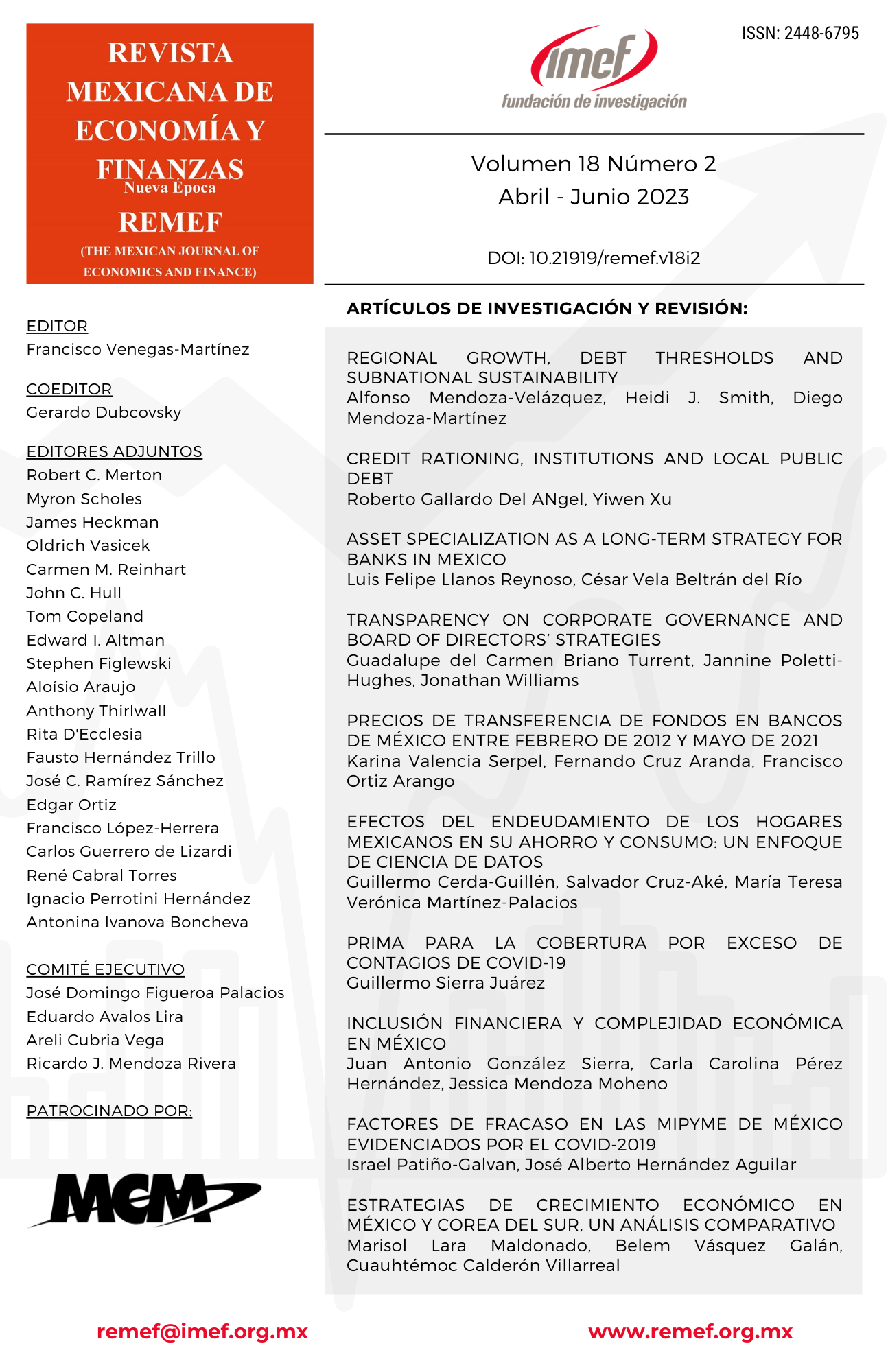

Transparency on Corporate Governance Reporting and board of directors’ strategies

DOI:

https://doi.org/10.21919/remef.v18.2.684Keywords:

Corporate Governance, Transparency, Agency Theory, Board Strategy, Latin America.Abstract

The objective of this paper is to investigate whether the transparency on corporate governance is determined by strategies followed by the board of directors. Based on agency and asymmetric information theories, we hypothesize that strategies pertaining to changes in liquidity, investment, capital structure, innovation and board composition impact on the corporate governance disclosure. The study sample is composed by 826 Latin American firms during the period 2004-2010. A two-way cluster standard errors and GMM methods have been adopted to perform the econometric analysis. Results suggest that corporate governance disclosure is attributable to changes on firm’s decisions made by the board with respect to financial aspects and innovation. However, the impact upon transparency of board composition with regards to female directors, independence and size of boards are attributable to industry and/or country effects.Downloads

Metrics

References

Ahmed, K., Hossain, M., & Adams, M. (2006). The effects of board composition and board size on the informativeness of annual accounting earnings. Corporate Governance: An International Review, 14(5): 418-431. https://doi.org/10.1111/j.1467-8683.2006.00515.x.

Ajinkya, B., Bhojraj, S., & Sengupta, P. (2005). The association between outside directors, institutional investors and the properties of management earnings forecasts. Journal of Accounting Research, 43(3):343-376. https://doi.org/10.1111/j.1475-679x.2005.00174.x.

Apostolos, K., & Konstantinos, A. (2009). Voluntary accounting disclosure and corporate governance:Evidence from Greek listed firms. International Journal of Accounting and Finance, 1(4): 395 – 414.https://doi.org/10.1504/IJAF.2009.029146.

Arellano, M., & Bond, S.R. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economics Studies, 58: 277-297. https://doi.org/10.2307/2297968.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error component models. Journal of Econometrics, 68: 29-51. https://doi.org/10.1016/0304-4076(94)01642-D.

Armstrong, C.S., Guay, W.R., Mehran, H., & Weber, J.P. (2016). The role of financial reporting and transparency in corporate governance. Federal Reserve Bank of New York Economic Policy Review, 22(1): 107-128. Available at: https://www.newyorkfed.org/research/epr/2016/epr_2016_role-of-financial-reporting_armstrong.

Balakrishnan, S., & Fox, I. (1993). Asset specificity, firm heterogeneity and capital structure. Strategic Management Journal, 14(1): 3-16. https://doi.org/10.1002/smj.4250140103.

Baysinger, B., & Hoskisson, R. (1990). The composition of boards of directors and strategic control: Effects on corporate strategy. Academy of Management Review, 15(1): 72-87. https://doi.org/10.2307/258106.

Berglöf, E., & Pajuste, A. (2005). What do firms disclose and why? Enforcing corporate governance and transparency in Central and Eastern Europe. Oxford Review Economic Policy, 21(2): 178-198. https://doi.org/10.1093/oxrep/gri011.

Bibi, N. & Amjad, S. (2017). The relationship between liquidity and firms’ profitability: A case study of Karachi Stock Exchange. Asian Journal of Finance & Accounting, 9(1): 54-67. https://doi.org/10.5296/ajfa.v9i1.10600.

Biddle, G.C., Hilary, G., & Verdi, R.S. (2009). How does financial reporting quality relate to investment efficiency? Journal of Accounting and Economics, 48(2): 112-131. https://doi.org/10.1016/j.jacceco.2009.09.001.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87: 115-143. https://doi.org/10.1016/S0304-4076(98)00009-8.

Braga-Alves, M. V., & Shastri, K. (2011). Corporate governance, valuation, and performance: Evidence from a voluntary market reform in Brazil. Financial Management, 40(1), 139-157. https://doi.org/10.1111/j.1755-053X.2010.01137.x.

Briano-Turrent, G. (2022). Female representation on boards and corporate ethical behavior in Latin American companies. Corporate Governance: An International Review, 30: 80-95. https://doi.org/10.1111/corg.12416.

Briano-Turrent, G. & Rodríguez-Ariza, L. (2016). Corporate governance ratings on listed companies: An institutional perspective in Latin America. European Journal of Managementand Business Economics, 25: 63-75. https://doi.org/10.1016/j.redeen.2016.01.001.

Cambrea, D. R., Calabrò, A., La Rocca, M., & Paolone, F. (2022). The impact of boards of directors’ characteristics on cash holdings in uncertain times. Journal of Management and Governance, 26(1): 189-221. https://doi.org/10.1007/s10997-020-09557-3.

Cameron, A., Gelbach, J.B., & Miller, D.L. (2011). Robust inference with multi-way clustering. Journal of Business & Economic Statistics, 29 (2): 238-249. https://doi.org/10.1198/jbes.2010.07136.

Campbell, D. (2004). A longitudinal and cross-sectional analysis of environmental disclosure in UK companies—a research note. The British Accounting Review, 36(1), 107-117. https://doi.org/10.1016/j.bar.2003.09.001.

Chang, X., Dasgupta, S., & Hilary, G. (2009). The effect of auditor quality on financing decisions. The Accounting Review, 84: 1085-1117. https://doi.org/10.2308/accr.2009.84.4.1085.

Chen, Z., Harford, J., & Kamara, A. (2019). Operating leverage, profitability, and capital structure. Journal of Financial and Quantitative Analysis, 54(1): 369-392. https://doi.org/10.1017/S0022109018000595.

De Jong, A., & Veld, C. (2001). An empirical analysis of incremental capital structure decisions under managerial entrenchment. Journal of Banking & Finance, 25(10): 1857-1895. https://doi.org/10.1016/S0378-4266(00)00163-1.

Fama, E.F., & Jensen, M.C. (1983). Separation of ownership and control. Journal of Law and Economics, 26(2): 301-325. https://www.jstor.org/stable/725104.

Filatotchev, I., Lien, Y.C., & Piesse, J. (2005). Corporate governance and performance in publicly listed, family controlled firms: Evidence from Taiwan. Asia Pacific Journal of Management, 22: 258–283. https://doi.org/10.1007/s10490-005-3569-2.

Gaa, J. C. (2009). Corporate governance and the responsibility of the board of directors for strategic financial reporting. Journal of Business Ethics, 90(2), 179-197. https://doi.org/10.1007/s10551-010-0381-9.

Gamba, A. & Triantis, A. (2008). The value of financial flexibility. The Journal of Finance, 63(5): 2263-2296.

https://doi.org/10.1111/j.1540-6261.2008.01397.x.

Garay, U., & González, M. (2008). Corporate governance and firm value: The case of Venezuela. Corporate Governance: An International Review, 16(3): 194-210. 10.1111/j.1467-8683.2008.00680.x.

Gill, D. (2008). Strategic disclosure of intermediate research results. Journal of Economics & Management Strategy, 17(3): 733-758. https://doi.org/10.1111/j.1530-9134.2008.00193.x.

Gow, I. D., Ormazabal, G., & Taylor, D.J. (2010). Correcting for cross-sectional and time-series dependence in accounting research. The Accounting Review, 85(2): 483-512. https://doi.org/10.2308/accr.2010.85.2.483.

Gul, F.A., Srinidhi, B., & Ng, A.C. (2011). Does board gender diversity improve the informativeness of stock prices? Journal of Accounting and Economics, 51(3): 314-338. https://doi.org/10.1016/j.jacceco.2011.01.005.

Gul, F.A., Hutchinson, M., & Lai, K.M. (2013). Gender-diverse boards and properties of analyst earnings forecasts. Accounting Horizons, 27(3): 511–538. https://doi.org/10.2308/acch-50486.

Healy, P., & Palepu, K. (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics, 31(1-3): 405–440. https://doi.org/10.1016/S0165-4101(01)00018-0.

Hendijani-Zadeh, M. (2021). The effect of corporate social responsibility transparency on corporate payout policies. International Journal of Managerial Finance, 17(5): 708-732. https://doi.org/10.1108/IJMF-07-2020-0386.

Hill, C.W.L., & Snell, S.A. (1988). External control, corporate strategy, and firm performance in research‐intensive industries. Strategic Management Journal, 9(6), 577-590. https://www.jstor.org/stable/2486691.

Hillman, A.J., Shropshire, C., & Cannella, J.A. (2007). Organizational predictors of women on corporate boards. The Academy of Management Journal, 50(4): 941-952. http://www.jstor.org/stable/20159898.

Jacoby, G., Liu, M., Wang, Y., Wu, Z., & Zhang, Y. (2019). Corporate governance, external control, and environmental information transparency: Evidence from emerging markets. Journal of International Financial Markets, Institutions & Money, 58: 269-283. https://doi.org/10.1016/j.intfin.2018.11.015.

Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4): 305-360. https://doi.org/10.1016/0304-405X(76)90026-X.

Jensen, M. (1986). Agency cost of free cash flow, corporate finance, and takeovers. American Economic Review, 76(2): 323-329. https://www.jstor.org/stable/1818789.

Jia, N. (2018). Corporate innovation strategy and stock price crash risk. Journal of Corporate Finance, 53: 155-173. https://doi.org/10.1016/j.jcorpfin.2018.10.006.

Kanodia, C., & Lee, D. (1998). Investment and disclosure: The disciplinary role of periodic performance reports. Journal of Accounting Research, 36(1): 33-55. https://doi.org/10.2307/2491319.

Kerr, J.L., & Werther Jr., W.B. (2008). The next frontier in corporate governance: Engaging the board in strategy. Organizational Dynamics, 37(2): 112-124. https://doi.org/10.1016/j.orgdyn.2008.02.003.

Kieschnick, R. & Moussawi, R. (2018). Firm age, corporate governance, and capital structure choices. Journal of Corporate Finance, 48: 597-614. https://doi.org/10.1016/j.jcorpfin.2017.12.011

Klasa, S., Ortiz-Molina, H., Serfling, M., & Srinivasan, S. (2018). Protection of trade secrets and capital structure decisions. Journal of Financial Economics, 128(2): 266-286. https://doi.org/10.1016/j.jfineco.2018.02.008.

Lang, M., & Lundholm, R. (1993). Cross-sectional determinants of analyst ratings of corporate disclosures. Journal of Accounting Research, 31(2): 246–271. https://doi.org/10.2307/2491273.

Lefort, F., & González, R. (2008). Hacia un mejor gobierno corporativo en Chile. Abante, 11(1): 17-37. Available at: https://repositorio.uc.cl/handle/11534/1522.

Lemmon, M.L., & Zender, J.F. (2010). Debt capacity and tests of capital structure theories. Journal of Financial and Quantitative Analysis, 45(5): 1161. https://doi.org/10.1017/S0022109010000499.

Lim, S.C., Macias, A.J., & Moeller, T. (2020). Intangible assets and capital structure. Journal of Banking & Finance, 105873. https://doi.org/10.1016/j.jbankfin.2020.105873.

Liu, Y.S., Valenti, A., & Chen, Y.J. (2016). Corporate governance and information transparency in Taiwan's public firms: The moderating effect of family ownership. Journal of Management & Organization, 22(5), 662-679. https://doi.org/10.1017/jmo.2015.56.

Mallin, C., & Ow-Yong, K. (2012). Factors influencing corporate governance disclosures: Evidence from Alternative Investment Market (AIM) companies in the UK. The European Journal of Finance, 18(6): 515-533. https://doi.org/10.1080/1351847X.2011.601671.

Matthews, L., Heyden, M. L., & Zhou, D. (2022). Paradoxical transparency? Capital market responses to exploration and exploitation disclosure. Research Policy, 51(1), 104396. https://doi.org/10.1016/j.respol.2021.104396.

McInerney-Lacombe, N., Bilimoria, D., & Salipante, P. (2008). Championing tough issues: How women corporate directors contribute to board deliberations. In S. Vinnicombe, V. Singh, R.J. Burke, D. Bilimoria y M. Huse, (Eds). Women on corporate boards of directors: Research and practice: 123-139. https://doi.org/10.4337/9781848445192.00021.

Mendoza-Quintero, D.D., Briano-Turrent, G.C., & Saavedra-García, M.L. (2018). Diversidad de género en posiciones estratégicas y el nivel de endeudamiento: evidencia en empresas cotizadas mexicanas. Revista Mexicana de Economía y Finanzas Nueva Época, 13(4): 631-654. https://doi.org/10.21919/remef.v13i4.343.

Minton, B.A., & Schrand, C. (1999). The impact of cash flow volatility on discretionary investment and the costs of debt and equity financing. Journal of Financial Economics, 54(3), 423-460. https://doi.org/10.1016/S0304-405X(99)00042-2.

Myers, S., & Majluf, N. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics 13: 187-221. https://doi.org/10.1016/0304-405X(84)90023-0.

Nel, G., Scholtz, H. and Engelbrecht, W. (2022). Relationship between online corporate governance and transparency disclosures and board composition: evidence from JSE listed companies. Journal of African Business, 23(2): 304-325. DOI: 10.1080/15228916.2020.1838831.

Nguyen, P. & Rahman, N. (2020). Institutional ownership, cross-shareholdings and corporate cash reserves in Japan. Accounting & Finance, 60: 1175-1207. https://doi.org/10.1111/acfi.12415.

O'Brien, J. P. (2003). The capital structure implications of pursuing a strategy of innovation. Strategic Management Journal, 24(5): 415-431. https://doi.org/10.1002/smj.308.

Omoregie, K., Olofin, S. A., & Ikpesu, F. (2019). Capital Structure and the Profitability-Liquidity Trade-off. International Journal of Economics and Financial Issues, 9(3): 105-115. Available at SSRN: https://ssrn.com/abstract=3506624

Ostberg, P. (2006). Disclosure, investment and regulation. Journal of Financial Intermediation, 15(3): 285-306. https://doi.org/10.1016/j.jfi.2006.01.002

Poletti-Hughes, J. (2009). Corporate value, ultimate control and law protection for investors in Western Europe. Management Accounting Research, 20: 41-52. https://doi.org/10.1016/j.mar.2008.10.004.

Poletti-Hughes, J., & Williams, J. (2019). The effect of family control on value and risk-taking in Mexico: A socioemotional wealth approach. International Review of Financial Analysis, 63: 369-381. https://doi.org/10.1016/j.irfa.2017.02.005.

Reguera-Alvarado, N., & Bravo, F. (2017). The effect of independent directors’ characteristics on firm performance: Tenure and multiple directorships. Research in International Business and Finance, 41: 509-599. https://doi.org/10.1016/j.ribaf.2017.04.045.

Reichmann, D., Möller, R., & Hertel, T. (2022). Nothing but good intentions: the search for equity and stock price crash risk. Journal of Business Economics, 92: 1455–1489. https://doi.org/10.1007/s11573-022-01085-w.

Samaha, K., & Dahawy, K. (2011). An empirical analysis of corporate governance structures and voluntary corporate disclosure in volatile capital markets: The Egyptian experience. International Journal of Accounting, Auditing and Performance Evaluation, 7(1-2): 61-93. https://doi.org/10.1504/IJAAPE.2011.037726.

Shi, W., Connelly, B. L., Mackey, J. D., & Gupta, A. (2019). Placing their bets: The influence of strategic investment on CEO pay for performance. Strategic Management Journal, 40(12), 2047-2077. https://doi.org/10.1002/smj.3050.

Ştefănescu (2014). Transparency and disclosure requirements – an analysis of corporate governance codes. Atlantic Economic Journal, 42: 113-114. https://doi.org/10.1007/s11293-013-9386-y.

Subrahmanyam, M.G., Tang, D.Y., & Wang, S.Q. (2017). Credit default swaps, exacting creditors and

corporate liquidity management. Journal of Financial Economics, 124(2): 395-414. https://doi.org/10.1016/j.jfineco.2017.02.001.

Sun, J., Ding, L., Guo, J. M., & Li, Y. (2016). Ownership, capital structure and financing decision: evidence from the UK. The British Accounting Review, 48(4): 448-463. https://doi.org/10.1016/j.bar.2015.04.001.

Stulz, R. (1990). Managerial discretion and optimal financing policies. Journal of financial Economics, 26(1): 3-27.

https://doi.org/10.1016/0304-405X(90)90011-N.

Tang, C. H., Lee, Y. H., Lu, W. Z., & Wei, L. (2022). The relationship between analyst coverage and overinvestment, and the mediating role of corporate governance. Evidence from China. Journal of Behavioral Finance, 1-16. https://doi.org/10.1080/15427560.2022.2037601.

Tejersen, S. & Singh, V. (2008). Female presence on corporate boards: A multi-country study of environmental context. Journal of Business Ethics, 83(1): 55-63. https://doi.org/10.1007/s10551-007-9656-1.

Tessema, A. (2019). The impact of corporate governance and political connections on information asymmetry: International evidence from banks in the Gulf Cooperation Council member countries. Journal of International Accounting, Auditing and Taxation, 35: 1-17. https://doi.org/10.1016/j.intaccaudtax.2019.05.001.

Torchia, M., & Calabrò, A. (2008). Board of directors and financial transparency and disclosure. Evidence from Italy. Corporate Governance, 16(3): 593-608. https://doi.org/10.1108/CG-01-2016-0019.

Upadhyay, A., & Sriram, R. (2011). Board size, corporate information environment and cost of capital. Journal of Business Finance & Accounting, 38(9): 1238-1261. https://doi.org/10.1111/j.1468-5957.2011.02260.x.

Wintoki, M.B., Linck, J.S., & Netter, J.M. (2012). Endogeneity and the dynamics of internal corporate governance. Journal of Financial Economics.105(3): 581-606. https://doi.org/10.1016/j.jfineco.2012.03.005.

Zahra, S. (1996). Governance, ownership, and corporate entrepreneurship: The moderating impact of industry technological opportunities. Academy of Management Journal, 39(6): 1713-1735. https://doi.org/10.5465/257076.

Zhong, R.I. (2018). Transparency and firm innovation. Journal of Accounting and Economics, 66(1): 67-93.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Revista Mexicana de Economía y Finanzas Nueva Época REMEF

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

PlumX detalle de metricas