Active portfolio management in the Andean countries’ stock markets with Markov-Switching GARCH models

DOI:

https://doi.org/10.21919/remef.v14i0.425Keywords:

Markov-Switching GARCH, Markov chain processes, Active portfolio management, Andean region stocks, Computational Finance, Risk management.Abstract

In the present paper we test the benefits of using two-regime Markov-Switching (MS) models in the stock markets of the MSCI Andean index (Chile, Colombia and Perú). We tested this with either, constant, ARCH or GARCH variances and Gaussian or t-Student log-likelihood functions. By performing 996 weekly simulations from January 2000 to January 2019 with each MS model, we tested the next investment strategy for a U.S. dollar based investor: 1) to invest in the risk-free asset if the probability of being in the high-volatility regime at t+1 is higher than 50 % or 2) to do it in the stock market index otherwise. Our results suggest that the Gaussian MS-GARCH models are the most suitable to generate alpha in the Chilean stock market and the Gaussian MS-ARCH in the Colombian one. For the Peruvian case, we found that is preferable to perform passive investing instead of active trading.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2019-08-13

How to Cite

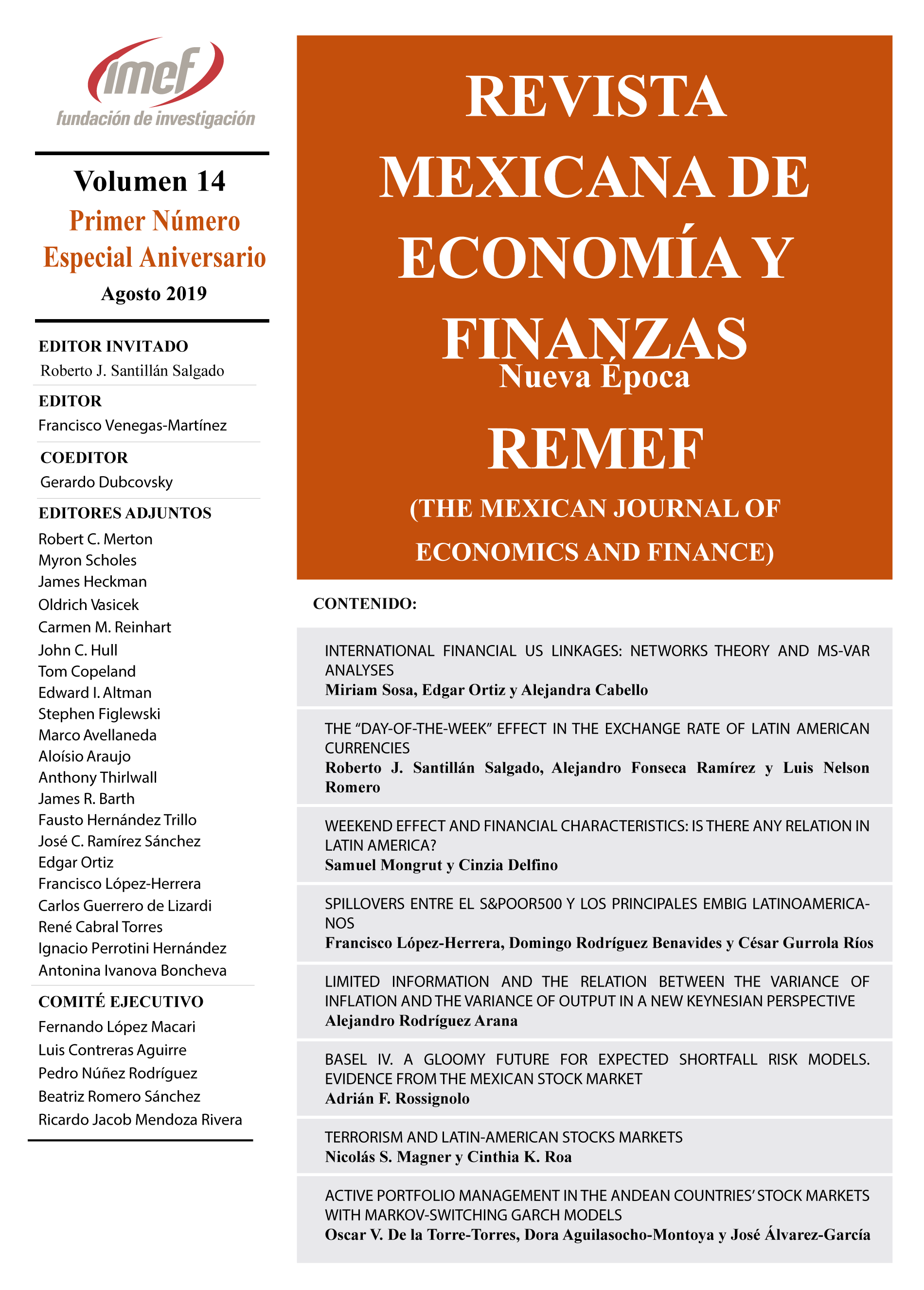

De la Torre-Torres, O. V., Aguilasocho-Montoya, D., & Álvarez-García, J. (2019). Active portfolio management in the Andean countries’ stock markets with Markov-Switching GARCH models. The Mexican Journal of Economics and Finance, 14, 601–616. https://doi.org/10.21919/remef.v14i0.425

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas