Credit Constraints and Investment in Mexico, an Empirical Test

DOI:

https://doi.org/10.21919/remef.v14i3.311Keywords:

Contemporary Mexico, Credit Constraints, InvestmentAbstract

Despite the vast overhaul the Mexican economy has gone through since the 1980s, the promised high and sustained economic growth has not materialized. Scholars and policy makers are unanimous in pointing to credit constraints as one of the key reasons for the disappointing growth performance. The link between financial restrictions and investment decisions, however, has not been solidly verified in the Mexican literature. This paper intends to start filling this lacuna. Using recent microeconomic, firm-level data which is reasonably nationally representative, it tests the hypothesis that credit constraints have reduced investment among Mexican firms. Consistent with the general thrust of the literature, it is found that indeed financial restrictions have reduced the investment carried out by Mexican firms. The result holds under different econometric estimations.

Downloads

Metrics

Published

How to Cite

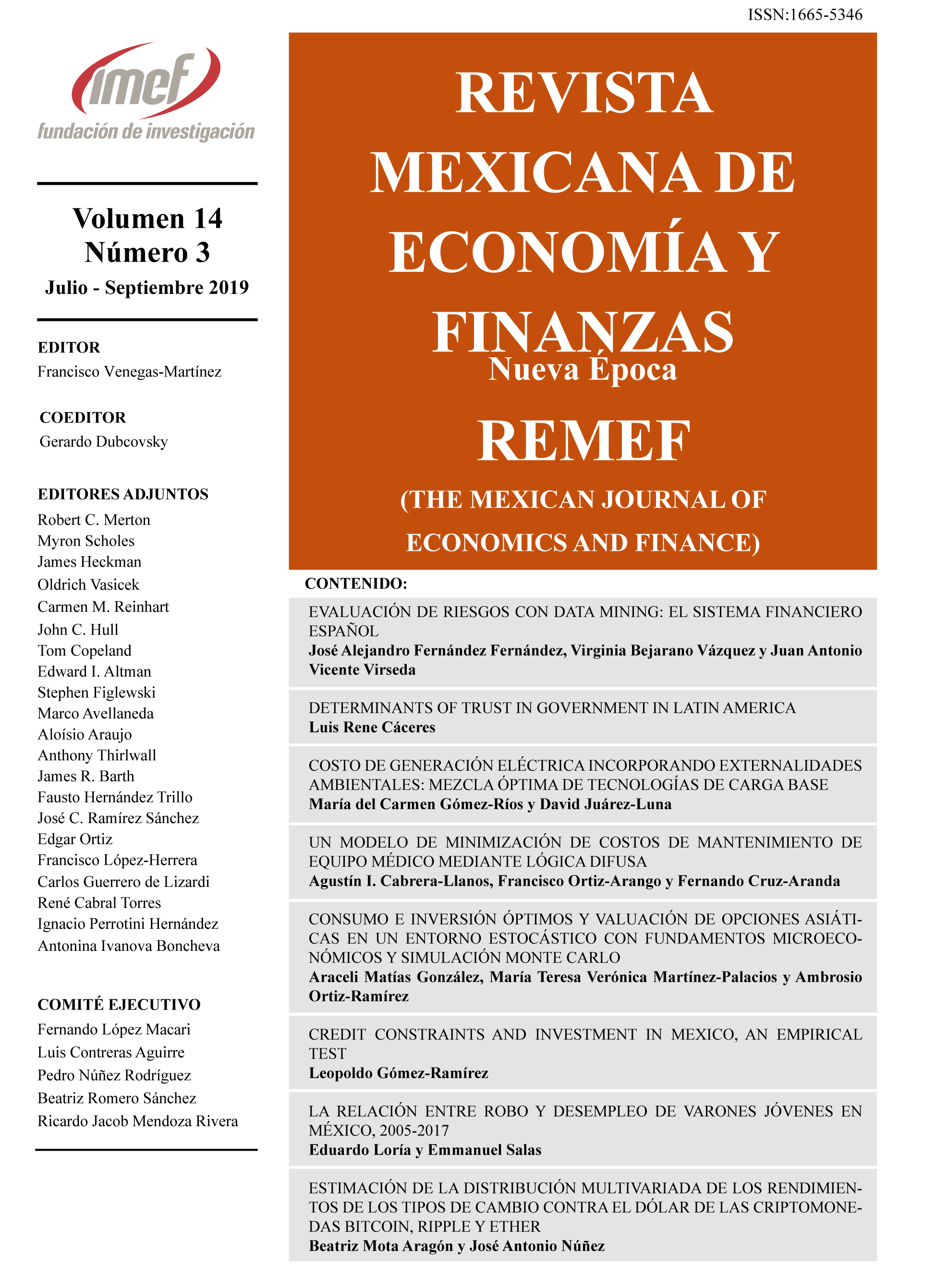

Issue

Section

License

PlumX detalle de metricas