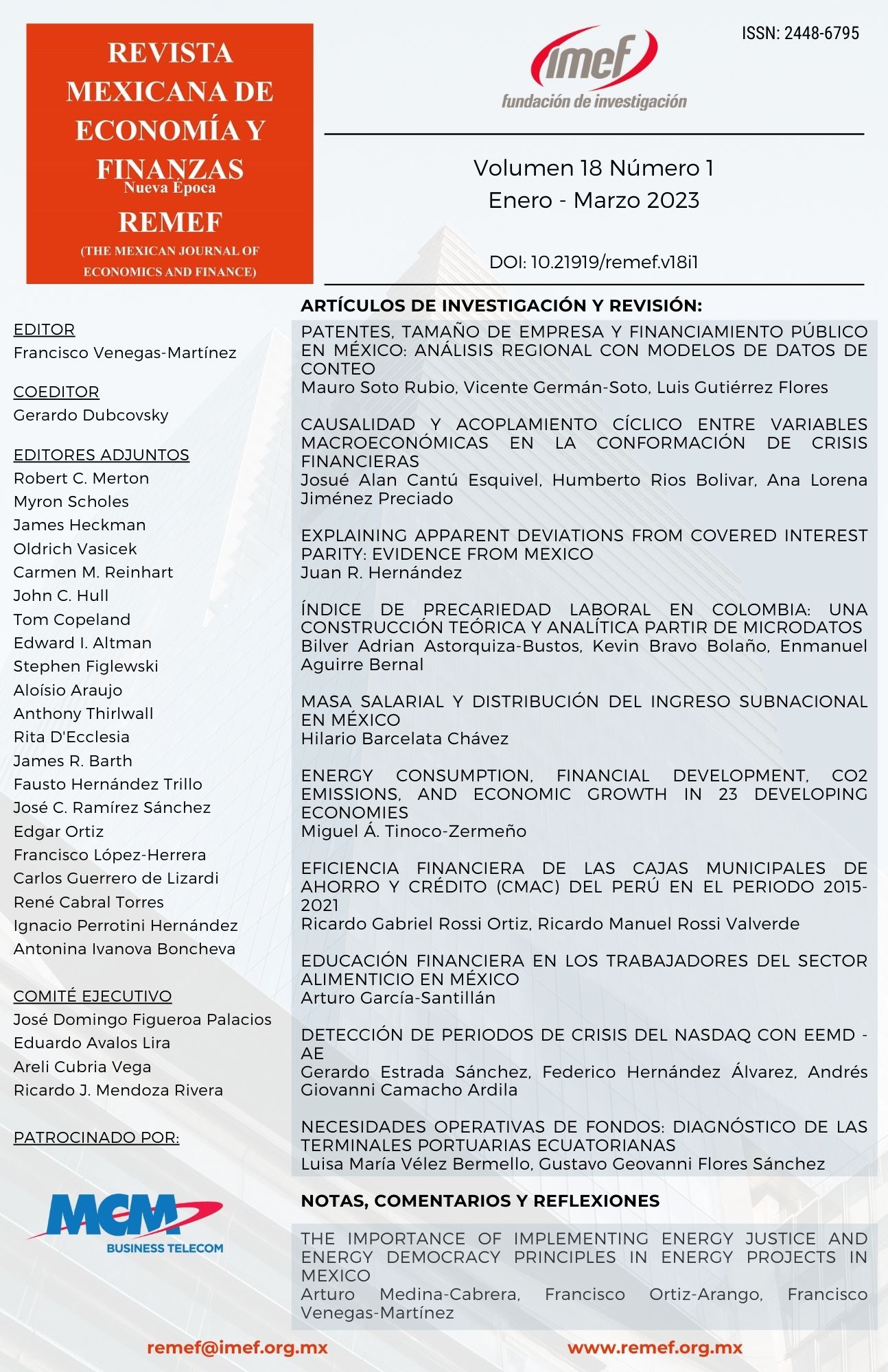

Detección de periodos de crisis del NASDAQ con EEMD -AE

DOI:

https://doi.org/10.21919/remef.v18i1.817Keywords:

EMD, EEMD, spectral analysis, financial markets, financial crisesAbstract

Crisis Periods Detection on NASDAQ Index Via EEMD-AE

It is proposed to identify the beginning and end of the SARS-CoV-2 and subprime crises on the NASDAQ. The EEMD was used to decompose the index into consecutive series with the same number of components and their correlation coefficients were calculated, the power spectrum of the original series was also analyzed. Signals of instability associated with changes in both the components’ correlations and the NASDAQ spectrum were identified. It is recommended to apply the procedure on other series and other crises; likewise, the method is based on the detection of discrepancies, thus being a monitoring tool, but not one of quantitative forecasts. The originality of the work lies in the use of the modified EEMD for the decomposition of consecutive series in the same number of components, and the use of the correlation coefficient between components and the spectrum of the original series as measures of system stability. The approach proved to be useful for identifying and anticipating large changes in the behavior of a time series.

Downloads

Metrics

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Revista Mexicana de Economía y Finanzas Nueva Época REMEF

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

PlumX detalle de metricas