El uso de productos financieros en la demanda de seguros en México

DOI:

https://doi.org/10.21919/remef.v17i3.555Keywords:

insurance, heuristic, financial inclusion, risks, financial productsAbstract

Income, social interaction and the use of financial products on insurance demand in Mexico

In the following work, data from the ENIGH (2010, 2012, 2014, 2016) and a Probit model are used to find out which are the main factors related with insurance. The aim is to test whether insurance ownership in Mexico depends on behavioral aspects such as social interaction, personal experiences (e.g. having faced an accident), as well as the use of financial products and services. Regarding originality, insurance ownership is approached through a mixed approach, which combines traditional and behavioral economics variables. Additionally, the use of microdata is promoted to understand insurance decisions at the household level. The main conclusion is that financial inclusion can lead to the development of heuristics in people who facilitate the ownership of insurance in Mexico.

Downloads

Metrics

Downloads

Additional Files

Published

How to Cite

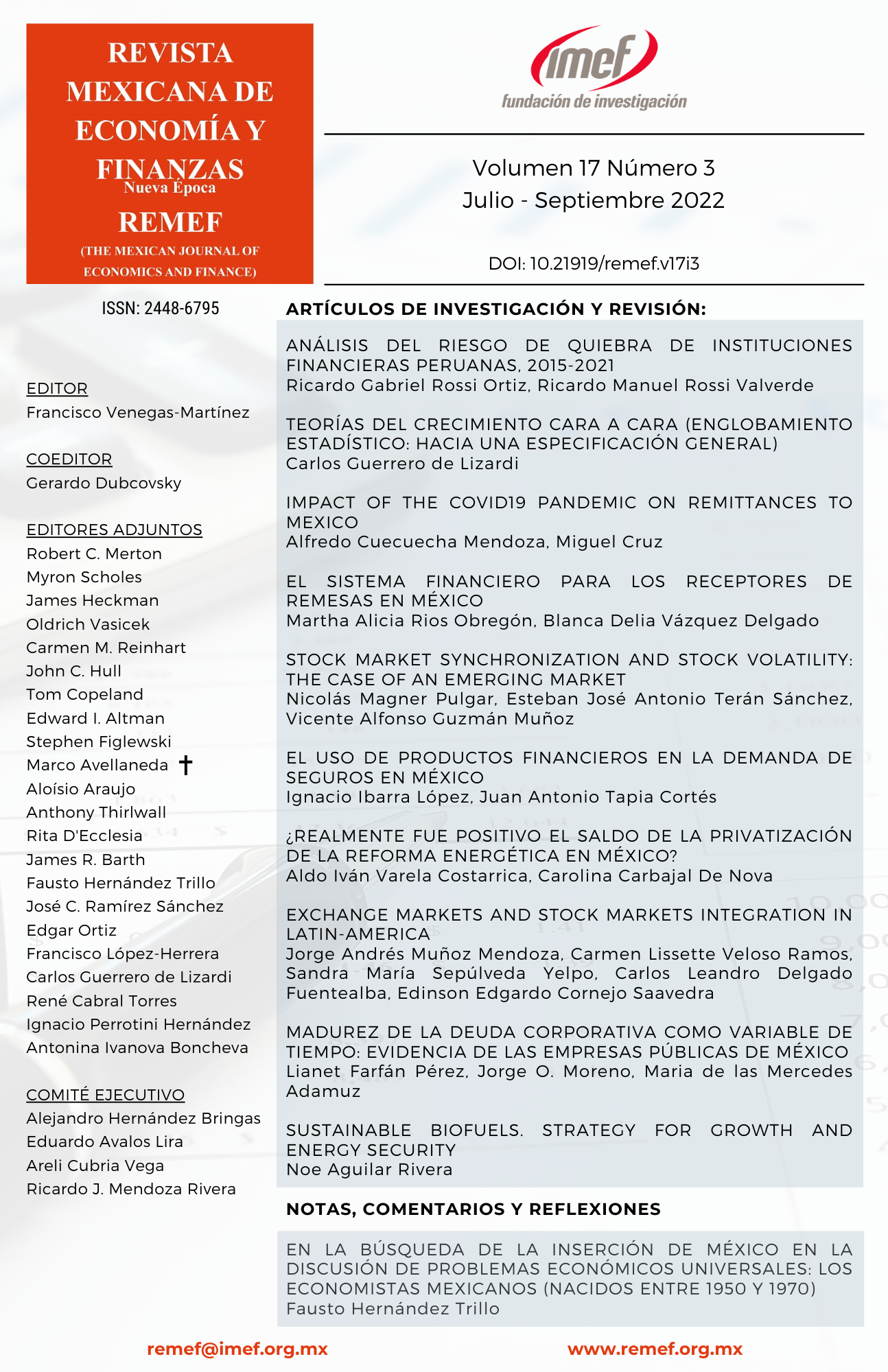

Issue

Section

License

PlumX detalle de metricas