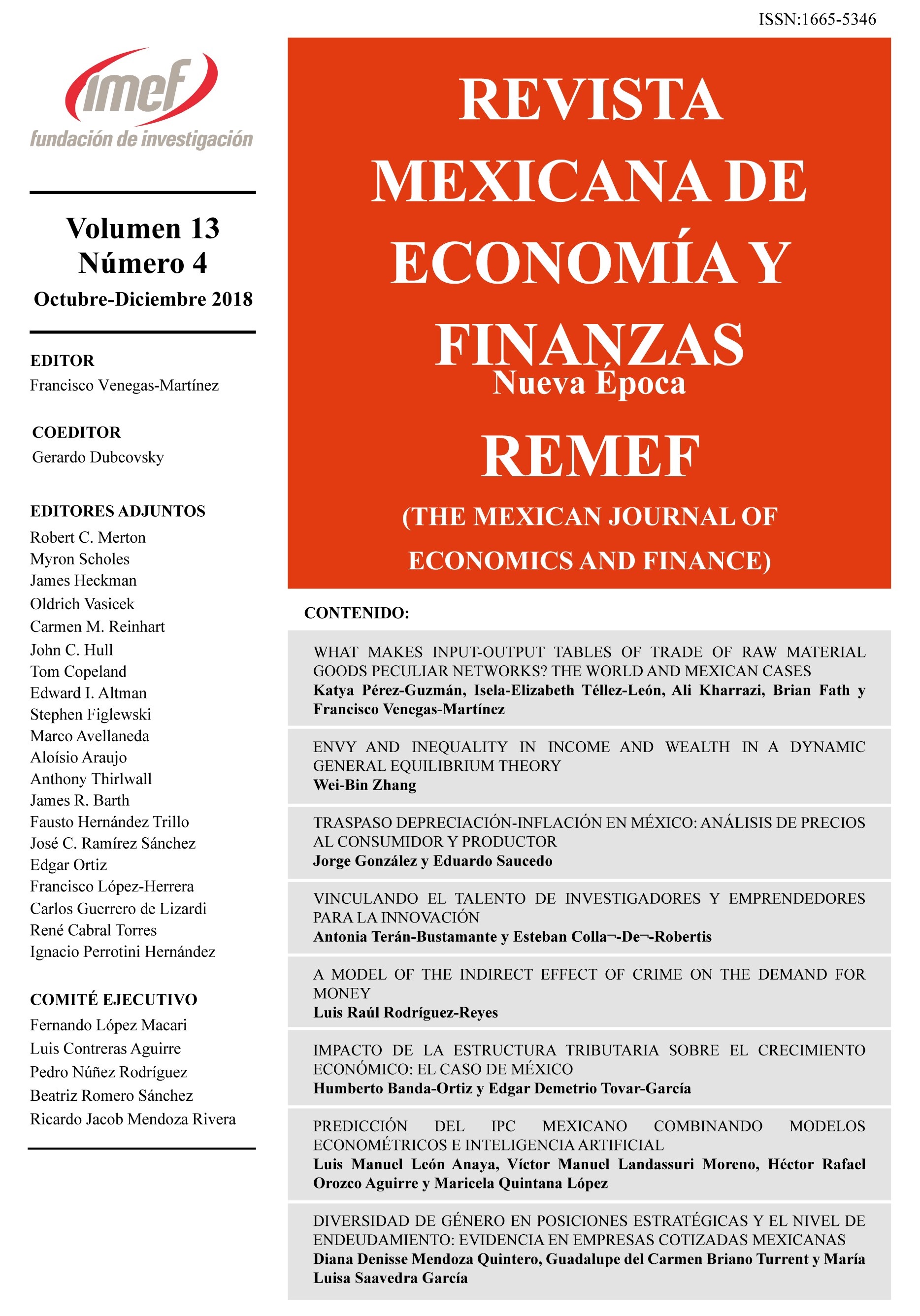

Diversidad de género en posiciones estratégicas y el nivel de endeudamiento: evidencia en empresas cotizadas mexicanas

DOI:

https://doi.org/10.21919/remef.v13i4.343Keywords:

Gender Diversity, Indebtedness, Management Team, Agency Theory, MexicoAbstract

(Gender diversity on strategic positions and the leverage level: Evidence from Mexican listed firms)

The purpose of this study is to analyze the effect on financial performance of gender diversity in the board of directors and the management team of 98 companies listed in the Mexican Stock Exchange during the period of 2004 to 2016. To this end, unbalanced panel data with fixed effects and a Logit regression analysis are adopted to support the econometric analysis. The results show that despite the low participation of women in strategic positions, they have a negative effect on the level of indebtedness, especially when integrated into the board of directors. With respect to profitability, there is no evidence of significant influence. It is necessary to promote gender diversity in leadership positions through the generation of inclusion policies and training and promotion plans. Although the study is limited to companies listed in Mexico, it does pioneer in analyzing the influence of women on financial decisions, and the results serve as a reference for those responsible of issuing corporate governance policies and principles in Mexico.

Downloads

Metrics

Published

How to Cite

Issue

Section

License

PlumX detalle de metricas