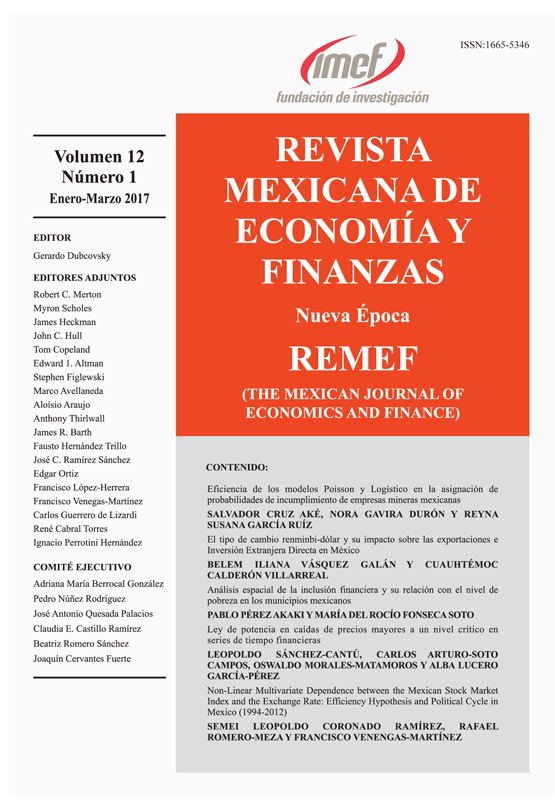

Power Law in Price Falls larger than a Critical Level in Financial Time Series

DOI:

https://doi.org/10.21919/remef.v12i1.8Abstract

The study of financial time series was addressed looking for evidence of self- organization. A methodology was developed to identify as units of study each one of price declines from a recent maximum level and back to the original level. An interval in the space of states in which price falls could be explained as a process that follows a power law was seek. A critical level in the size of falls was identified separating the set of falls operating under a random regime (falls smaller than the critical level), from the set which follows a power law (falls larger than the critical level). This critical level is presumed to be a phase transition point towards a self-organized system. Both the methodology and the approach are original and add a new way to bring out that fluctuations in financial prices obey the power law, a relevant element to build a new systemic theory of price generation in financial markets, more proper to explain deep falls than the Efficient Market Hypothesis.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2017-05-23

How to Cite

Sánchez Cantú, L., Soto Campos, C. A., Morales Matamoros, O., & García Pérez, A. L. (2017). Power Law in Price Falls larger than a Critical Level in Financial Time Series. The Mexican Journal of Economics and Finance, 12(1). https://doi.org/10.21919/remef.v12i1.8

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas