Expectativas en las tasas de interés y noticias de política monetaria de EEUU.

DOI:

https://doi.org/10.21919/remef.v15i1.463Keywords:

interest rates, risk-neutral densities, Taper TantrumAbstract

(Interest Rates Expectations and Monetary Policy News in the US)

The Taper Tantrum event is related to the high volatility experienced in the US stock markets between April and June 2013. The apparent cause was a set of announcements made by the Fed as a means to increase the interest rate, which was at relative low levels since the financial crises of 2008-2009. This research estimates the expected value of the level of T-Note of a representative agent, and its significant variations, around the Taper Tantrum. For this purpose, the risk-neutral density of the interest rate extracted from option prices, which has implicit information on the expectations, is estimated. The obtained results indicate that the proposed methodology implicitly measures the expectations in the debt market. This is relevant, because this kind of research has not been doing for this important event. The working hypothesis is that the announcements of policymakers made during the Taper Tantrum have a statistically significant effect on US stock markets.

Downloads

Metrics

Downloads

Published

How to Cite

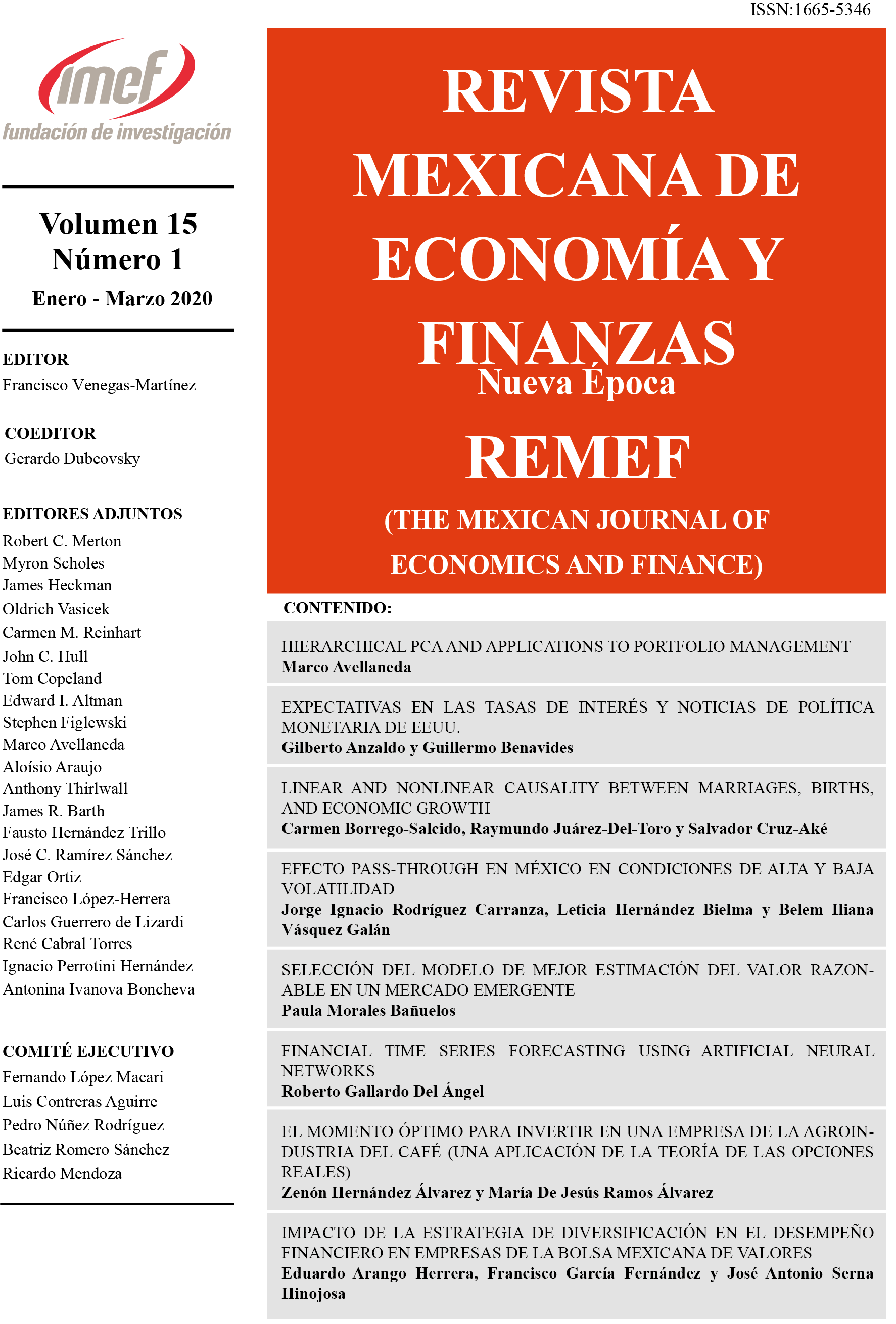

Issue

Section

License

PlumX detalle de metricas