Modelo ARIMA aplicado al tipo de cambio peso-dólar en el periodo 2016-2017 mediante ventanas temporales deslizantes

DOI:

https://doi.org/10.21919/remef.v15i3.466Keywords:

Peso/Dollar Exchange Rate, Forecasting, ARIMA Models, Structural ChangeAbstract

(ARIMA model from 2016 to 2017 term implemented to the peso/dollar exchange rate through temporary sliding windows)

A wide variety of forecasting in the peso/dollar exchange rate through ARIMA(1,1,1) model from 2016 to 2017 has been done in this work, such model was implemented on the peso/dollar exchange rate it is estimated in many different ways through temporary sliding windows. Also, problems of structural change are identified and an optimal adjustment is proposed to the ARIMA(1,1,1) model which allows to give a better forecasting. The empirical evidence highlights the complexity in giving a forecasting with data which specific characteristic is to change through the time, and also with structural change. In such way, the recommendation and the innovation of this research is located in the procedures that help to improve the forecasting like the one for the temporary sliding windows and the structural change proposition. As a conclusion, the 30-day obtained forecast through sliding windows and sliding growing right windows is viable, because with a 95% confidence interval there are 12 out of 30 registers in the rank of real value of the peso/dollar exchange rate.

Downloads

Metrics

Downloads

Additional Files

Published

How to Cite

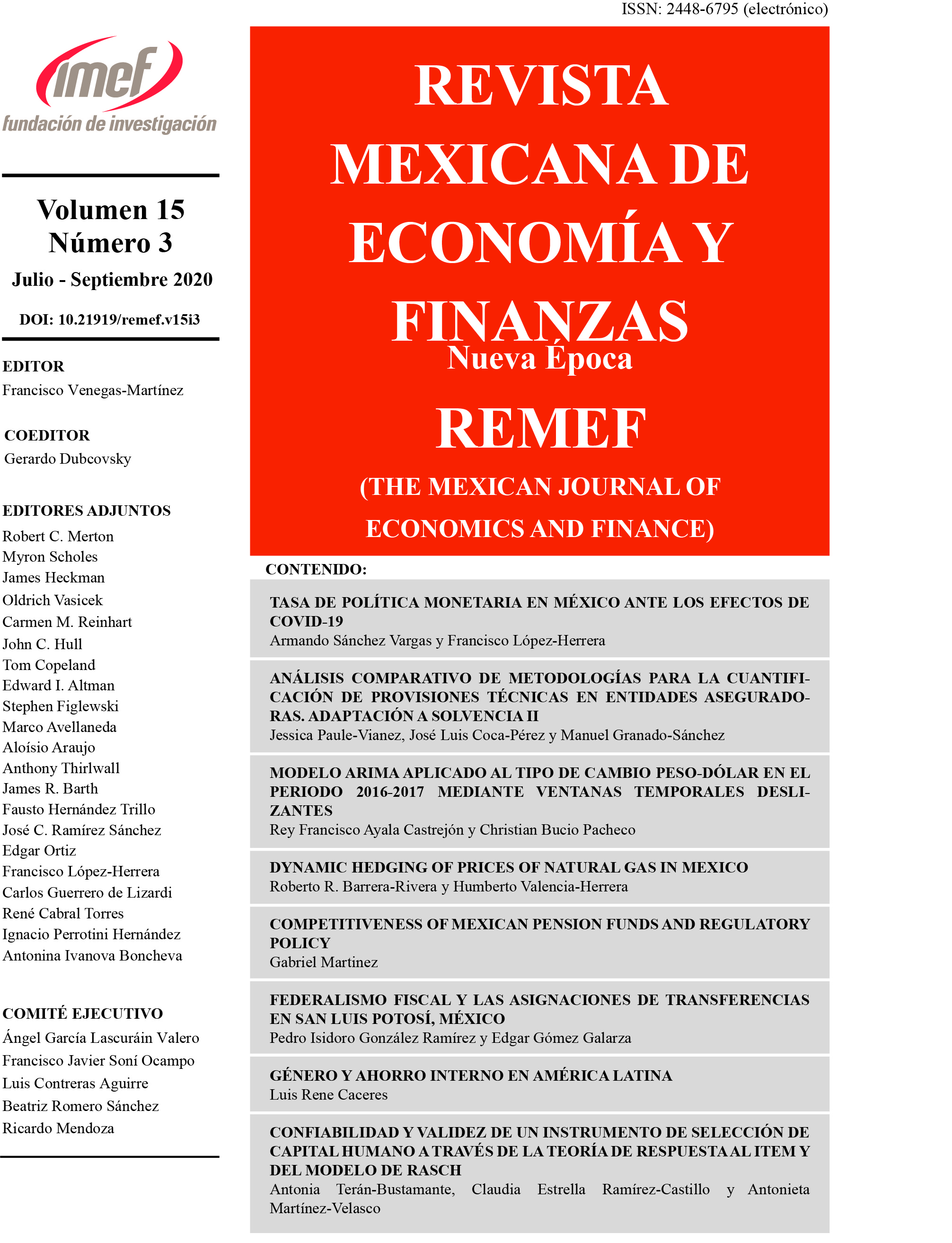

Issue

Section

License

PlumX detalle de metricas