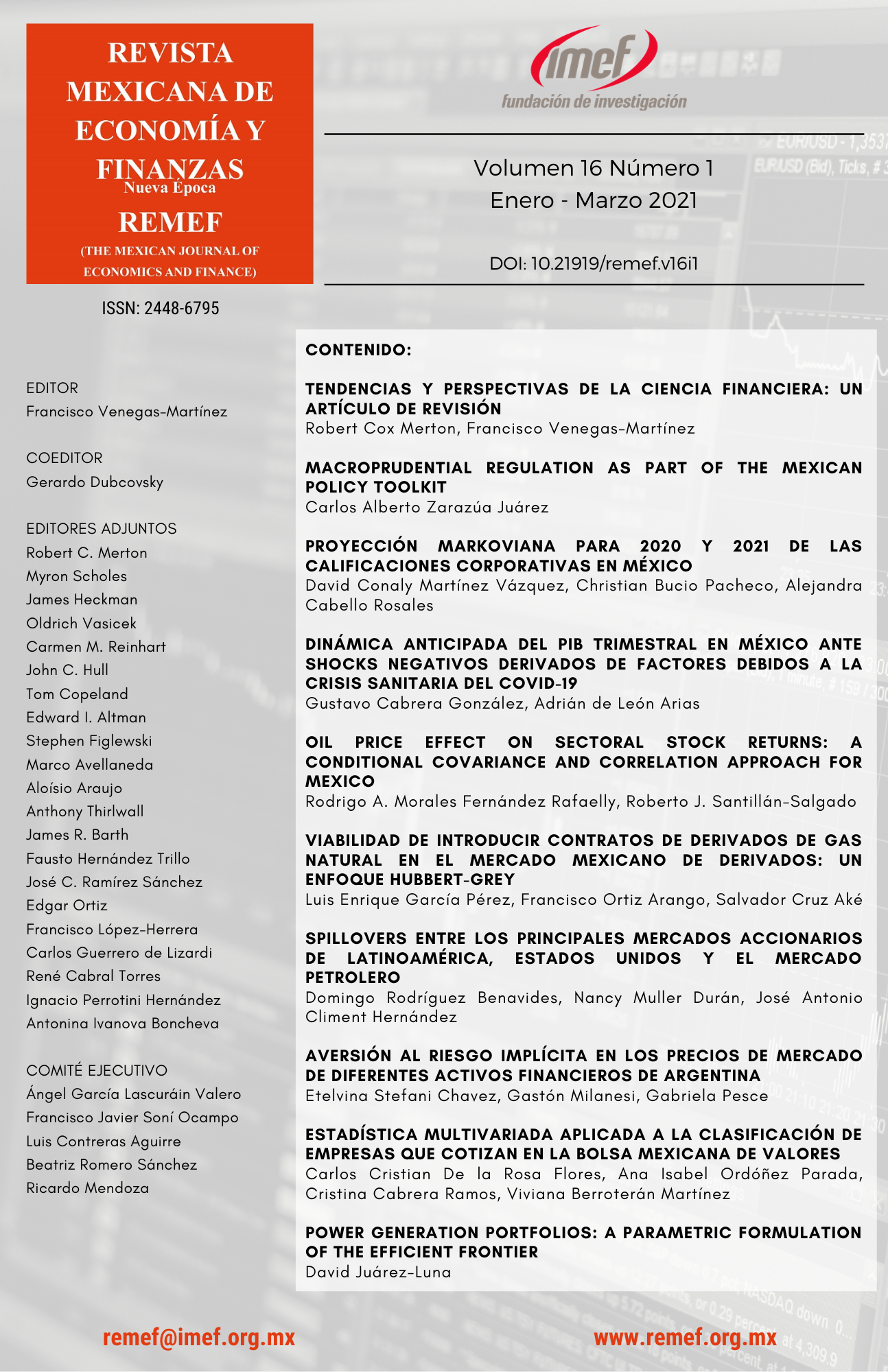

Power generation portfolios: A parametric formulation of the efficient frontier

DOI:

https://doi.org/10.21919/remef.v16i1.447Keywords:

Portfolio, Power Generation, Efficient Frontier, Risk, Return.Abstract

This paper aims to provide a methodology to construct parametrically the Efficient Frontier (EF) of Power Generation Portfolio (PGP). The methodology works as follows. First, we obtain two sets of the shares of the assets: one that guarantee the maximal expected return on the PGP; and another that guarantee the minimal risk of the PGP. The EF corresponds to the parametric equation of the risk-return profiles from the minimal risk to the maximal expected return of the PGP. We apply our methodology to replicate the results from three existing papers. The present methodology allows to and different and more coherent results than those obtained in the original papers. The analysis suggests that there are optimal investment alternatives that have been denied by previous analysis. This fact creates a bias in the design of investment policies in electricity generation. One limitation of the paper is that the analysis relies on the assumption that the covariances of the returns of the different assets is zero. This assumption leads to gains in tractability, clarity, and in the scope of the methodology formulated.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2020-10-12

How to Cite

Juárez-Luna, D. (2020). Power generation portfolios: A parametric formulation of the efficient frontier. The Mexican Journal of Economics and Finance, 16(1), e447. https://doi.org/10.21919/remef.v16i1.447

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas