Expectations for financial operations done through Transition Matrices in the Vulnerable Sectors

DOI:

https://doi.org/10.21919/remef.v12i2.92Abstract

The general objective of this work is to estimate the scenarios for the volume of operations that could emerge in Vulnerable Sectors, susceptible to illicit financial operations. The methods used are the stochastic matrices, also known as transition matrices, as they have demonstrated to be efficient in the prevention of financial risk. The results allowed for the understanding of the volume of operations that could be reported for a period of up to 36 months after the historical data until September 2014. As part of the stochastic analyses, the results provide elements for the financial intelligence to further analyze certain sectors until confirming illicit precedence. The method had not been used for the estimation of operations with illegally obtained resources.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2017-06-16

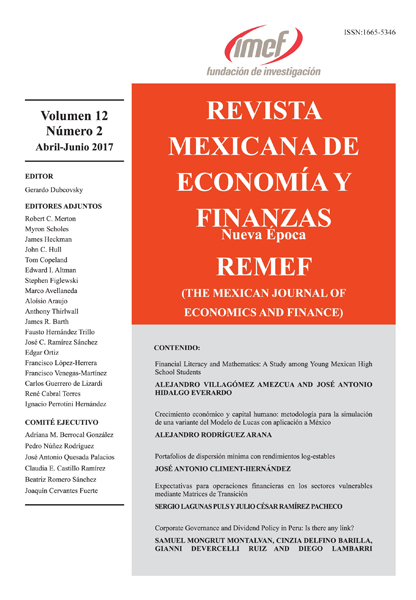

How to Cite

Lagunas Puls, S., & Ramirez Pacheco, J. C. (2017). Expectations for financial operations done through Transition Matrices in the Vulnerable Sectors. The Mexican Journal of Economics and Finance, 12(2). https://doi.org/10.21919/remef.v12i2.92

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas