Estimación de la distribución multivariada de los rendimientos de los tipos de cambio contra el dólar de las criptomonedas Bitcoin, Ripple y Ether

DOI:

https://doi.org/10.21919/remef.v14i3.409Keywords:

leptokurtosis, skewness, Variance-Gamma, MultivariateAbstract

(Estimation of the multivariate distribution of exchange rate yields against the dollar of the Cryptocurrencies Bitcoin, Ripple and Ether)In this paper we estimated the multivariate distribution among Bitcoin (BTC), Ripple (XRP) and Ether (ETH) to analyze the dependence. We used the Hyperbolic Generalized (GH) family of distributions and in particular the Variance-Gamma distribution. The procedure for the estimation of the parameters of the GH distribution is through the EM (Expectation-Maximization) algorithm. The results show that there exists a positive dependence among the three exchange rates with respect to the American dollar and a Variance-Gamma distribution of dimension three is estimated. This distribution is very flexible for the adjustment of returns with leptokurtosis and skewness. This distribution is very flexible for the adjustment of the returns with leptokurtosis and skewness. The information is important for the investors who construct their portfolios in an efficient way.

Downloads

Metrics

Downloads

Published

How to Cite

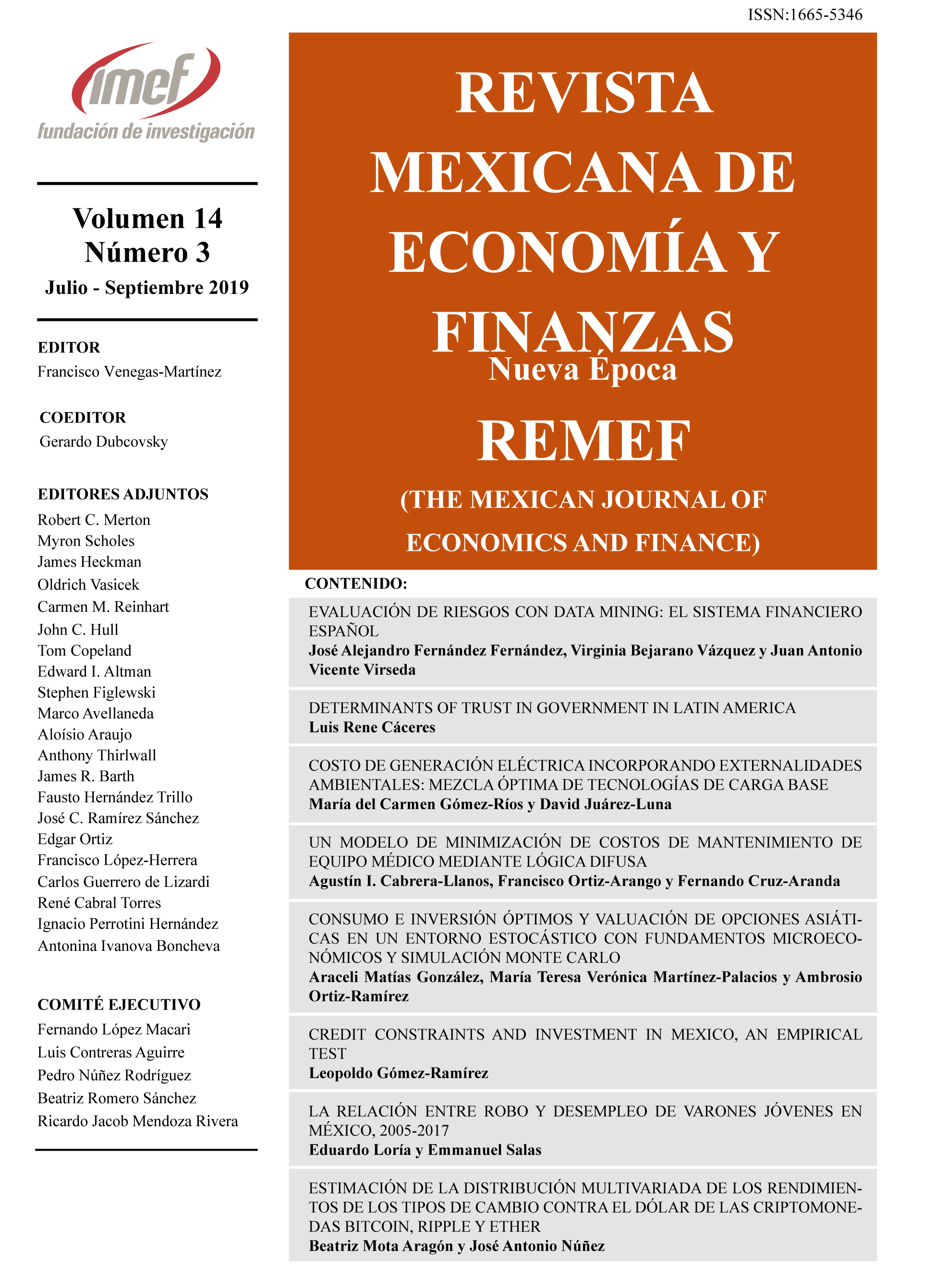

Issue

Section

License

PlumX detalle de metricas