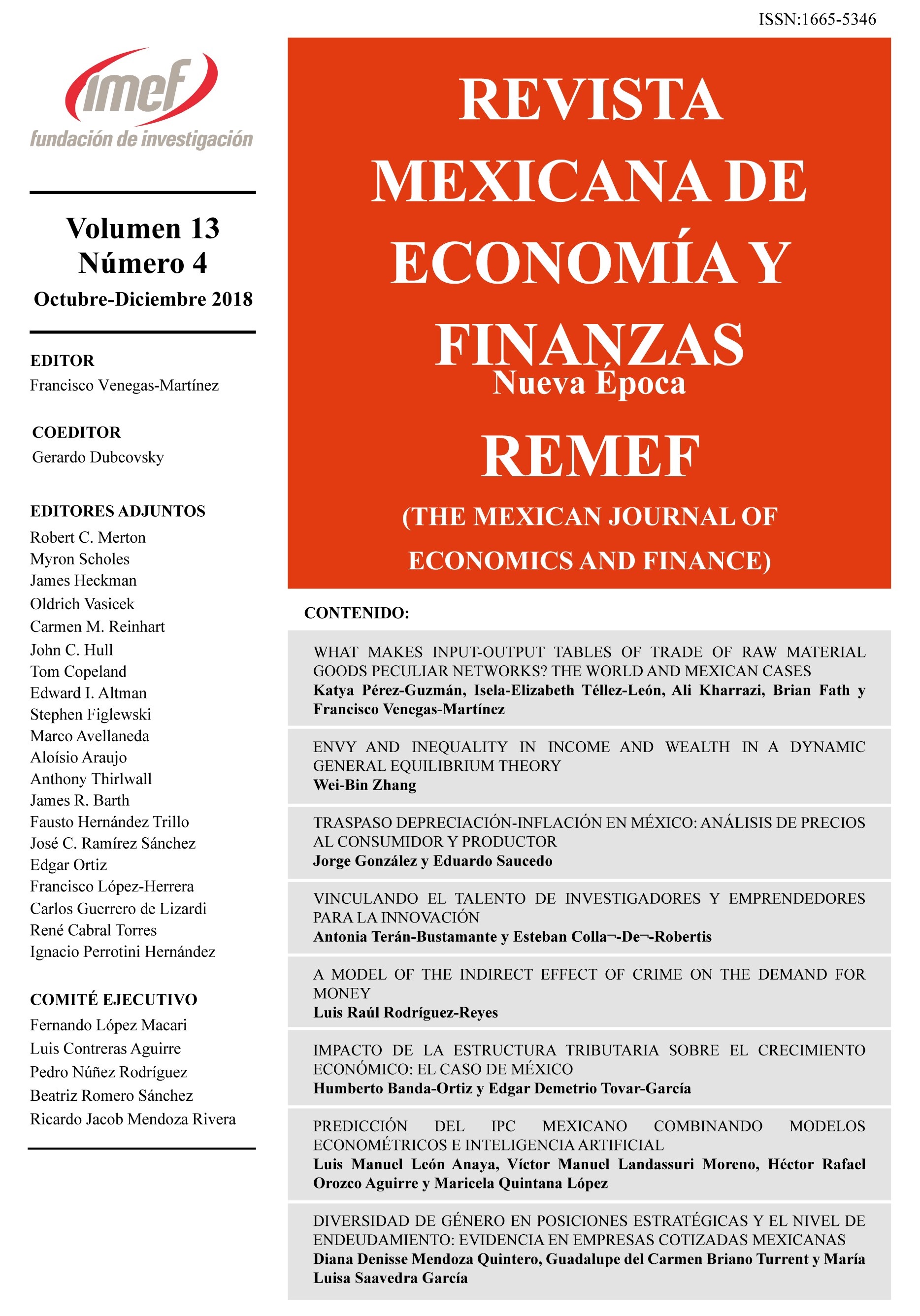

Predicción del IPC mexicano combinando modelos econométricos e inteligencia artificial

DOI:

https://doi.org/10.21919/remef.v13i4.342Keywords:

Forecast, Stock Index, Time Series, Empirical Mode Decomposition, Evolutionary Artificial Neural Networks.Abstract

(Mexican IPC Prediction Combining Econometric Models and Artificial Intelligence)

The purpose of this paper is to decompose the behavioral factors of the Mexican Price and Quotation Index (IPC for its acronym in Spanish) to be forecast using econometric models and evolutionary artificial neural networks. The methodology used consists on reducing the analysis complexity and eliminating the noise in the IPC data through empirical mode decomposition (EMD), combining the intrinsic mode functions (IMFs) resulting with the variants of the autoregressive integrated mobile average (ARIMA) and autoregressive conditional heteroskedasticity (ARCH) models, as well as the algorithm for selection of characteristics of evolutionary network programing (FS-EPNet) to forecast its behavior. The experimental configuration and results are shown and are analyzed using three prediction phases of the IPC. The limitations are that the Mexican IPC is not stationary, which implies that some IMFs are also not stationary. The originality of this consists on the combination of DEM with the FS-EPNet algorithm to analyze the evolution of the Mexican Stock Exchange through its IPC, which is used to show and conclude that it generates a better prediction than that obtained from the original data.

Downloads

Metrics

Published

How to Cite

Issue

Section

License

PlumX detalle de metricas