El desempeño financiero de la empresa y la composición del consejo de administración

DOI:

https://doi.org/10.21919/remef.v17i2.609Keywords:

board of directors, independent directors, company financial performance, PLS-SEM, corporate governanceAbstract

Company's Financial Performance and Board of Directors Composition

Based on the Resource Dependence Theory (TDR) and the Agency Theory (TA), this research aims to analyze whether there is a relationship between the number and type of directors (construct board of directors) concerning indicators of financial performance of the company based on ROA, ROE, Net Profit Margin, Income Per Employee, and Beta or Systematic Risk (construct financial performance). Using the innovative and suitable method for small samples, PLS-SEM, authors create a theoretical model based on literature review and a measurement model that operates based on multiple and simultaneous correlations between the selected variables. The results show the conformation of two constructs and denote a statistically significant relationship between them. It has the limitation of being an exploratory and transversal analysis. The study is original in applying the statistical method to the field of corporate governance and finance and in the selection of variables. It is concluded that the proposed theoretical model is efficient in studying the constructs in companies.

Downloads

Metrics

Downloads

Additional Files

Published

How to Cite

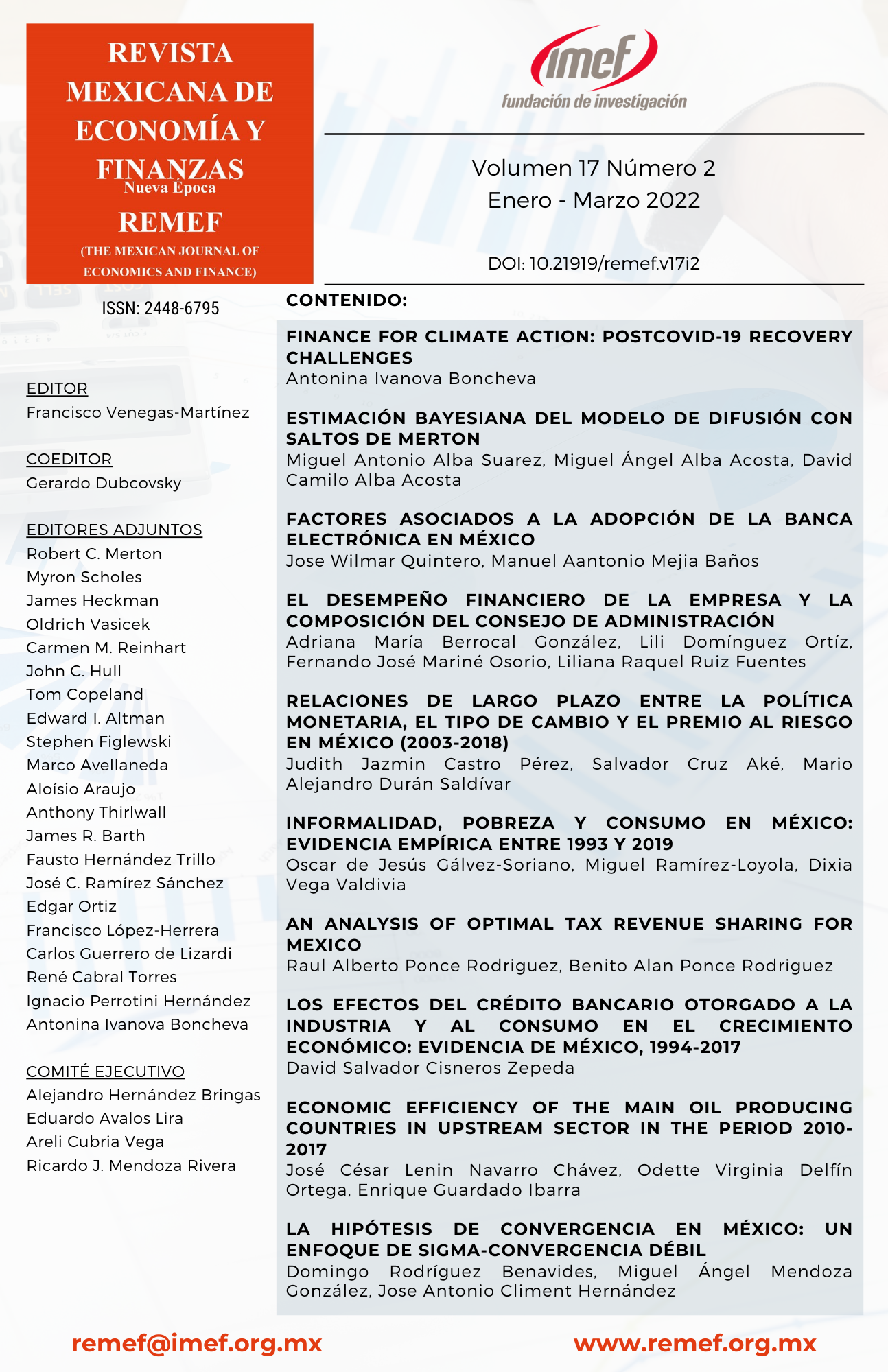

Issue

Section

License

PlumX detalle de metricas