Consumo e inversión óptimos y valuación de opciones asiáticas en un entorno estocástico con fundamentos microeconómicos y simulación Monte Carlo

DOI:

https://doi.org/10.21919/remef.v14i3.408Keywords:

Monte Carlo method, stochastic optimal control, portfolio choice, Asian option pricing, stochastic volatility.Abstract

(Optimal consumption and investment and Asian option pricing in a stochastic environment with microeconomic foundations and Monte Carlo simulation)

Abstract. This research presents an alternative model that characterizes the price of an European-style Asian put option with variable exercise price with arithmetic average subscribed on an stock whose volatility is stochastic, through a system of differential equations that comes from a model of stochastic optimal control in continuous time. For this purpose, a model of a rational agent is developed that has an initial wealth and faces the decision of distributing its wealth between consumption and investment in a portfolio of assets, which includes an European-style Asian put option with exercise price with arithmetic average, in a finite temporal horizon. The valuation is carried out in terms of the amount that the consumer is willing to pay to maintain its Asian option contract in order to hedge against market risk. Also, prices of European and Asian call and put options are approximated by Monte Carlo simulation with calibrated parameters adapting the Cox-Ingersoll-Ross model with realized volatility. The valuation formula obtained was not determined by fundamentals of economic rationality. The empirical evidence indicates that prices are very close in the short term, but in the long term, the difference between European and Asian prices increases.

Downloads

Metrics

Downloads

Published

How to Cite

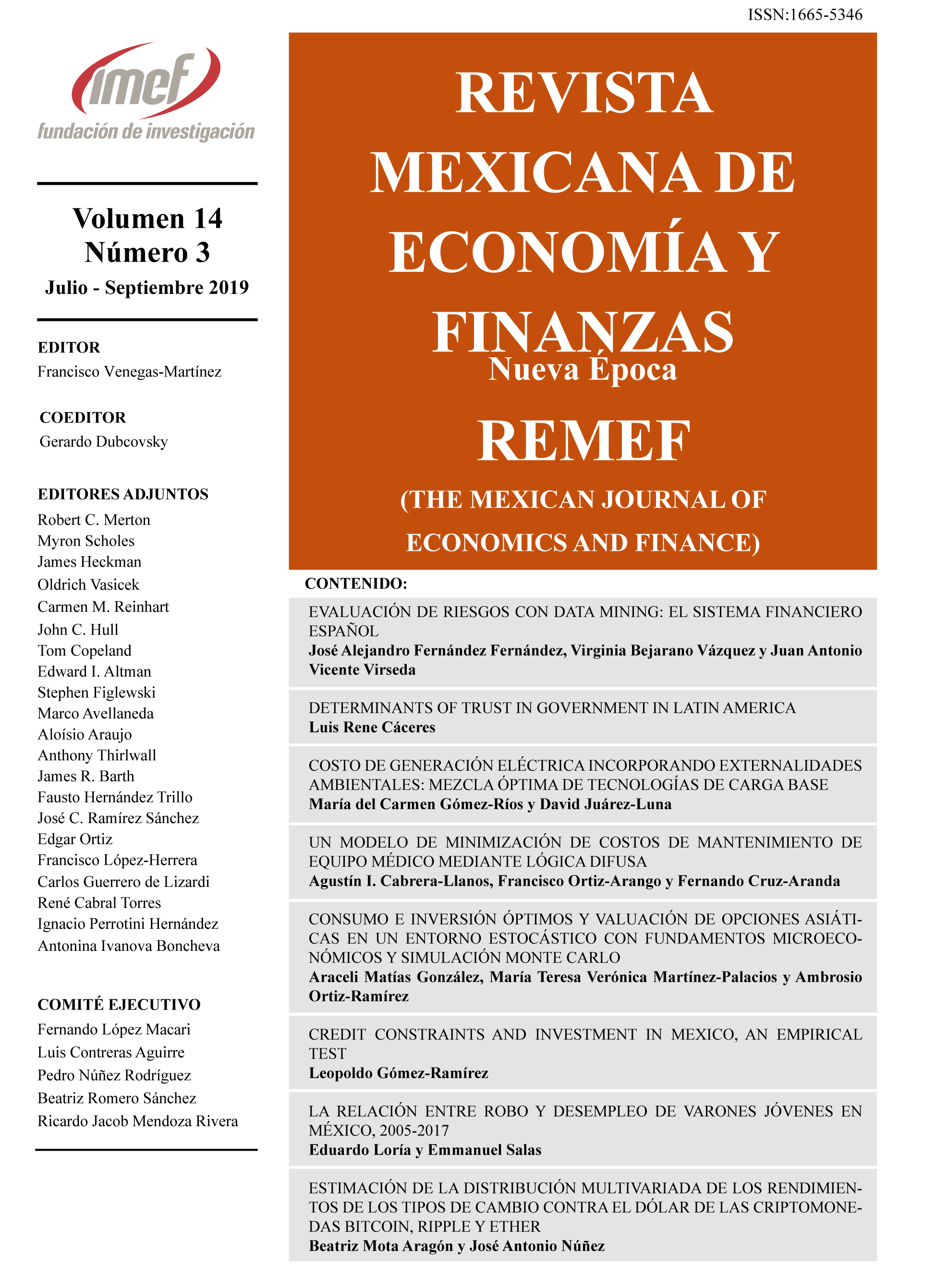

Issue

Section

License

PlumX detalle de metricas