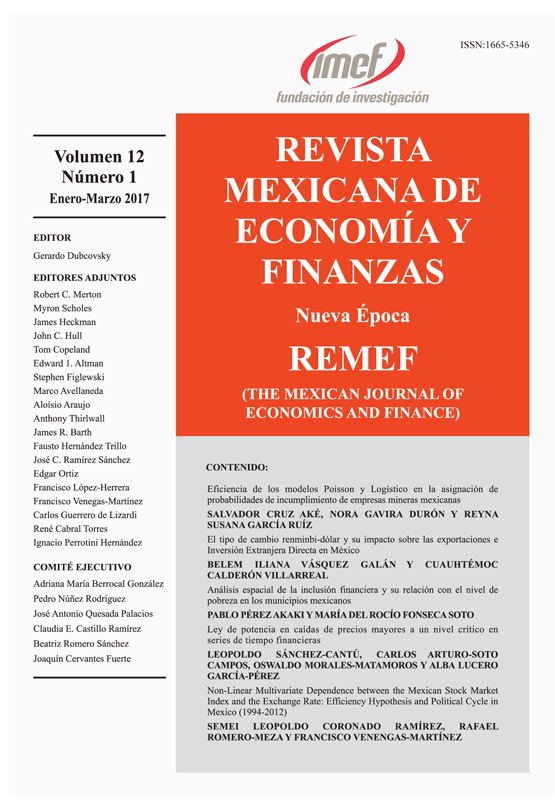

Non-Linear Multivariate Dependence between the Mexican Stock Market Index and the Exchange Rate: Efficiency Hypothesis and Political Cycle in Mexico (1994-2012)

DOI:

https://doi.org/10.21919/remef.v12i1.17Abstract

This paper uses a multivariate extension of the non-parametric nonlinearity test from Hinich (1991) with the objective of investigating whether there is a nonlinear relation between the index of The Mexican Stock Exchange (IPC) and the peso/dollar exchange rate measured through the Cross-correlation and cross-correlation in the period 1994-2012 for three sub-periods of presidential administration. This method divides the sample into windows and provides information on nonlinear dependency. The main finding is that no significant cross-correlation windows are detected. However, time windows are observed with a significant cross bicorrelation, which suggests a non-linear and bidirectional relationship between the series. This paper concludes that for the three sub-periods of presidential administration both series maintain the same nonlinear and bidirectional relation for any change in the government with significant windows concentrated at the beginning of the presidential period regardless of the ruling party. Finally, It is important to note that the non-linear bidirectional periods were concentrated in the middle of the last Mexican presidential period, indicating that global external and economic financial factors affected this relationship.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2017-05-23

How to Cite

Coronado Ramírez, S., Romero Meza, R., & Venegas Martinez, F. (2017). Non-Linear Multivariate Dependence between the Mexican Stock Market Index and the Exchange Rate: Efficiency Hypothesis and Political Cycle in Mexico (1994-2012). The Mexican Journal of Economics and Finance, 12(1). https://doi.org/10.21919/remef.v12i1.17

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas