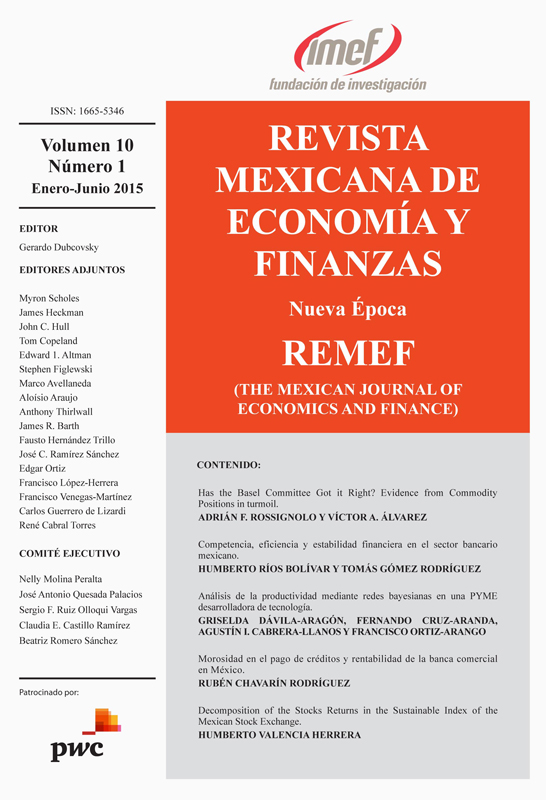

"Decomposition of the Stocks Returns in the Sustainable Index of the Mexican Stock Exchange "

DOI:

https://doi.org/10.21919/remef.v10i1.68Abstract

The Mexican Sustainable Index with the composition at its beginning is less volatile and offers less return than the Mexican Exchange Index in the analyzed period, from January, 1995 to March, 2012. An equally weighted portfolio of the stocks in the Mexican Sustainable Index statistically offers less risk, but similar return to the Mexican Sustainable Index. Betas of the market premium factor, the market capitalization factor and the one-year momentum factor are statistically different from cero in the Fama French and Fama French Carhart model in the period of study for an equally weighted portfolio of stocks in THE Mexican Sustainable Index. In the Fama French Carhart model, betas of the Mexican Sustainable Index change through time.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2017-05-23

How to Cite

Valencia Herrera, D. H. (2017). "Decomposition of the Stocks Returns in the Sustainable Index of the Mexican Stock Exchange ". The Mexican Journal of Economics and Finance, 10(1). https://doi.org/10.21919/remef.v10i1.68

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas