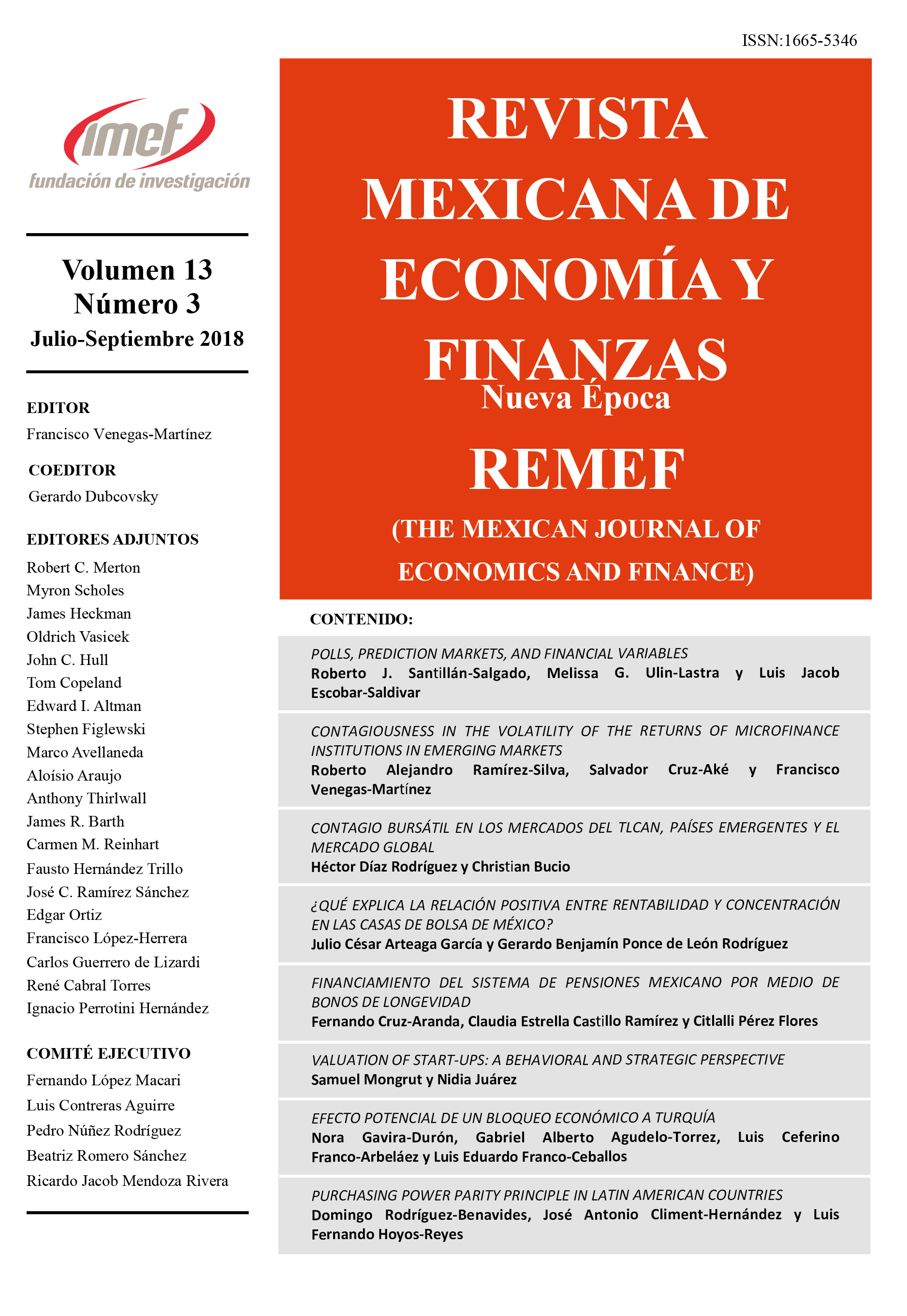

¿Qué explica la relación positiva entre rentabilidad y concentración en las Casas de Bolsa de México?

DOI:

https://doi.org/10.21919/remef.v13i3.328Keywords:

Brokerage firms, market power, efficiencyAbstract

The aim of this paper is to empirically analyze which of the aspects related to the exercise of market power or to efficiency explain the profitability-concentration relation for the Mexican brokerage firms. Data Envelopment Analysis (DEA) is used to estimate measures for economic efficiency and structural efficiency; and panel data techniques are used to estimate the impact of each hypothesis on profitability. The results show improvements for both efficiency measures during the period of 2007-2014, and that aspects of the Efficiency-Structure hypothesis are the explicative factors. A public policy recommendation derived from this paper is that mergers among brokerage firms should not be prevented. On the other hand, a limitation of our estimations is that the goodness of fit measures are low, and imply not including other profitability determinants. The originality of this paper lies in that it is the first to apply this methodology to this economic sector. It concludes that no evidence is found to support that the market power hypothesis explains the profits in this sector.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Published

2018-06-20

How to Cite

Arteaga García, J. C., & Ponce de León Rodríguez, G. B. (2018). ¿Qué explica la relación positiva entre rentabilidad y concentración en las Casas de Bolsa de México?. The Mexican Journal of Economics and Finance, 13(3), 363–386. https://doi.org/10.21919/remef.v13i3.328

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas