Volatility Contagion of Stock Returns of Microfinance Institutions in Emerging Markets: A DCC-M-GARCH Model

DOI:

https://doi.org/10.21919/remef.v13i3.326Keywords:

Microfinance institutions, volatility of returns, GARCH and M-GARCH models, Dynamic Conditional Correlation (DCC).Abstract

The objective of this paper is to analyze the contagion in the returns on the volatilities of the Microfinance Institutions (MFIs) that are listed on emerging stock markets in India, Indonesia and Mexico. To do this, local benchmarking variables and the global index –All Countries World Index (ACWI) are included in the analysis. The methodology used is a Dynamic Conditional Correlation (DCC) multivariable GARCH model. The empirical findings show that contagion effects only occur in periods of high volatility. One limitation of this research is that there are still few MFIs listed in stock markets, which does not allow for a broader study. The originality of this paper is the analysis of contagion in the returns of MFIs listed on stock markets. It is concluded that the performance of the analyzed MFIs is not affected by external effects of volatility, but for its fundamental results reflected in their level of liquidity in the stock market.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Published

2018-06-20

How to Cite

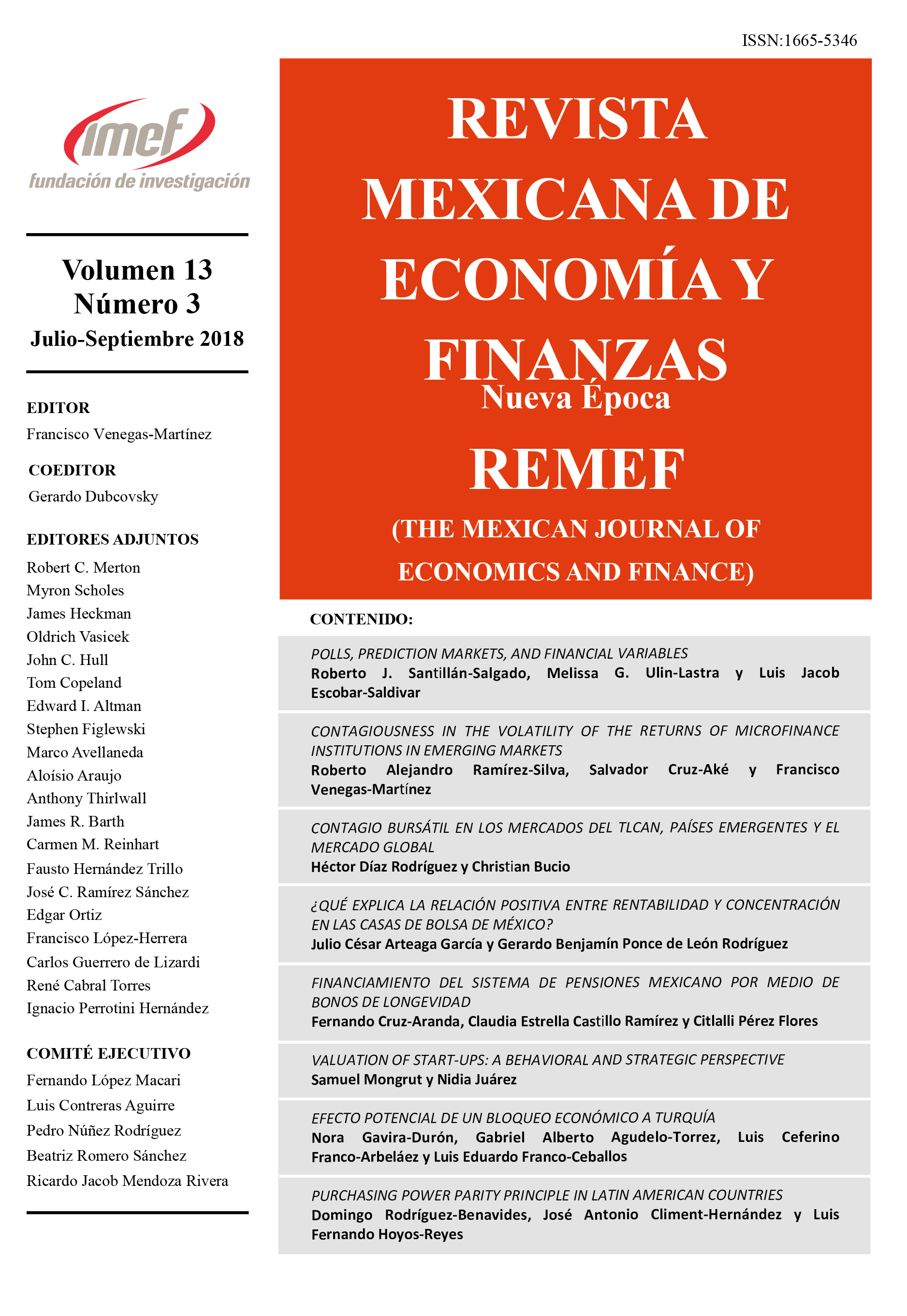

Ramírez-Silva, R. A., Cruz-Aké, S., & Venegas-Martínez, F. (2018). Volatility Contagion of Stock Returns of Microfinance Institutions in Emerging Markets: A DCC-M-GARCH Model. The Mexican Journal of Economics and Finance, 13(3), 325–343. https://doi.org/10.21919/remef.v13i3.326

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas