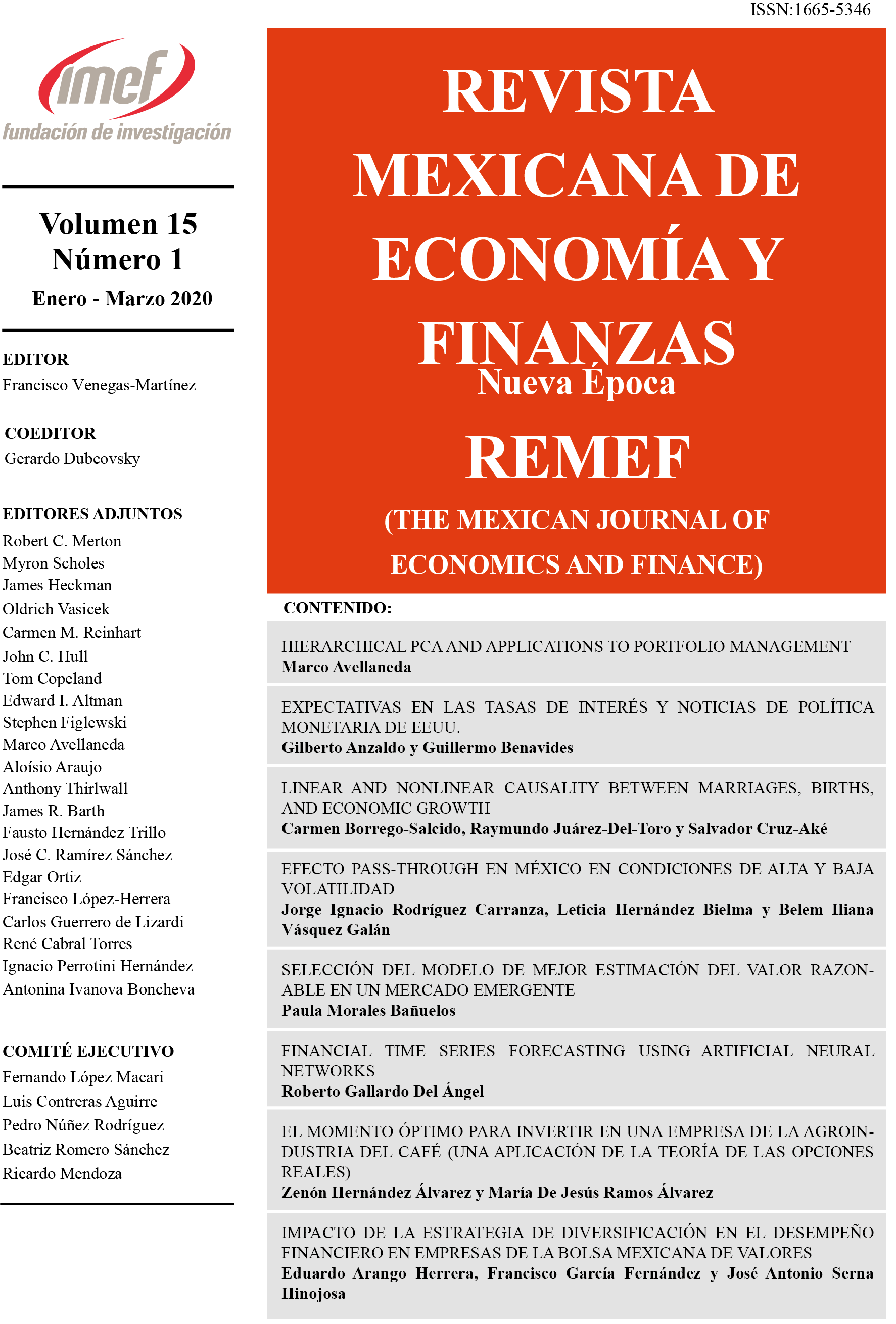

El momento óptimo para invertir en una empresa de la agroindustria del café (Una Aplicación de la Teoría de las Opciones Reales)

DOI:

https://doi.org/10.21919/remef.v15i1.354Keywords:

traditional valuation, real options, critical value, volatility, green coffeeAbstract

(The Optimal Time to Invest in A Coffee Agribusiness Company: an Application of the Real Options Theory)

The high volatility of the real price of coffee in the international market makes traditional valuation insufficient to value investment projects in the coffee agribusiness. This work illustrates how to quantify and incorporate uncertainty in the valuation to determine the optimal timing when a coffee company would invest to market its coffee, as roasted coffee and green coffee, in the national market. Using the optimal time to invest model, the real options theory helps decide whether or not to invest through a critical value. For the case of the social enterprise under study, it was found that the investment must be carried out since the project value ( ) is greater than the critical value ( ). If the company only sells green coffee ( ), its decision would be not to invest ( ). When volatility is high, the investment must be deferred. With its volatility in mind, the “true value” of the investment could be estimated to help management in the decision-making process.

Downloads

Metrics

Downloads

Published

How to Cite

Issue

Section

License

PlumX detalle de metricas