"Optimización de Portafolios con Capital en Riesgo Acotado "

DOI:

https://doi.org/10.21919/remef.v7i2.36Abstract

In recent years Capital at Risk has been brought into the market as a way to minimizing risks in the replacement of the variance in optimal portfolio selection problems. A study was conducted for this work, by utilizing the classical stochastic control methodology on the consequences of using the Capital at Risk measure in a Black-Scholes simple market model and in a Generalized Inverse Diffusion market. Theoretical results were compared to data taken from bolsa de Valores de Colombia, for the cases of Ecopetrol and Isa.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2017-05-23

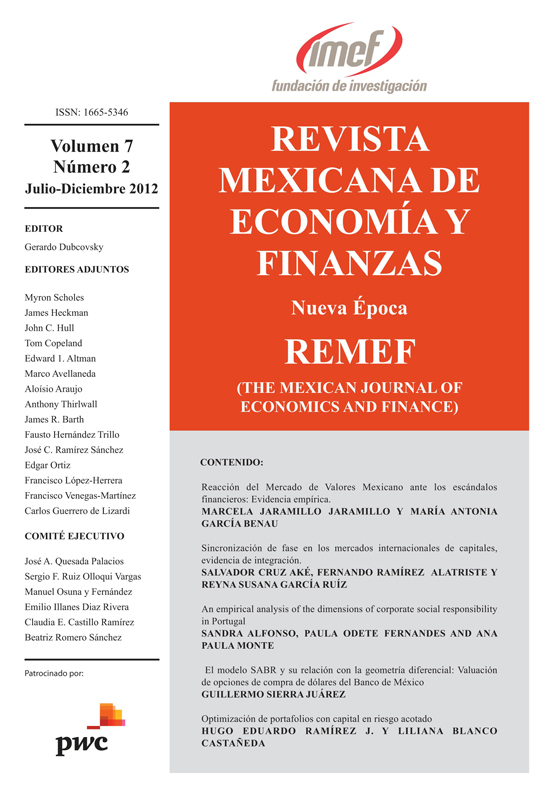

How to Cite

Ramirez J., H. E., & Blanco Castañeda, L. (2017). "Optimización de Portafolios con Capital en Riesgo Acotado ". The Mexican Journal of Economics and Finance, 7(2). https://doi.org/10.21919/remef.v7i2.36

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas