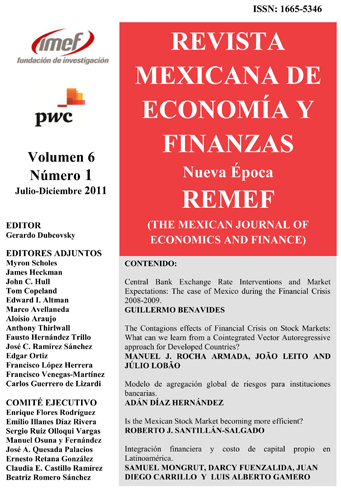

"Is the Mexican Stock Market Becoming More Efficient? "

DOI:

https://doi.org/10.21919/remef.v6i1.16Abstract

This paper studies the recent evolution of market efficiency in the Mexican Stock Exchange by testing the hypothesis that stock prices have become ”more efficient” through time. This is done by observing the evolution of the coefficients of the regressions between individual stocks returns and a market proxy sample portfolio. The sample of shares was selected under the criterion of a greater frequency of trading. Following Morck, Yeung and Yu’ (2000) work, we built a Market Proxy Sample Portfolio (MPSP) that includes 27 larger firms issuing shares (with respect to a relative capitalization measure), frequently traded shares, listed in the Mexican Stock Exchange. The database included daily closing prices from January 1999 to May 2010. The results of the tests indicate there is a downward trend in the magnitude of the average R2 during the first half of the decade, but there is an inflection in the trend in the last three years of the period of study, which may be explained by the extraordinary turbulence that prevailed during the 2007-2009 financial crisis.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2017-05-23

How to Cite

Santillán Salgado, R. J. (2017). "Is the Mexican Stock Market Becoming More Efficient? ". The Mexican Journal of Economics and Finance, 6(1). https://doi.org/10.21919/remef.v6i1.16

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas