Estadística multivariada aplicada a la clasificación de empresas que cotizan en la Bolsa Mexicana de Valores

DOI:

https://doi.org/10.21919/remef.v16i1.452Keywords:

Financial reasons, multivariate statistics, principal component analysis, cluster analysisAbstract

Multivariate statistics applied to the classification of companies listed on the Mexican Stock Exchange

The objective was to demonstrate the effectiveness of multivariate statistics to compact, analyze and classify information obtained from financial performance indicators. A principal component analysis (PCA), justified by the Kaiser-Meyer-Olkin (KMO) measurement test and the Barlett sphericity test, was applied to 14 financial reasons of each of the 21 companies selected by sampling probabilistic, which were listed on the Mexican Stock Exchange during 2017, to finally apply a hierarchical and a non-hierarchical cluster analysis. In the results, 3 main components were obtained, capable of summarizing the total variability in 76%, which allowed a classification of lower to higher level of liquidity, profitability and activity, in addition to forming clusters of companies in relation to the similarity of Your financial performance We suggest replicating this research in companies that are listed in other markets, such as the NYSE or the NASDAQ. It is concluded that multivariate statistics is capable of generating more compact financial information, optimizing decision making by investors.

Downloads

Metrics

Downloads

Additional Files

Published

How to Cite

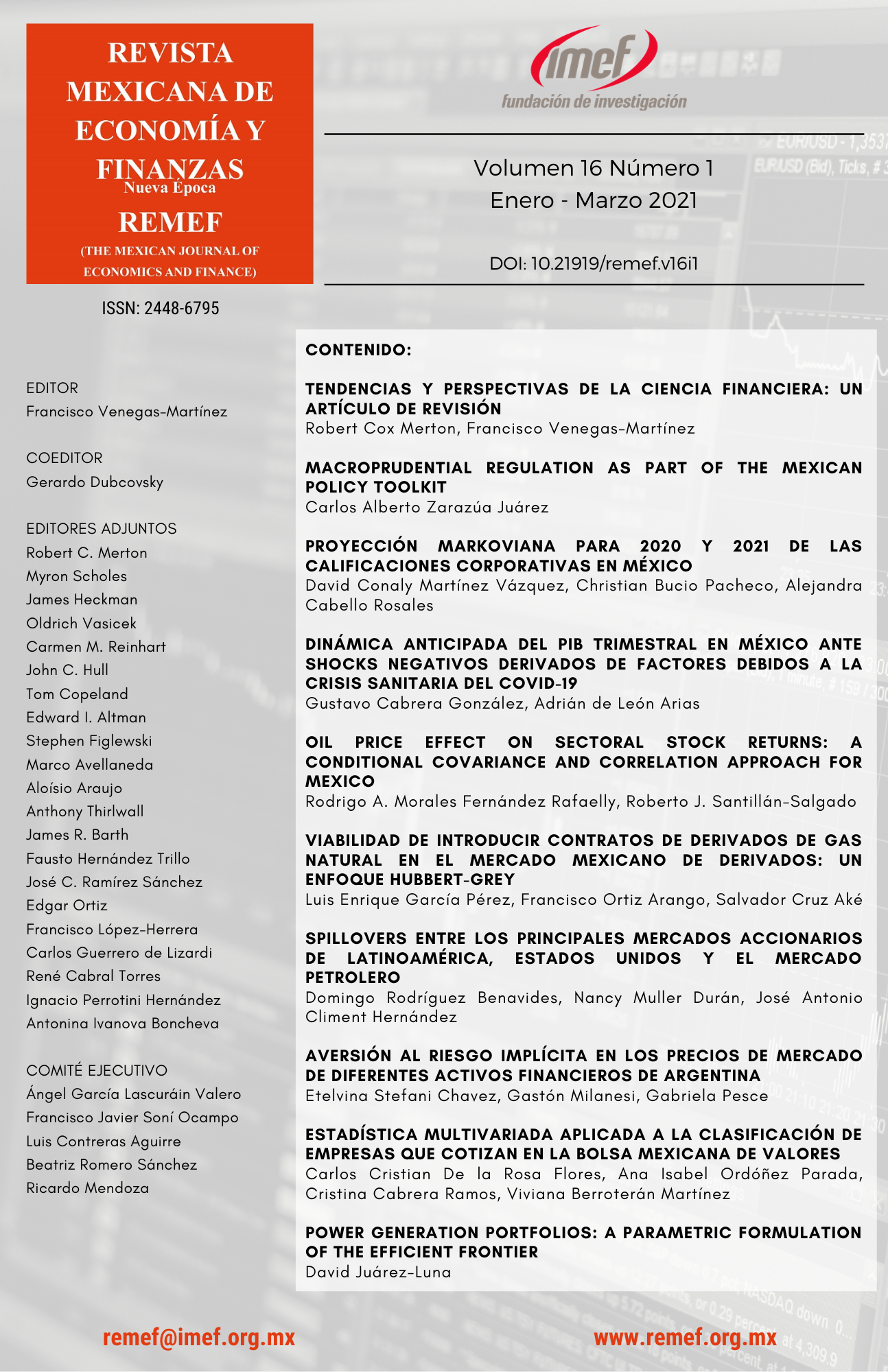

Issue

Section

License

PlumX detalle de metricas