Proyección Markoviana para 2020 y 2021 de las Calificaciones Corporativas en México

DOI:

https://doi.org/10.21919/remef.v16i1.504Keywords:

Markov Chain, Rating Agencies, Corporate Credit Ratings, Mexican Stock MarketAbstract

Markovian Projection of Mexican Corporate Credit Ratings by 2020 and 2021

The objective of this work is to predict the probability of migration between corporate ratings in Mexico, during the period 2018-2021. The Markovian process methodology is applied in discrete time. Empirical evidence shows that corporations' credit ratings have a declining but stable trend in the short term. For the long term, no analyses are applied due to the intrinsic limitations of the model in predicting the probability of transition to long timeframes. Important contribution of this research to the financial literature lies in the application of the Markovian transition to an entire corporate sector to analyze changes in credit ratings, in an environment of uncertainty. The results allow to conclude the relevance of the model to predict the stochastic phenomenon of credit ratings, considering the data characteristics and memory loss. Based on the results obtained it is recommended that companies deepen their economic diversification and maintain a disciplined management of their operations.

Downloads

Metrics

Downloads

Additional Files

Published

How to Cite

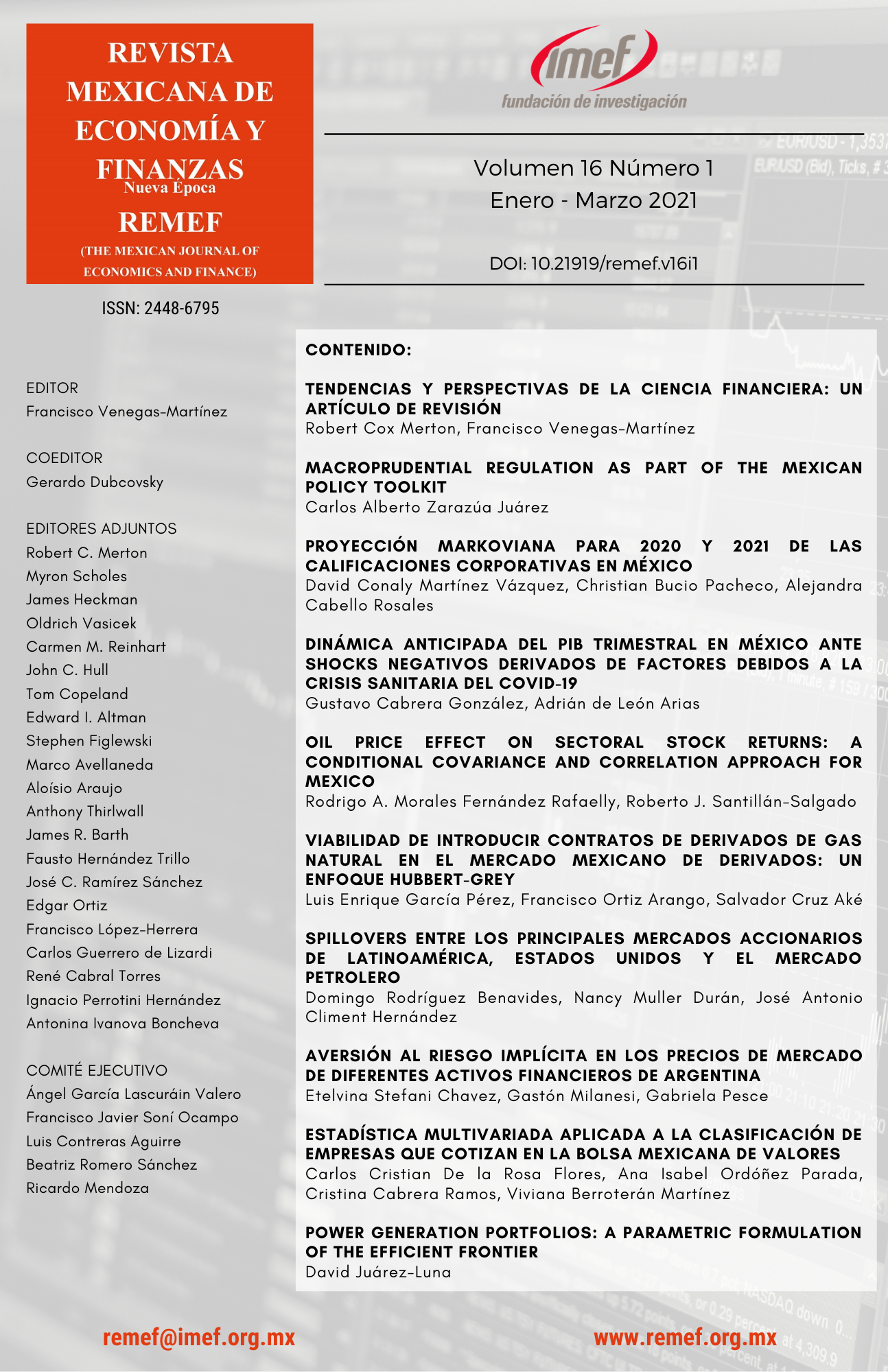

Issue

Section

License

PlumX detalle de metricas