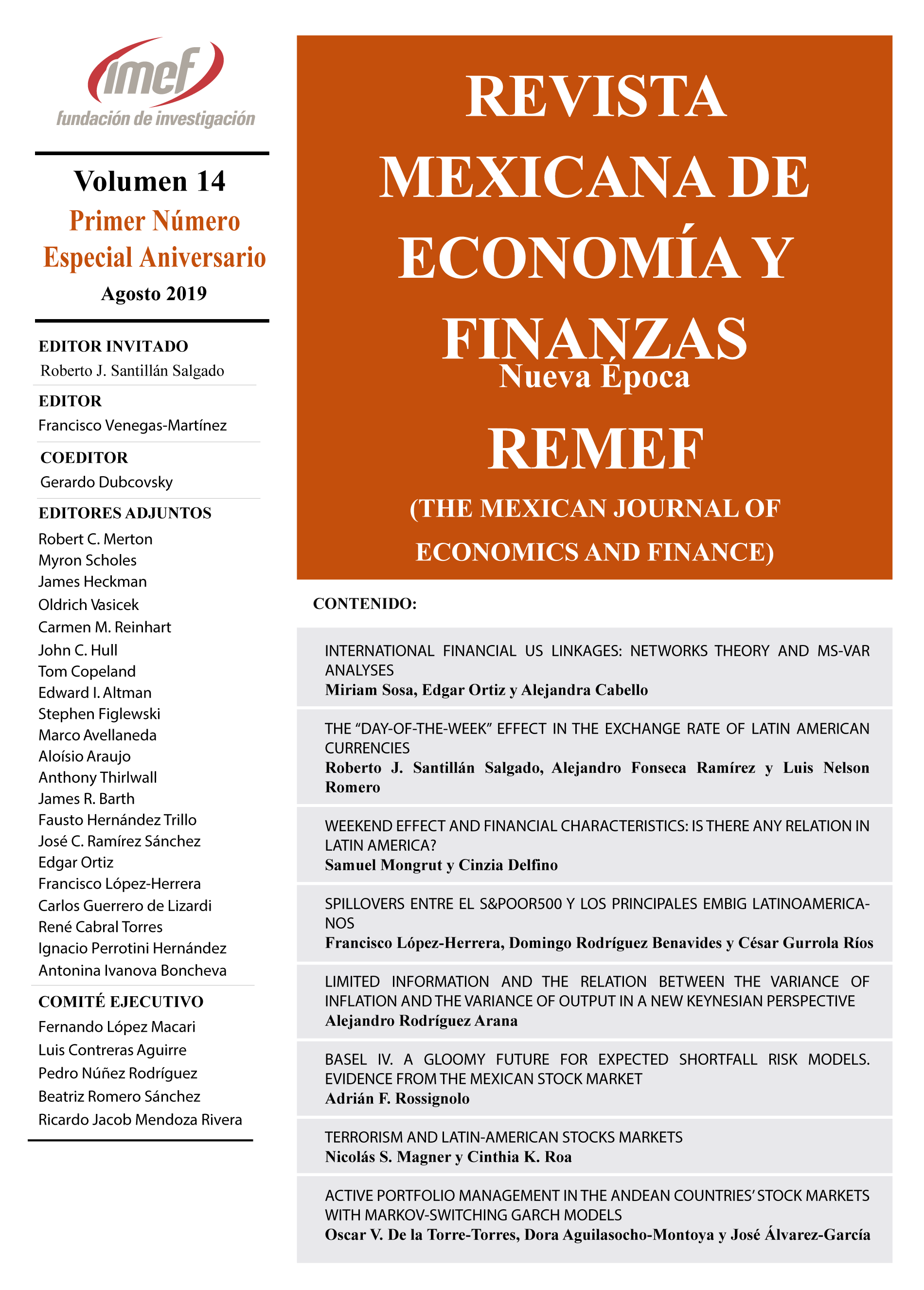

Weekend effect and financial characteristics: is there any relation in Latin America?

DOI:

https://doi.org/10.21919/remef.v14i0.420Keywords:

Market anomalies, weekend effect, Latin AmericaAbstract

This study seeks to investigate the presence of the weekend effect in six Latin American markets (Argentina, Brazil, Chile, Colombia, Mexico and Peru) and to show the relationship between the weekend effect and investment portfolios sorted by four financial characteristics: stock market liquidity, current liquidity ratio, market capitalization (size) and price-to-book ratio. Using an extension of the French (1980) Model and a portfolio study we identified a significant weekend effect in all countries and found a negative relation between the weekend effect and four financial characteristics: the weekend effect is stronger in portfolios that contain stocks with low market liquidity, securities with low current liquidity ratios, small cap stocks (size) and stocks with low price-to-book ratios. Our contribution lies in unveiling the role of institutional investors in generating the weekend effect in emerging markets. As opposed to previous studies, we suggest that the weekend effect may be influenced by the investment of institutional investors in securitized loans issued by companies with value stocks and tight current liquidity ratios, and by the investment of individual investors in small-cap and illiquid stocks. Our results are limited by the fact that we do not know in detail institutional investors’ investment practices, but they also imply that there must be higher scrutiny in the composition of their investment portfolios.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2019-08-13

How to Cite

Mongrut, S., & Delfino, C. (2019). Weekend effect and financial characteristics: is there any relation in Latin America?. The Mexican Journal of Economics and Finance, 14, 509–525. https://doi.org/10.21919/remef.v14i0.420

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas