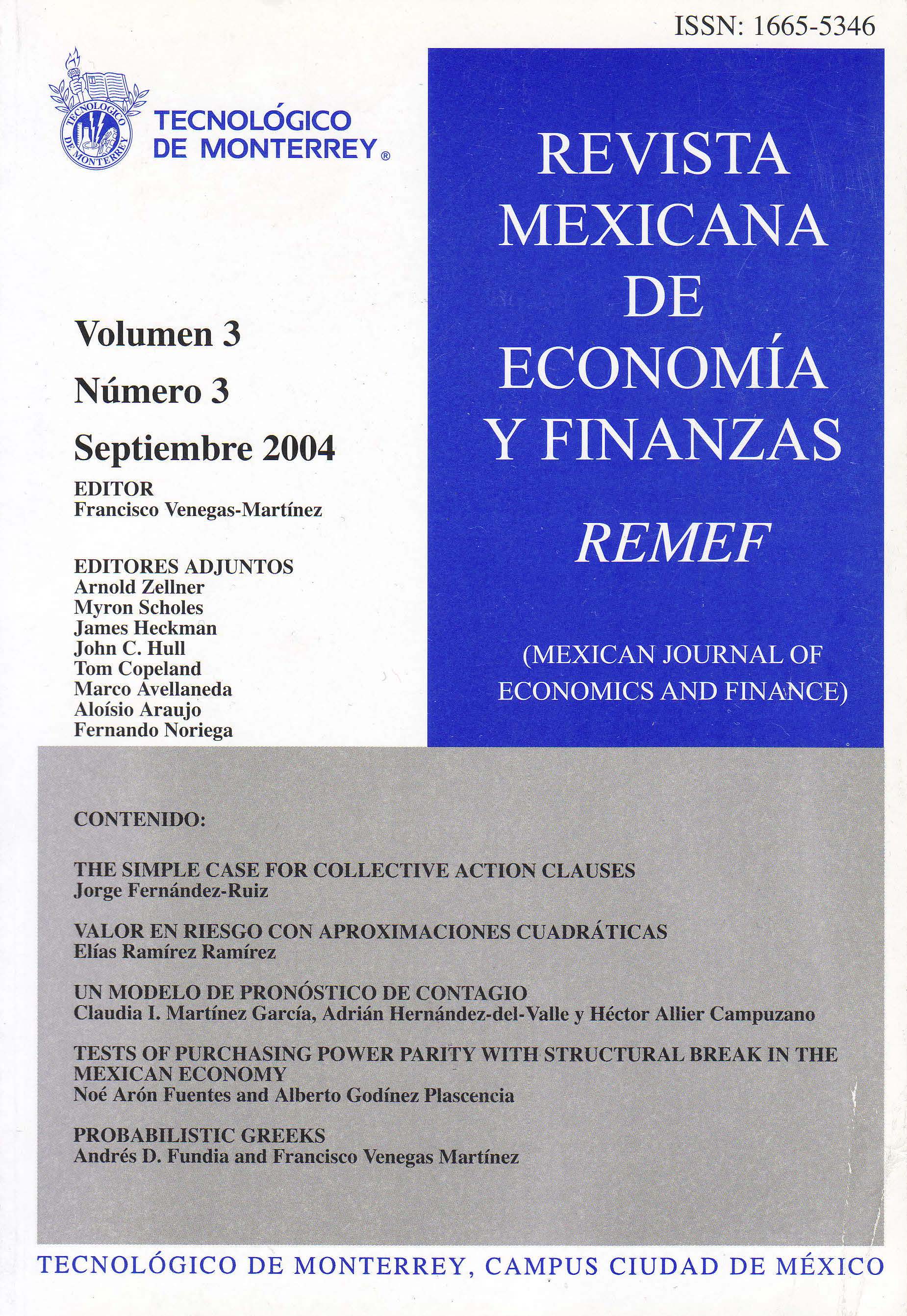

Fundia, A. D., & Venegas-Martínez, F. (2017). PROBABILISTIC GREEKS. Revista Mexicana De Economía Y Finanzas Nueva Época REMEF (The Mexican Journal of Economics and Finance), 3(3). https://doi.org/10.21919/remef.v3i3.171

Issue

Section

Artículos