An Analysis of Optimal Tax Revenue Sharing for Mexico

DOI:

https://doi.org/10.21919/remef.v17i2.523Keywords:

Tax revenue sharing, optimal taxation, state and local expenditures, fiscal federalismAbstract

We develop an analysis that identifies the characteristics of an optimal system of shared tax collection and intergovernmental transfers. Mathematical optimization is used to find the level of taxes and intergovernmental transfers. Formulas for the optimal level of taxes and transfers to subnational governments are characterized. We suggest reforms to intergovernmental transfers to include the costs of tax inefficiency, some tax equalization transfer rules, and the marginal social benefits of local public spending. Future research could include local public spending with regional externalities, migration, and consider a dynamic model. This article proposes an original theoretical model of optimal tax coordination and transfers. The optimal level of taxes and transfers are identified. This paper proposes reforms to the participation formula for subnational governments.

Downloads

Metrics

Downloads

Published

How to Cite

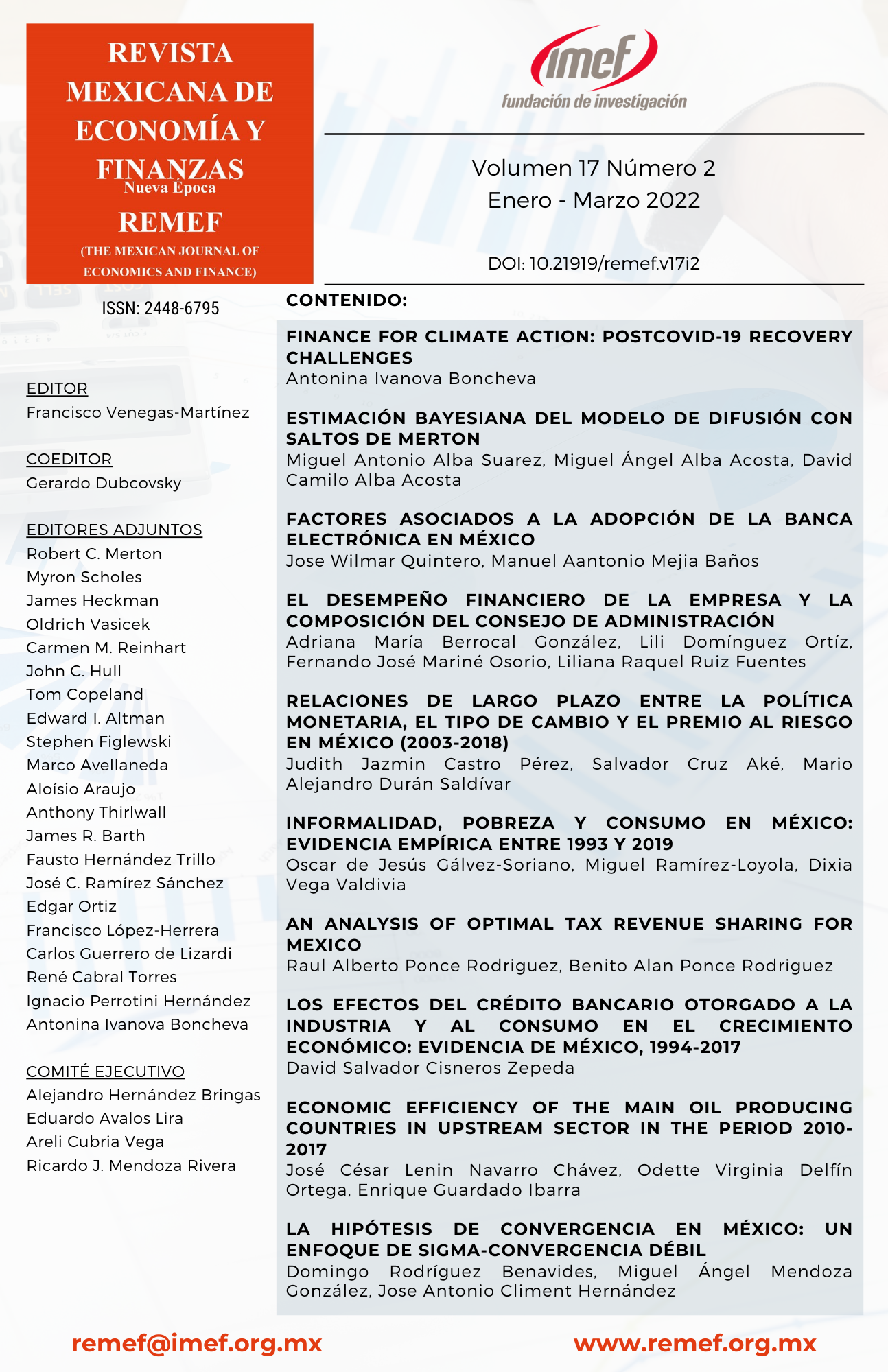

Issue

Section

License

PlumX detalle de metricas