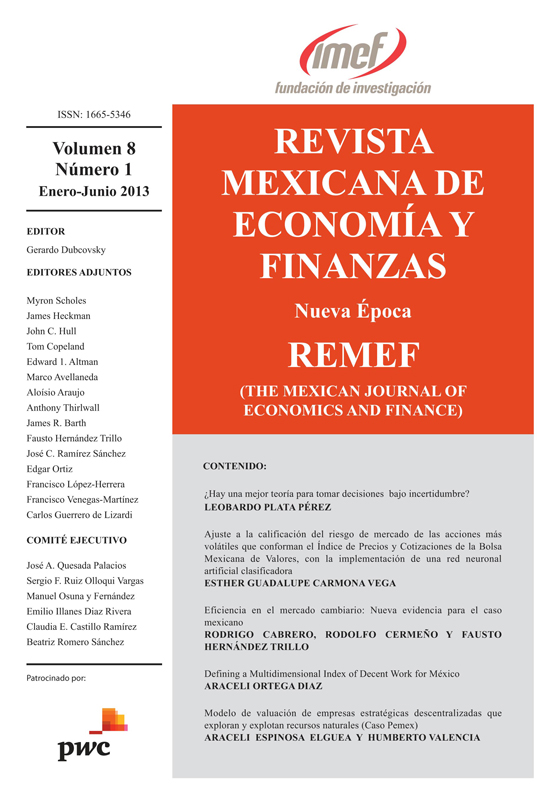

"Ajuste a la Calificación del Riesgo del Mercado de las Acciones más Volátiles que Conforman el Índice de Precios y Cotizaciones de la Bolsa Mexicana de Valores, con la Implementación de una Red Neuronal Artificial "

DOI:

https://doi.org/10.21919/remef.v8i1.40Abstract

In Mexico, the Artificial Neuronal Network applicated to the finances has focused in the study of the analysis of the credit risk; and to fit the results of stock-exchange indicators that offer useful information to the financial investors. Nevertheless, in this case in particular, this tool it is used to measure and classified the Mexican market risk; showing the results obtained in the experimental phase of the training and test in the second simulation stage of the network; reaching a classification rate of over 70%, presenting the variables that significantly contribute to the measurement and classification of the systematic risk.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2017-05-23

How to Cite

Carmona Vega, E. G. (2017). "Ajuste a la Calificación del Riesgo del Mercado de las Acciones más Volátiles que Conforman el Índice de Precios y Cotizaciones de la Bolsa Mexicana de Valores, con la Implementación de una Red Neuronal Artificial ". The Mexican Journal of Economics and Finance, 8(1). https://doi.org/10.21919/remef.v8i1.40

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas