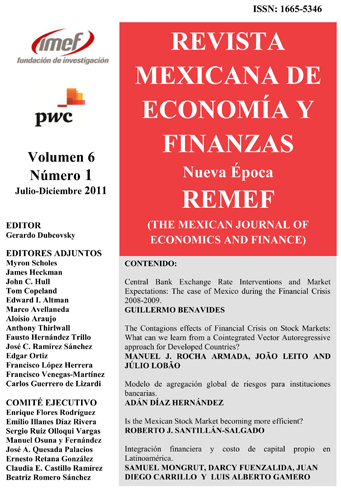

"Integración Financiera y Costo de Capital Propio en Latinoamérica "

DOI:

https://doi.org/10.21919/remef.v6i1.18Abstract

In this paper is assessed the importance of the level of financial integration in the costs of capital that the firms in the Latin American markets face. This relation is studied by means of a non balanced panel data model applied to 270 firms trading in six Latin American markets (Argentina, Brazil, Chile, Colombia, Mexico and Peru) during 2000 and 2009. It was found that a greater financial integration leads to a diminution of the costs of capital for the firms in the region with a lag from six months to one year. Also it was found that the larger Latin American firms face a lower cost of capital; that an increase in the risk country raises the cost of capital and that an increase in the inflationary expectations raises the cost of capital. The obtained results are robust by using alternative measures of financial integration.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2017-05-23

How to Cite

Mongrut, S., Fuenzalida, D., Carrillo, J. D., & Gamero, L. A. (2017). "Integración Financiera y Costo de Capital Propio en Latinoamérica ". The Mexican Journal of Economics and Finance, 6(1). https://doi.org/10.21919/remef.v6i1.18

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas