Madurez de la deuda corporativa como variable de tiempo: evidencia de las empresas públicas de México

DOI:

https://doi.org/10.21919/remef.v17i3.688Keywords:

Debt maturity, capital structure, determinants, BMV, MexicoAbstract

Maturity of Corporate Debt as a Time Variable: Evidence of Public Firms from Mexico

This research aims to determine the factors of debt maturity for Mexican companies listed on the BMV, using an alternative method to define the dependent variable. Maturity is defined as "time to contract expiration" considering the weighted average of the expiration time, which contributes to the originality of this work. Panel data models and the Heckman selection model are used, since working with an unbalanced longitudinal panel can present sample selection problems due to atrition. The results suggest that the attrition bias is significant, and that the average maturity of the debt is determined by firm characteristics such as size and leverage, among others, and the interest rate of the Mexican market. As a limitation and due to the omissions of data reported by the information sources used for the analysis, a short and unbalanced panel is used. It is concluded that, by using this maturity alternative measurement method, better results are obtained to analyze the maturity of the debt, compared to the traditional metrics in the literature.

Downloads

Metrics

Downloads

Published

How to Cite

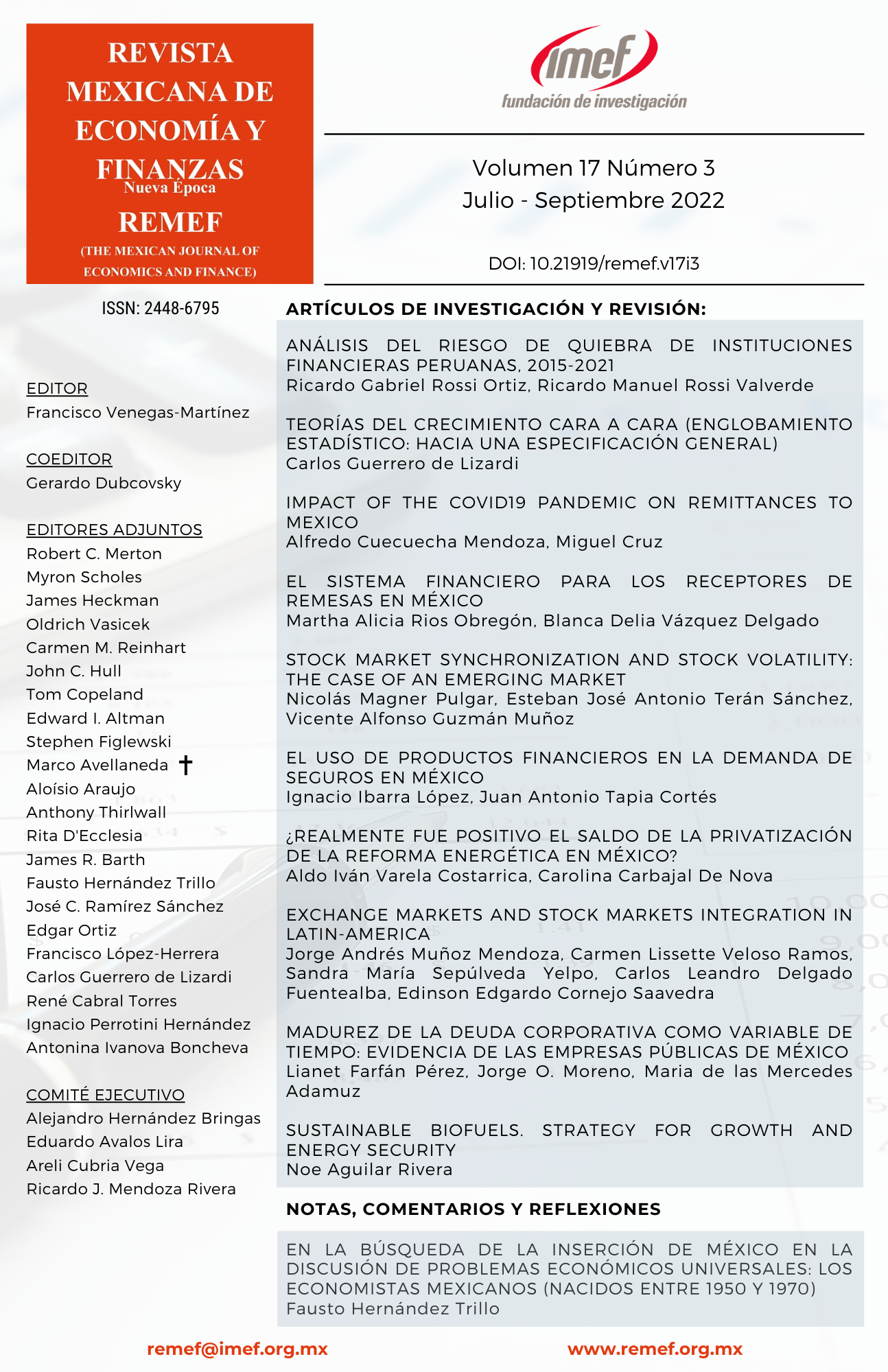

Issue

Section

License

PlumX detalle de metricas