Evaluación de riesgos con Data Mining: el sistema financiero español

DOI:

https://doi.org/10.21919/remef.v14i3.349Keywords:

Data Mining, Machine Learning, classification methods, risk prediction, solvencyAbstract

(Risk assessment with Data Mining: the Spanish financial system)

Abstract. The objective of this work, based on Data Mining techniques, is to identify the best risk prediction method for the Spanish banking system, taking into account its specific characteristics and the economic situation of Spain during the period under study. For this purpose, first of all, fourteen ratios are defined in order to identify, in terms of risks, the situation of Spanish banks and savings banks during the period under review. Through a technique of reduction of dimensions which simplifies the interpretation of results, four latent factors are obtained on which are evaluated, together with four additional macroeconomic variables, a set of algorithms of Data Mining, being finally selected the CHAID tree, unlike previous works, in which it had never come to propose the application of techniques of Data Mining and Machine Learning in the identification of situations of risk in the Spanish banking industry. One limitation of this work has been the impossibility of incorporating regulatory variables, due that this information is confidential, otherwise, we would have been able to incorporate a new dimension in the prediction of risks.

Downloads

Metrics

Downloads

Published

How to Cite

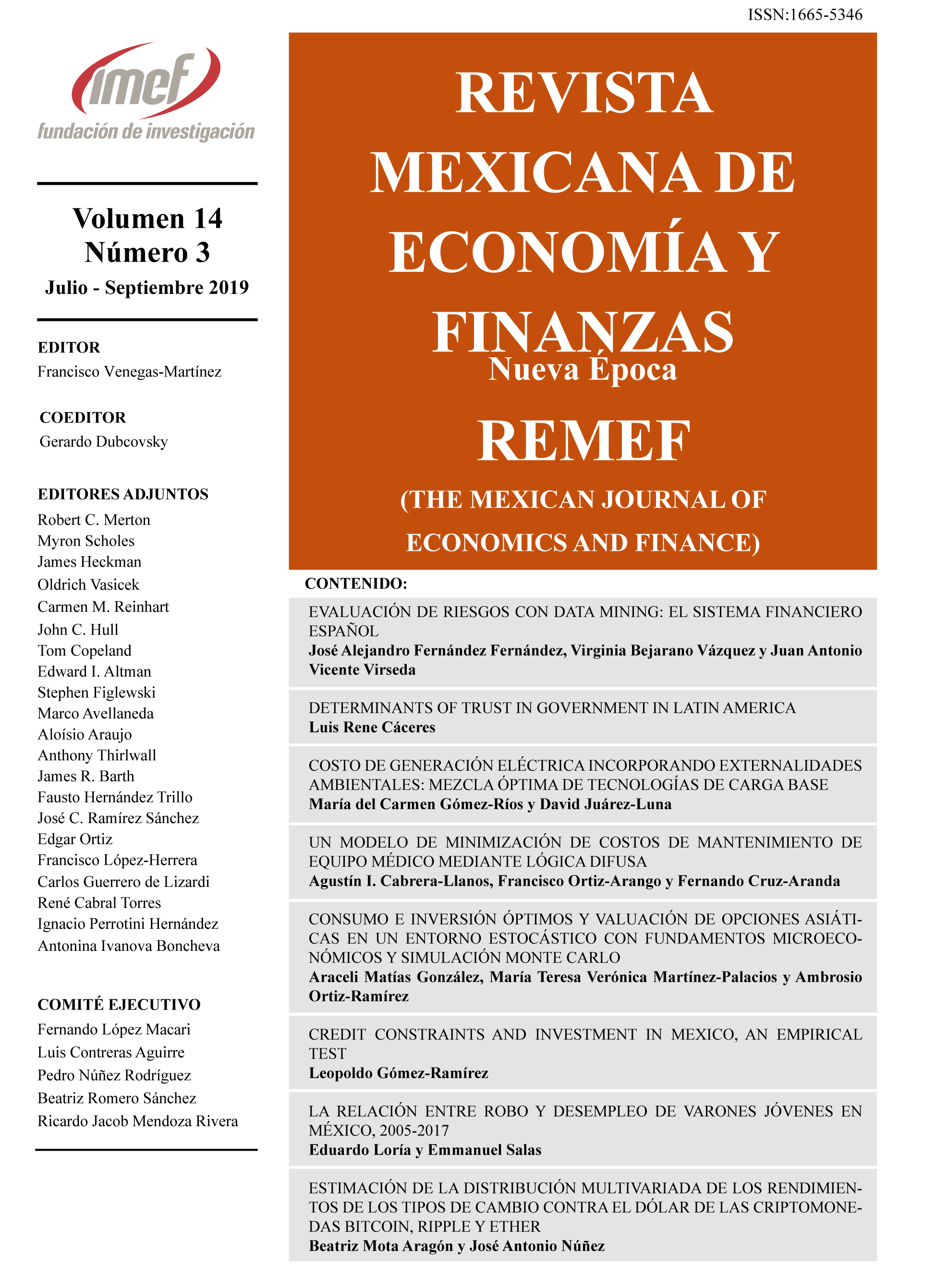

Issue

Section

License

PlumX detalle de metricas