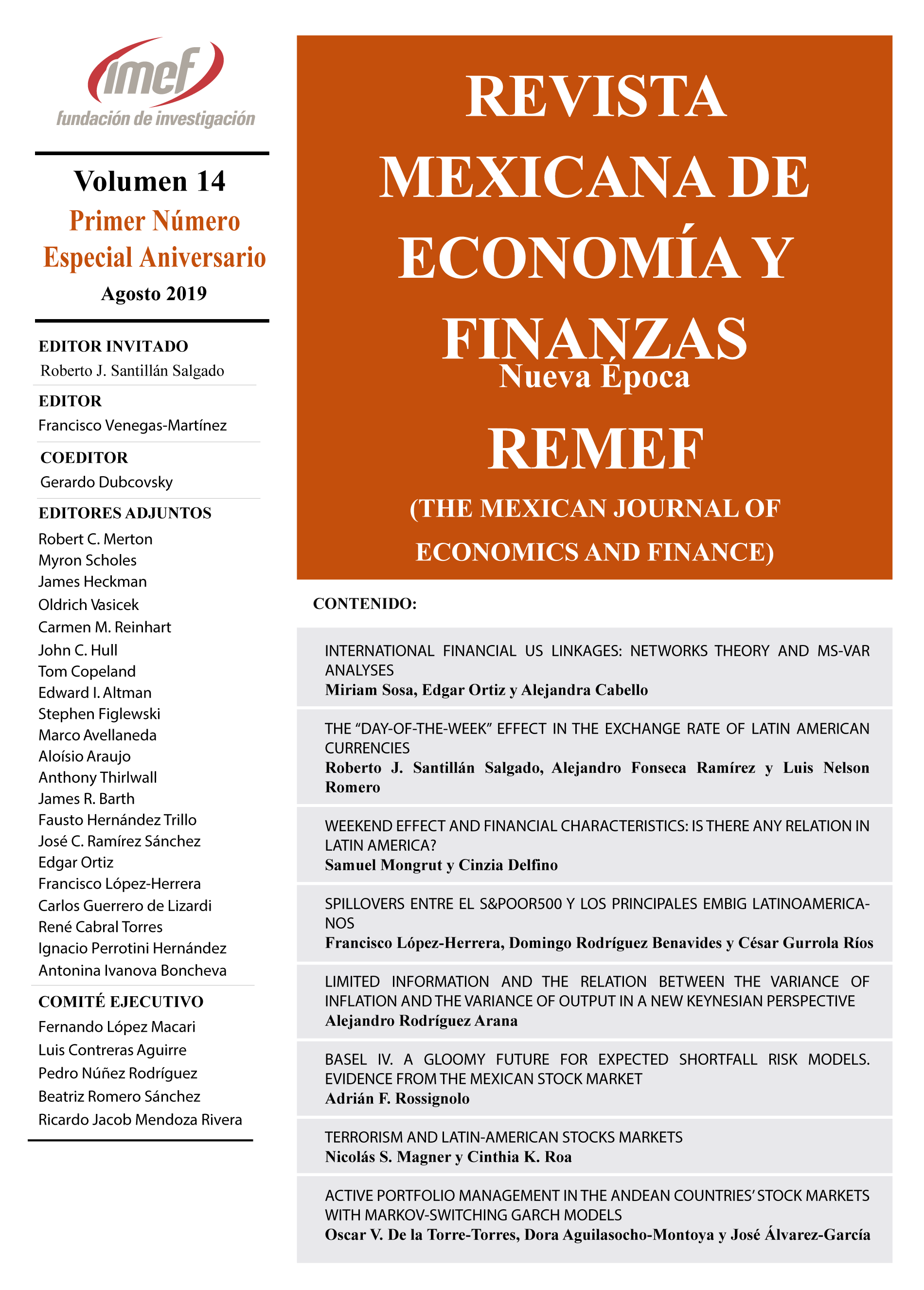

Limited Information and the Relation Between the Variance of Inflation and the Variance of Output in a New Keynesian Perspective

DOI:

https://doi.org/10.21919/remef.v14i0.422Keywords:

Inflation, variance of inflation, variance of output, interest rate’s setting, inflation targetingAbstract

The objective of this paper is to analyze the effects on welfare of a monetary policy that establishes the reference interest rate at discrete intervals of time. The hypothesis is that because there is uncertainty about various disturbances that will occur in the period in which the referential interest rate is established, this can cause a loss of social welfare. To analyze the problem, a model is proposed where the central bank minimizes a loss function. When there is perfect certainty, an efficient frontier between the variances of inflation and output is reached. With uncertainty the result is inefficient. This implies the need to discuss whether it would be convenient for the interest rate to be set contingently. The main limitation of the work is perhaps that the model used makes a large number of abstractions, which allows it to be functional, but can leave out important aspects of reality. There seems to be very few papers, in any, that deal with the problem addressed in this workDownloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2019-08-13

How to Cite

Rodríguez Arana, A. (2019). Limited Information and the Relation Between the Variance of Inflation and the Variance of Output in a New Keynesian Perspective. The Mexican Journal of Economics and Finance, 14, 541–557. https://doi.org/10.21919/remef.v14i0.422

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas