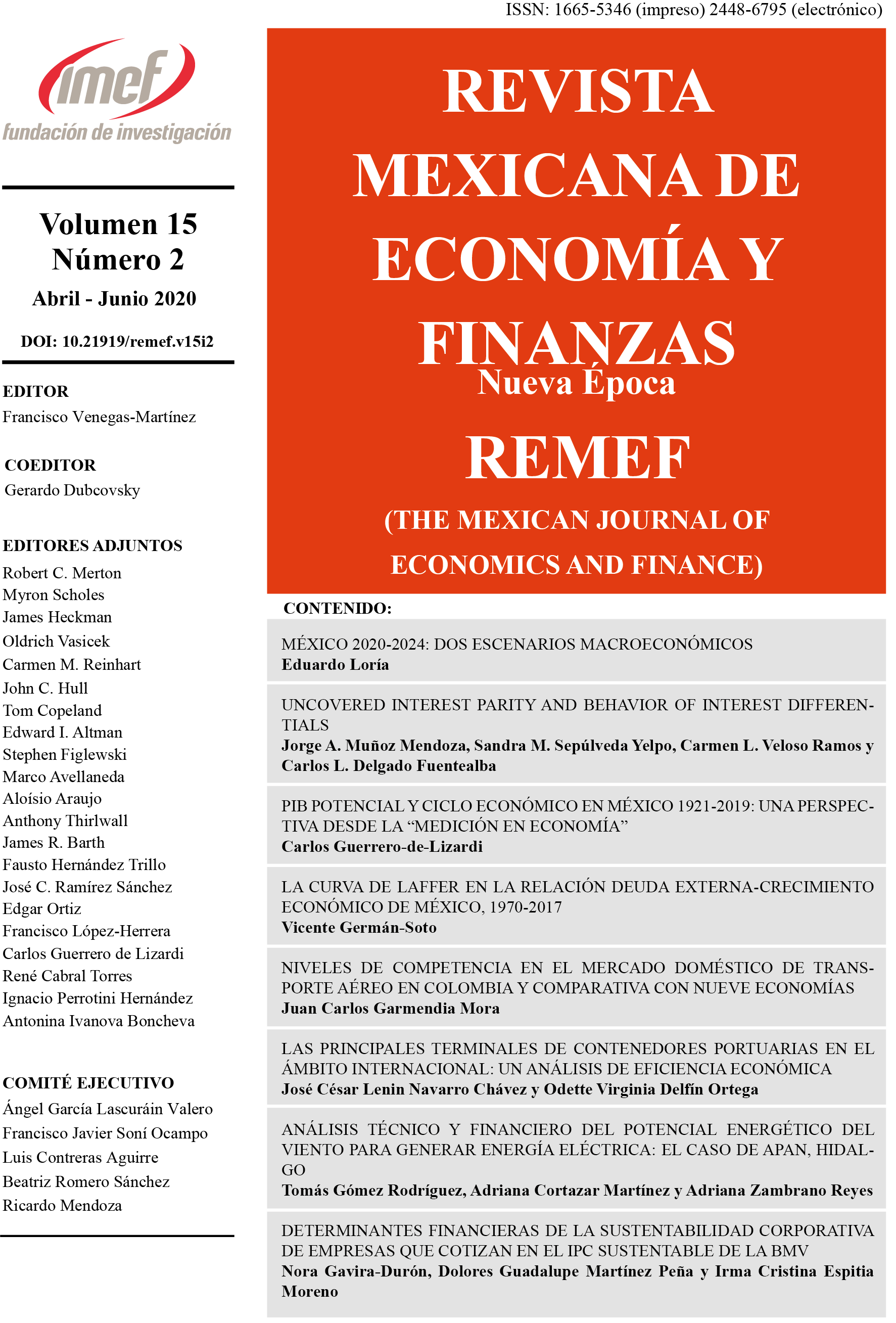

La curva de Laffer en la relación deuda externa-crecimiento económico de México, 1970-2017

DOI:

https://doi.org/10.21919/remef.v15i2.395Keywords:

external debt, economic growth, Laffer’s curve, MexicoAbstract

The Laffer Curve in the External Debt-Economic Growth Relationship in Mexico, 1970-2017

The aim is to investigate if external debt-economic growth relationship is like a Laffer curve in Mexico along 1970-2017. Methodology is a regression model in two stages (LS2S) that overcome problems of modeling, as heteroskedasticity, endogeneity and serial correlation. Results confirm the hypothesis and suggest that levels of debt/GDP below to 24% enhance growth, while higher ratios discourage it. Direction of results are similar for public debt. Findings are compatible with empirical performance of this relationship. Recommendations highlight that Mexico should reduce the weight of its external debt to recover the path of steady-state growth. Although evidence is favorable, some limitations on the model apply, as the problem of sensitivity to changes on the period and number of exogenous variables; moreover, some regressions do not fulfilled the normality assumption at the levels of significance desired. However, this proposal is original due to the period of analysis and the use of diagnostics of regression. As main conclusion, external debt may be factor of the low growth of the Mexican economy in the last forty years.

Downloads

Metrics

Downloads

Published

How to Cite

Issue

Section

License

PlumX detalle de metricas