Impacto de la estrategia de diversificación en el desempeño financiero en empresas de la Bolsa Mexicana de Valores

DOI:

https://doi.org/10.21919/remef.v15i1.384Keywords:

diversification, financial performance, metricsAbstract

(Impact of the diversification strategy on the financial performance of companies in the Mexican Stock Exchange)

The present research work aims to analyze the impact of diversification using the Herfindahl and Entropy metrics on financial performance (EBITDA and Q-Tobins). The information was obtained through secondary sources corresponding to 133 companies of the Mexican Stock Exchange during the period 2011-2016, undergoing a quantitative analysis using the panel data technique. The results show that the diversification metrics used are significant when performance is measured through EBITDA. It is recommended to observe the effect using other analysis techniques through intervening variables. EBITDA can be a metric used to measure the performance of the strategy in companies, the main limitation being access to the total financial information of companies. This research proposes EBITDA as a metric for measuring financial performance in a context of diversification in emerging countries. Finally, it concludes with the positive and significant effect of the Herfindahl metric, showing that EBITDA has a better result when measuring diversification performance than Q-Tobins.

Downloads

Metrics

Downloads

Published

How to Cite

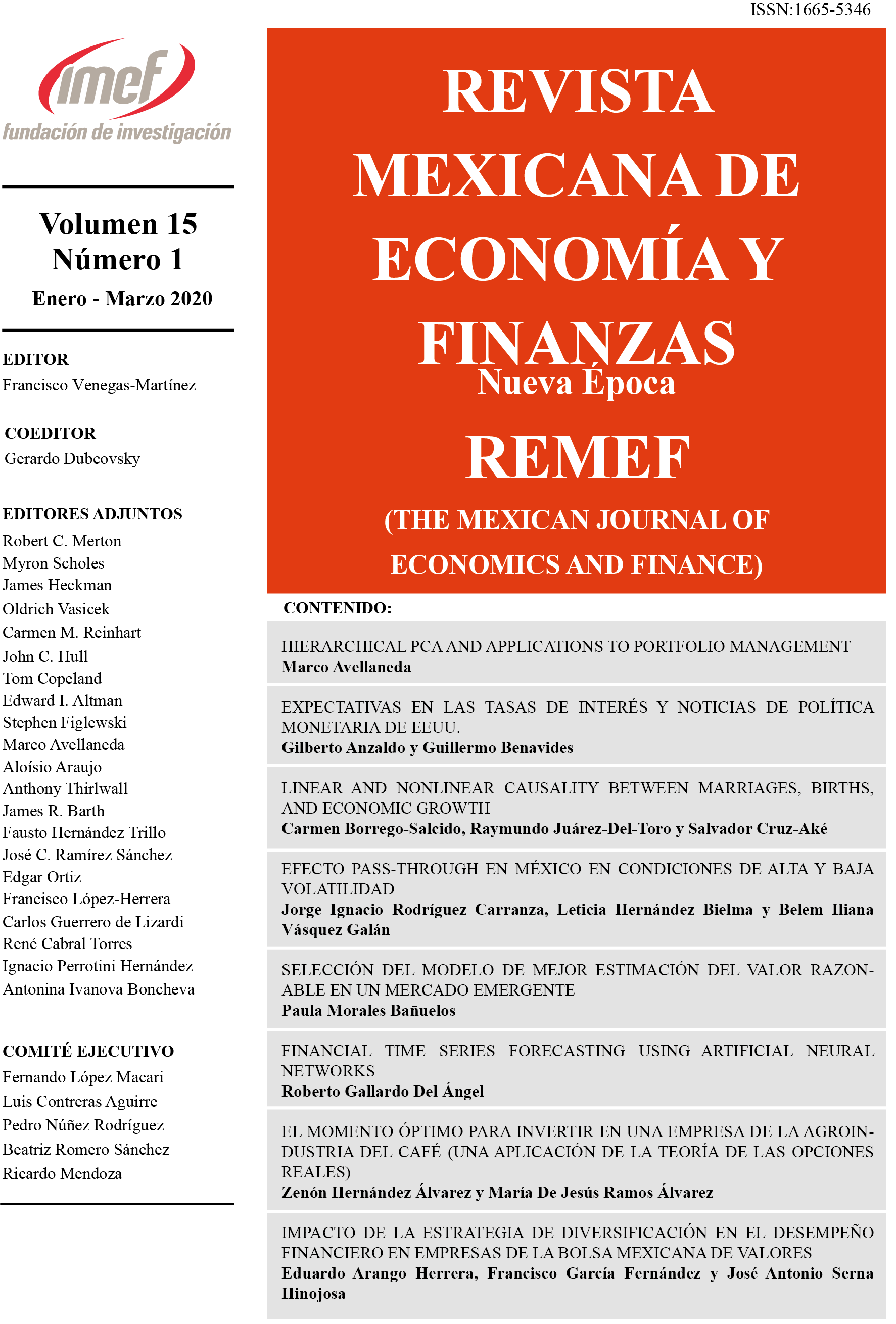

Issue

Section

License

PlumX detalle de metricas