Impacto de la estructura tributaria sobre el crecimiento económico: el caso de México

DOI:

https://doi.org/10.21919/remef.v13i4.340Keywords:

E62, H20, O40Abstract

(The impact of tax structure on economic growth: The case of Mexico)

The purpose of this article is to empirically study the impact of the tax structure on the economic growth of Mexico from 2005 to 2016. An econometric model was developed using income tax, value added tax, excise duty on production and services, and import tax as independent variables. The results showed a negative and significant effect on the per capita GDP of the income tax. Conversely, the value added tax showed positive impacts. Therefore, the recommendation is to support a tax structure where the income tax has little relevance. Due to a lack of data for some variables for the years prior to 2005, the analysis is limited to the abovementioned period of study. Nevertheless, this is the first research on the economic growth nexus and tax structure for Mexico, although said nexus has been studied in various developed countries and in a couple developing countries. In line with this literature, it is also found that in Mexico the tax structure affects economic growth in the long term.

Downloads

Metrics

Published

How to Cite

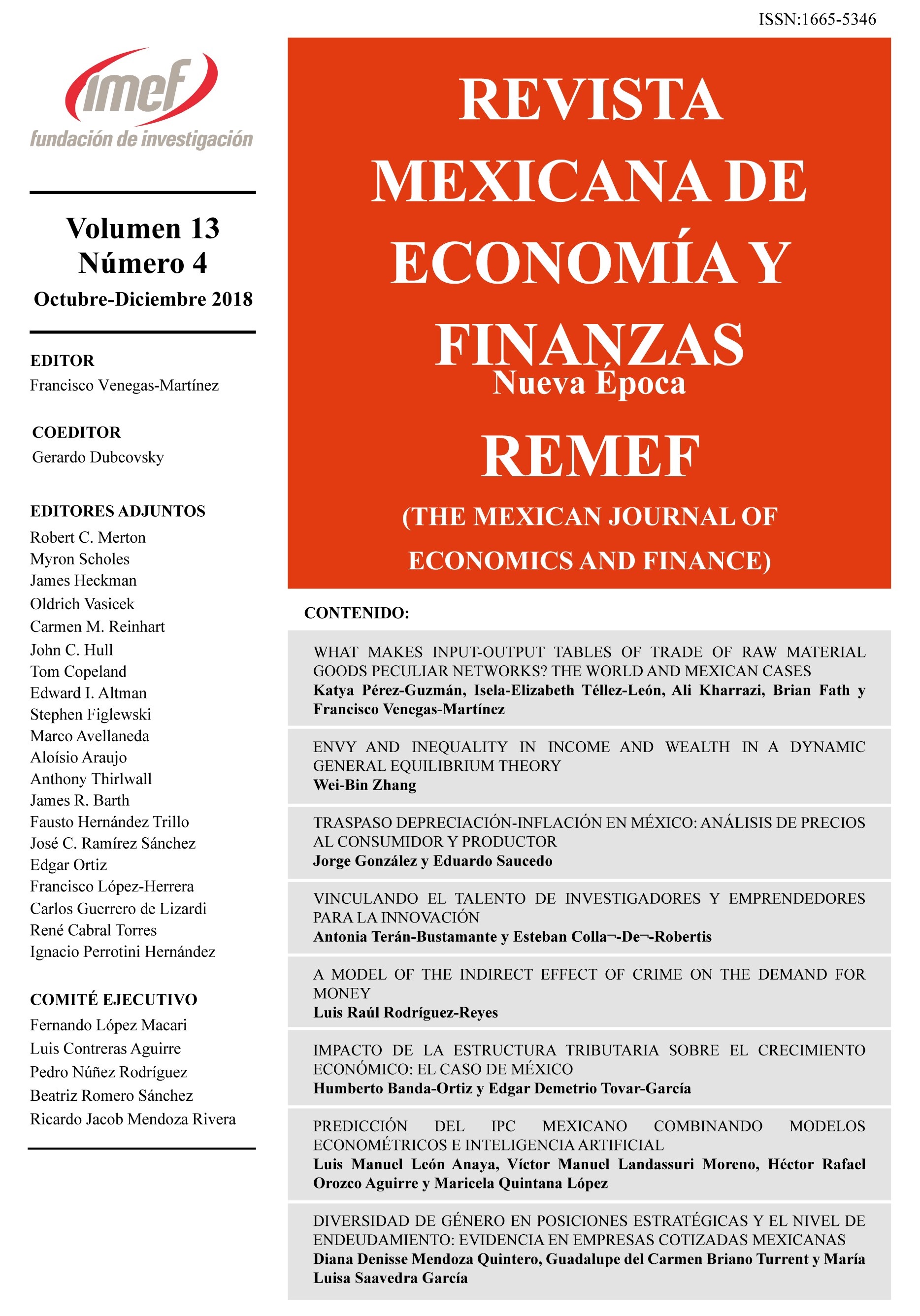

Issue

Section

License

PlumX detalle de metricas