Efecto Potencial de un bloqueo económico a Turquía

DOI:

https://doi.org/10.21919/remef.v13i3.329Keywords:

Ito processes, exchange rate, stochastic modeling, spatial econometrics.Abstract

Due to the recent coup d’état events in Turkey and ISIS attacks on several European countries, the process of Turkey's accession to the European Union—and with it the trade agreements it has with member countries—has been slowed down; as well as with non-members and Asian countries, with which it has commercial treaties. The objective of this research is to determine the economic impact on the relative exchange rate of the US dollar with respect to currencies of a group of countries economically related to Turkey, as consequence of the imposition of economic sanctions on said country. By means of a stochastic dynamic model of the dollar price subject to different forces that affect its relative price with respect to the currencies in the different markets analyzed, through combined economically weighted Itô processes. The results show that a possible trade embargo on Turkey would lead to the instability of the US dollar price in most of the analyzed regions, particularly in Russia. One limitation is that the optimal distance between a region and its neighbors is not determined to minimize the effect on the dollar price or of any asset that is traded in a set of regions and that may have an external shock. This will be analyzed in future research; as well as determine the system of compensation to allied countries.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Published

2018-06-20

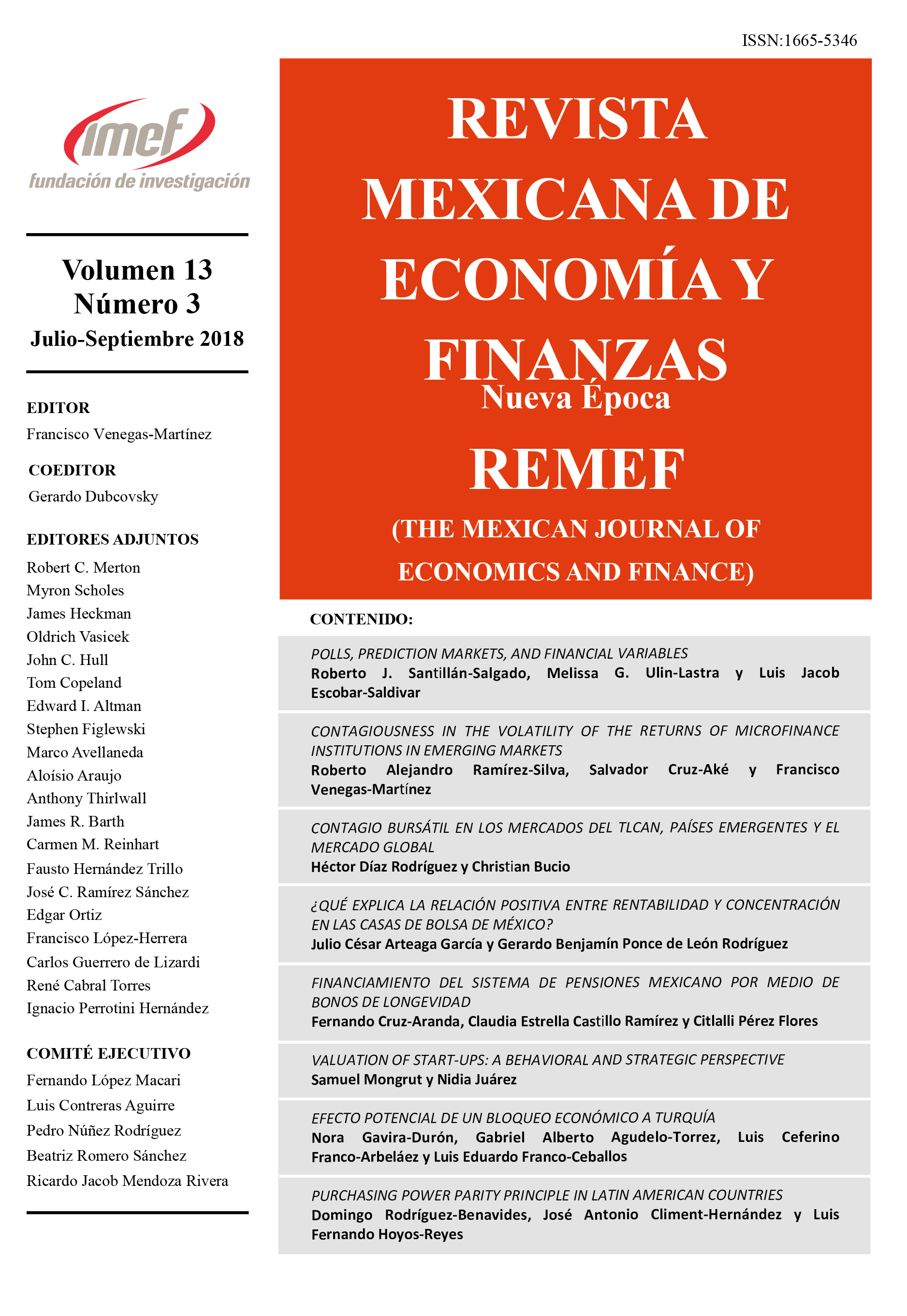

How to Cite

Gavira-Durón, N., Agudelo-Torres, G. A., Franco-Arbeláez, L. C., & Franco-Ceballos, L. E. (2018). Efecto Potencial de un bloqueo económico a Turquía. The Mexican Journal of Economics and Finance, 13(3), 441–460. https://doi.org/10.21919/remef.v13i3.329

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas