Macroprudential regulation as part of the Mexican policy toolkit

DOI:

https://doi.org/10.21919/remef.v16i1.568Keywords:

Business cycles fluctuations, supply of credit, policy designs, macroprudential policy.Abstract

The objective of this work is to assess the effect of implementing countercyclical macroprudential regulation in Mexico with the objective of verify whether this type of policy is welfare-improving. Using a DSGE model, two kinds of macroprudential rules are tested: countercyclical bank capital requirements and countercyclical loan-to-value ratios. Results suggest that these rules are welfare-improving and avoid the formation of credit bubbles as well as facilitate loans in the presence of macroeconomic crises. Results suggest that the use of countercyclical rules is effective in keeping the debt level according to its long-term equilibrium. This paper presents a theoretical framework to analyze banking regulation for policy purposes and is the first attempt to analyze countercyclical regulation in Mexico using a microfounded model. Results can be used to rationalize the use of macroprudential tools during the COVID‑19 pandemic given the current interventions in the Mexican banking system.

Downloads

Metrics

Downloads

Published

How to Cite

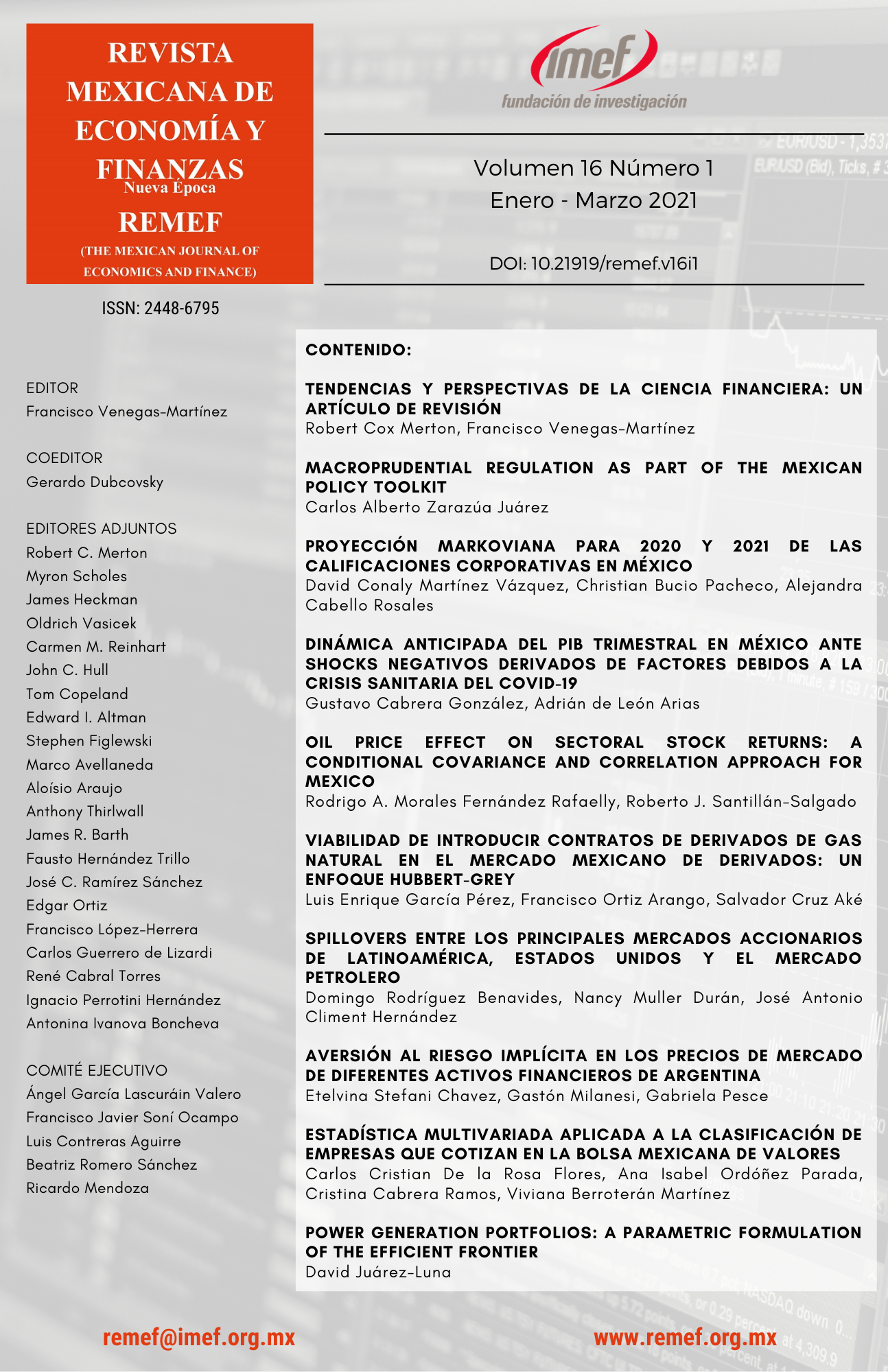

Issue

Section

License

PlumX detalle de metricas