Tasa de política monetaria en México ante los efectos de Covid-19

DOI:

https://doi.org/10.21919/remef.v15i3.514Keywords:

Covid-19, pandemic, monetary policy, interest rate, global crisisAbstract

(Monetary policy rate in Mexico due to the effects of Covid-19)

The economic crisis feeded by Covid-19 has produced supply and demand shocks that affect the potential product and consumer preferences, an impact that suggests that the neutral real interest rate was modified and, therefore, the real interest rate should be adjusted so as not to generate a deeper economic contraction in Mexico. We estimate the value of the neutral rate using the Laubach and Williams method, based on the Kalman filter, and confirm the results with a cointegrated vector of autoregressions (CVAR) model. The results show that the neutral real rate, theoretically consistent with the full employment rate and the inflation target in Mexico, is reduced to 0.1% and the nominal to 3.1%. The empirical determination of the neutral rate based on two different methods for Mexico and its use to approximate how expansive the monetary policy should be in Mexico in the COVID stage. The results suggests the existence of enough room for an expansionary monetary policy that allows facing the crisis and boost economic activity for at least three years.

Downloads

Metrics

Downloads

Published

How to Cite

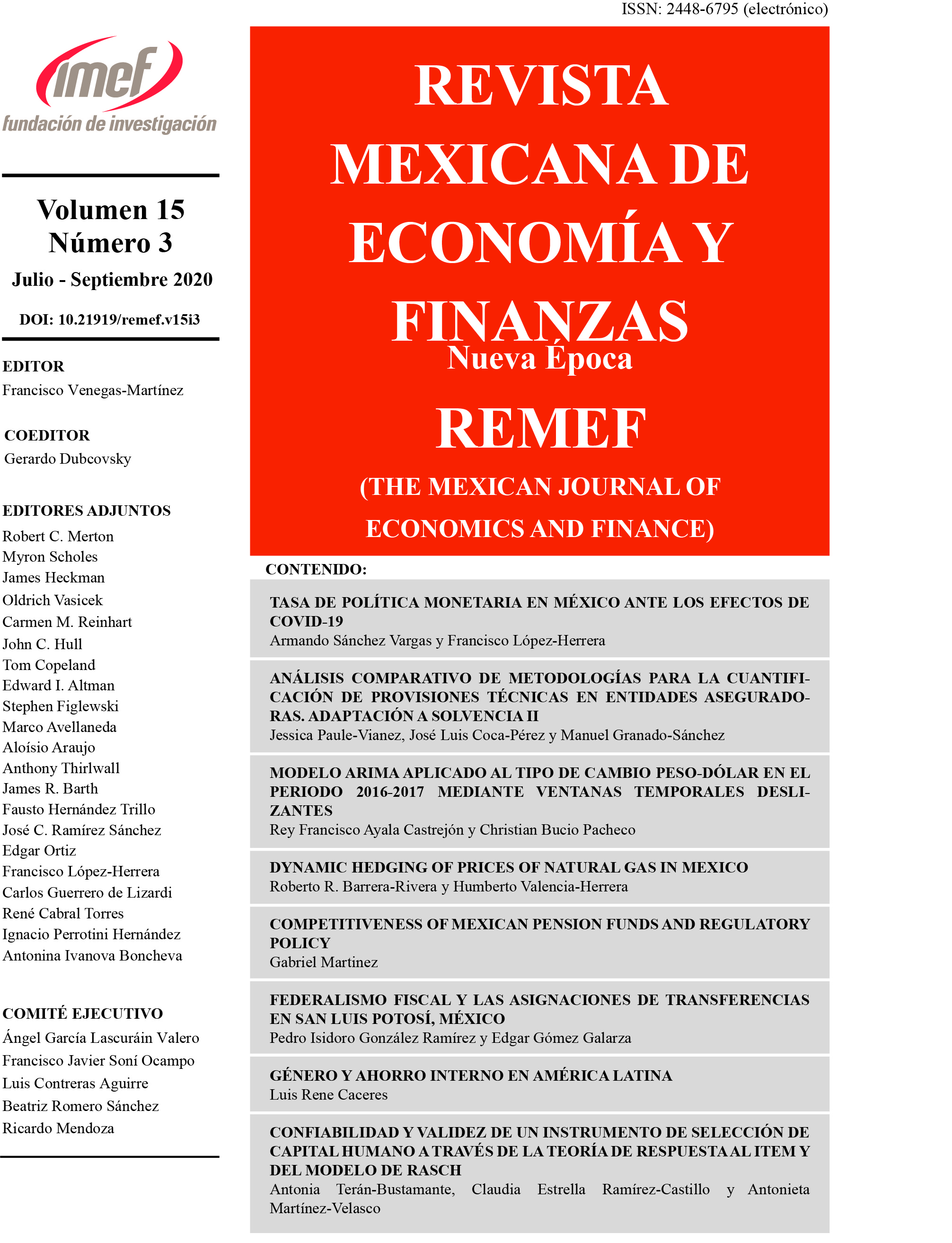

Issue

Section

License

PlumX detalle de metricas