Aversión al riesgo implícita en los precios de mercado de diferentes activos financieros de Argentina

DOI:

https://doi.org/10.21919/remef.v16i1.451Keywords:

risk aversion, US dollar, monetary policy rate, stocks, CRRA, FTPAbstract

Risk aversion implied in the market prices of different financial assets in Argentina

The article aims to determine the degree of risk aversion that is implicit in the market price of the US dollar, the Argentine monetary policy rate and the leading actions of the S&P Merval index. Methodologically, we apply the concept of certainty equivalent, modeling the behavior against risk of the agents based on the utility function with constant relative risk aversion (CRRA) and the function of three flexible parameters (FTP). The results show that the implicit risk aversion coefficient takes values between 0.50 and 0.89 under the assumption of CRRA, while it fluctuates between 0.4622 and 1.1038 when FTP is assumed. The limitations of the paper include the extension of the time series and utility functions chosen. The originality of the study lies in the proposed methodology, the types of assets considered, the comparative use of two utility functions and their application in an emerging market. As a main conclusion, a risk aversion behavior with both functions is identified, which varies from moderate to very high depending on which one is used.

Downloads

Metrics

Downloads

Additional Files

Published

How to Cite

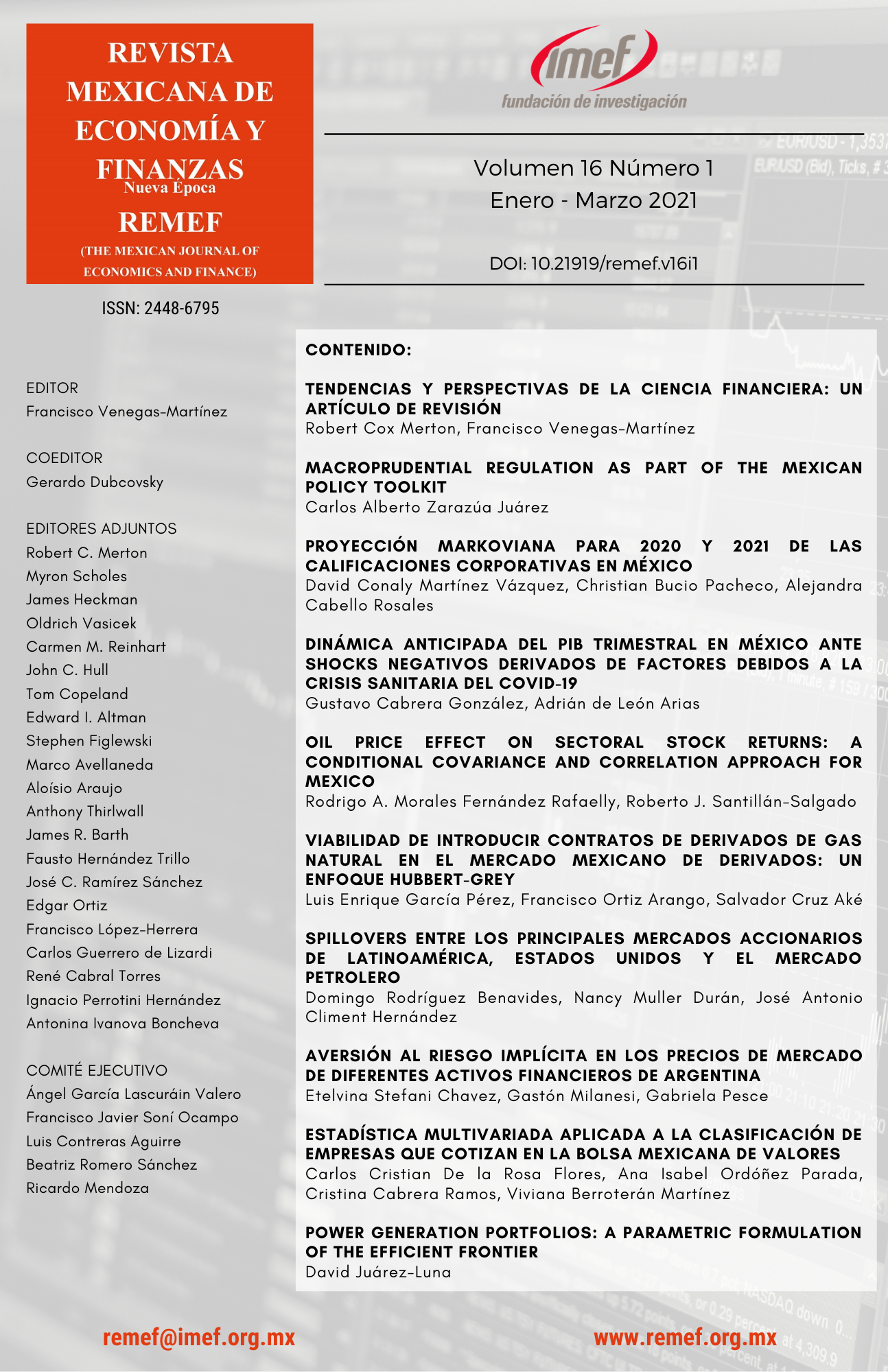

Issue

Section

License

PlumX detalle de metricas