Contagio bursátil en los mercados del TLCAN, países emergentes y el mercado global

DOI:

https://doi.org/10.21919/remef.v13i3.327Keywords:

Copula approach, Markovian Regimen Change, NAFTA, Mexico, Stock Markets.Abstract

This study aims to analyze the stock market contagion between the main stock markets of the member countries of the NAFTA (Mexico, the United States, and Canada), the Morgan Stanley Capital International Emerging (MSCIE), and the Morgan Stanley Capital International World (MSCIW), during the period of 1994-2016. The change in the dependence relation between the markets is modeled through a dynamic bivariate copula approach. Once the dynamic dependence between the series is estimated, the self-regressive model with Markovian Regiment Change (MS-AR) is used to determine whether dynamic dependence evolves according to two regimes: a low dependence regime and a high dependence regime. The results show that there are significant changes in the dependence relation, particularly, in periods of crisis, showing a contagion effect between the equity markets. The economic policy recommendation is the restructuring of regulatory and supervisory policies oriented to capital flows. The main limitation is that the indices (MSCIW and MSCIE) capture the average behavior of emerging countries and worldwide, which implies leaving aside the behavior particular to each of them. The main contribution is the use of a complementary methodology that has not been used until now to analyze the phenomenon and countries subject of this study.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Published

2018-06-20

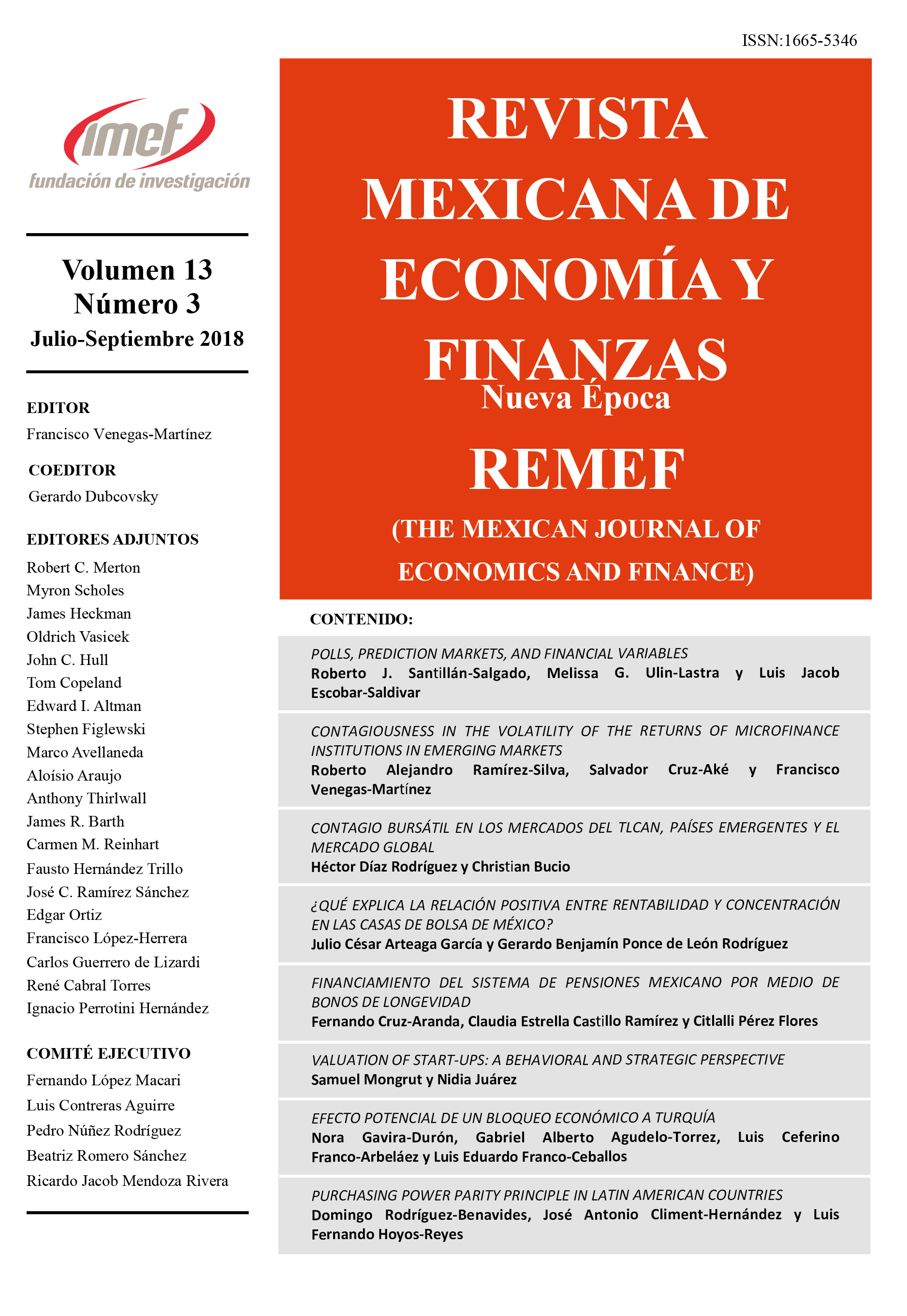

How to Cite

Díaz Rodríguez, H., & Bucio, C. (2018). Contagio bursátil en los mercados del TLCAN, países emergentes y el mercado global. The Mexican Journal of Economics and Finance, 13(3), 345–362. https://doi.org/10.21919/remef.v13i3.327

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas