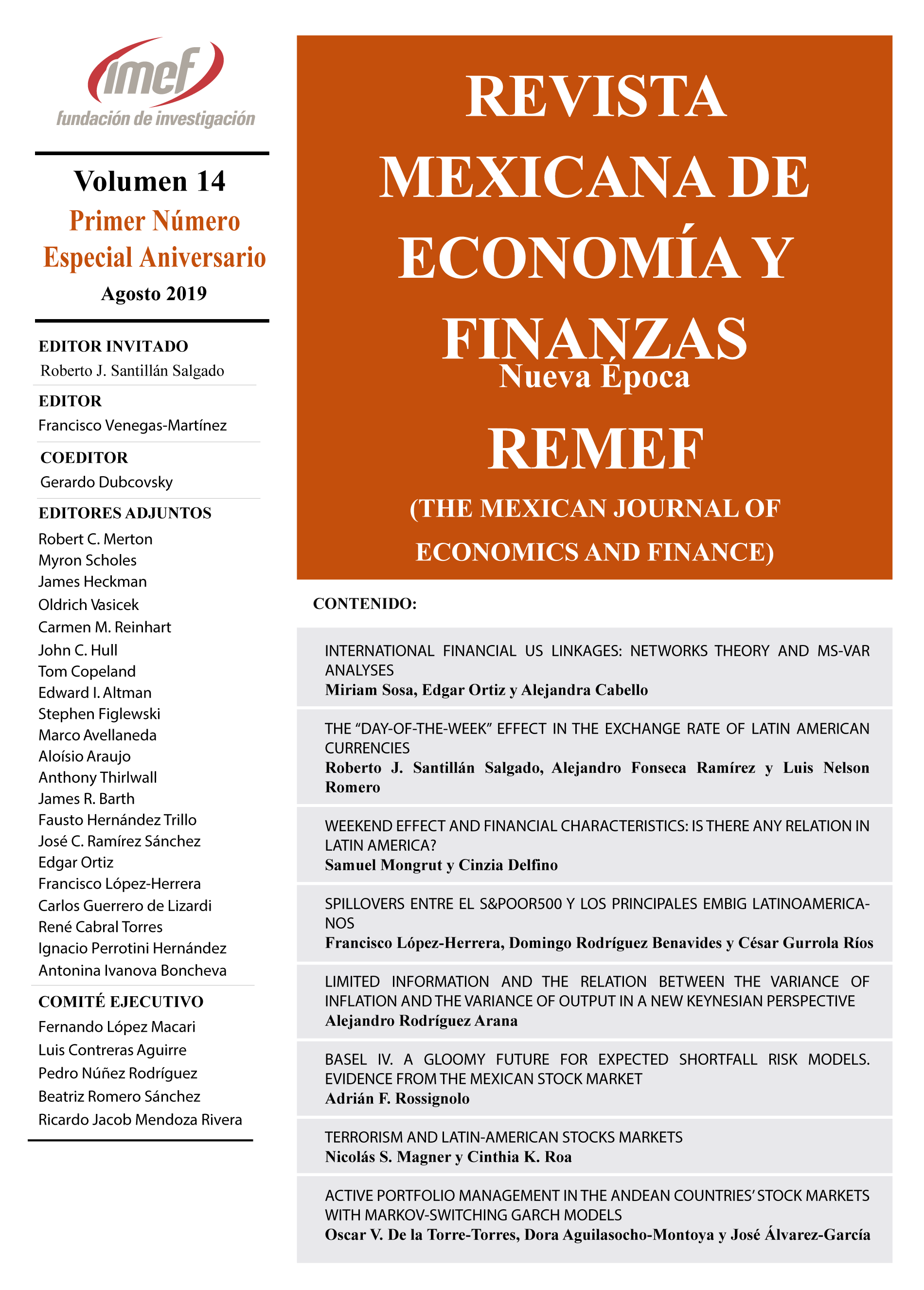

The “day-of-the-week” effects in the exchange rate of Latin American currencies

DOI:

https://doi.org/10.21919/remef.v14i0.419Keywords:

“Day-of-the-week” effect, exchange rate markets, Latin America, Market Efficiency, GARCH, EGARCH, TARCH.Abstract

This paper studies the "day of the week" anomaly in the exchange rate of the currencies of Argentina, Brazil, Chile, Colombia, Mexico and Peru, with respect to the United States’ dollar. In all cases, yields are stationary, allowing the combined use of linear regressions with GARCH, TARCH, and EGARCH models to explore the "day of the week" anomaly. The presence of "abnormal" effects on some of the currencies is confirmed, particularly on Fridays and Mondays. In addition, volatility in exchange rates shows clusters of volatility as well as leverage effects. This work contributes to the literature by studying the "day of the week" effect on the currency exchange rate market, an innovation with respect to the analysis of the stock market. The reported results are useful for currency brokers, foreign exchange risk managers, monetary authorities, and financial policy designers. Subsequent studies should incorporate transaction costs and tax implications to determine if there are economically interesting arbitrage opportunities in these markets.

Downloads

Metrics

Downloads

Published

How to Cite

Issue

Section

License

PlumX detalle de metricas